Chainlink’s Elliott Wave Surge: Whale Accumulation Signals Major Upside Ahead

Whales are piling into LINK as technicals scream bullish—because nothing says 'trust the charts' like crypto's favorite self-fulfilling prophecy.

Elliott Wave theory points to extended gains for Chainlink, with whale wallets gobbling up tokens at a pace that'd make a Bitcoin maximalist sweat. The pattern suggests we're in wave three of five—the 'recognition phase' where even your Uber driver starts dropping Fibonacci levels.

Meanwhile, institutional players are quietly building positions while retail traders still think 'oracle' is a movie franchise. Classic.

Just remember: In crypto, TA works until it doesn't—usually right after you YOLO your rent money.

LINK price jumps amid whale buying

Chainlink, the biggest oracle network in the crypto industry, has been in a strong uptrend in the past few days. One catalyst for this is on-chain data showing that whales have gone on a buying spree recently.

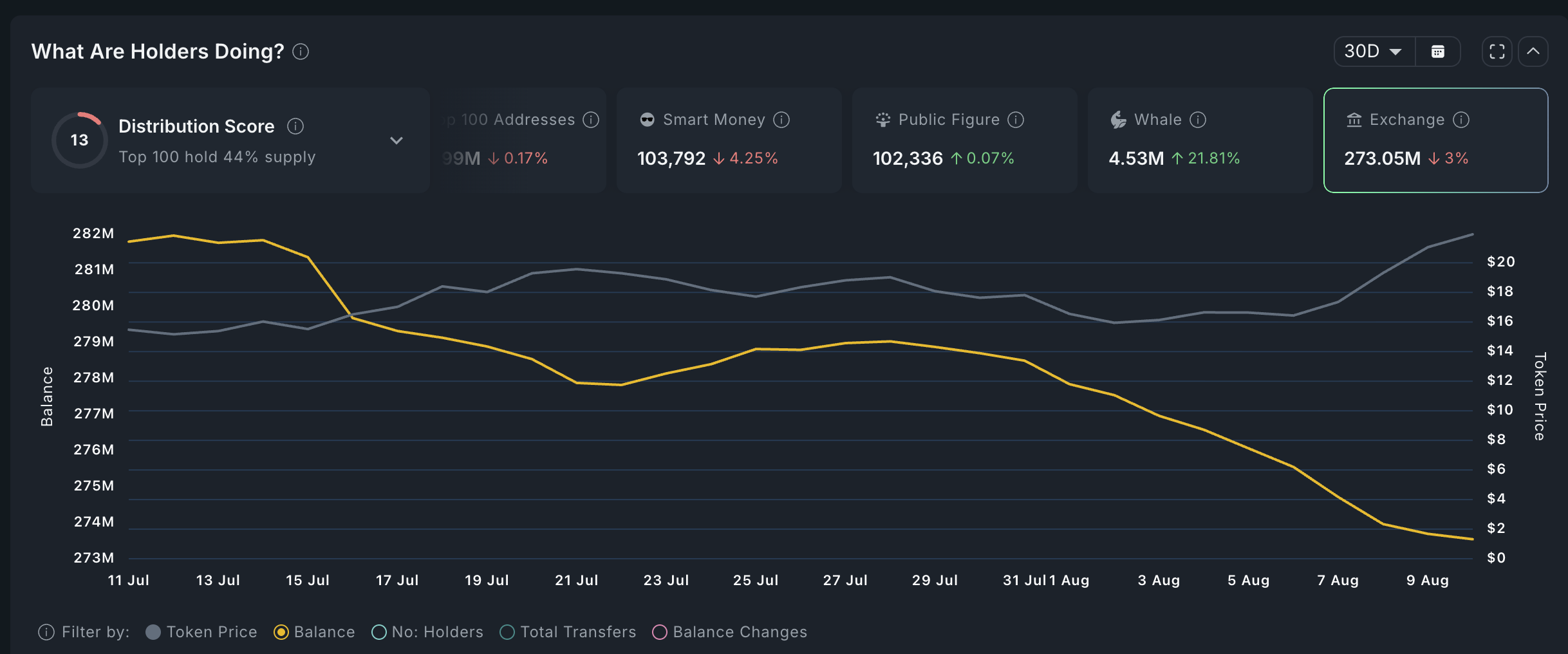

Nansen data shows that LINK whales hold 4.53 million tokens, a 21% monthly increase. Their holdings have jumped by 41% in the last 90 days, a sign that they see the upward momentum continuing.

The soaring whale buying coincided with the ongoing plunging of its exchange balances. These reserves have plunged to 273 million, down from a high of 281 million last month.

Chainlink price continued rising after the developers announced its accumulation strategy. It will now use its on-chain revenue and enterprise revenue to buy more LINK tokens. This buying is expected to gradually boost its tokens over time.

Chainlink has emerged as one of the most important players in the crypto industry. It operates the biggest oracle in the crypto industry, connecting off-chain data to the on-chain. For example, it recently launched data streams for US equities and ETFs.

Chainlink is also a major player in the real-world asset tokenization industry, where its CCIP product helps to connect data across multiple chains.

Chainlink price technical analysis

The daily chart shows that the LINK price has strong technicals. It formed a double-bottom pattern at $10.95, its lowest swings in April and June this year.

Chainlink price moved above the neckline at $17.85, its highest swing on May 12. There are signs that it has completed forming the first and second phases of the Elliot Wave pattern. It has now moved into the third phase, which is usually the longest one.

Therefore, chainlink price will likely continue rising as bulls target the 23.6% retracement level at $25.51, which is about 15% above the current level. A drop below the support at $20 will invalidate the bullish LINK price forecast.