Institutional Whale Alert: $4.17B Ethereum Buy-Up Sends ETH Soaring Past $4K

Wall Street meets blockchain—again. Institutional players just snapped up 1.03 million ETH in a single move, catapulting Ethereum past the $4,000 psychological barrier. Guess banks finally realized 'decentralized' doesn’t mean 'no profits allowed.'

The Institutional Stampede

When suits start accumulating crypto at this scale, two things happen: exchanges see record inflows, and retail FOMO kicks in. This buy-in represents one of the largest single asset grabs in crypto history—roughly equivalent to three El Salvador GDPs.

Price Domino Effect

The $4K breakthrough wasn’t subtle. ETH ripped through resistance like a hot knife through stablecoin butter, proving once again that when institutions move, markets tremble. Now the question is whether this triggers a liquidity cascade or just another 'buy the rumor, sell the news' cycle.

Cynical take? Watch how fast these 'long-term holders' dump positions when the SEC starts muttering about 'investor protection.'

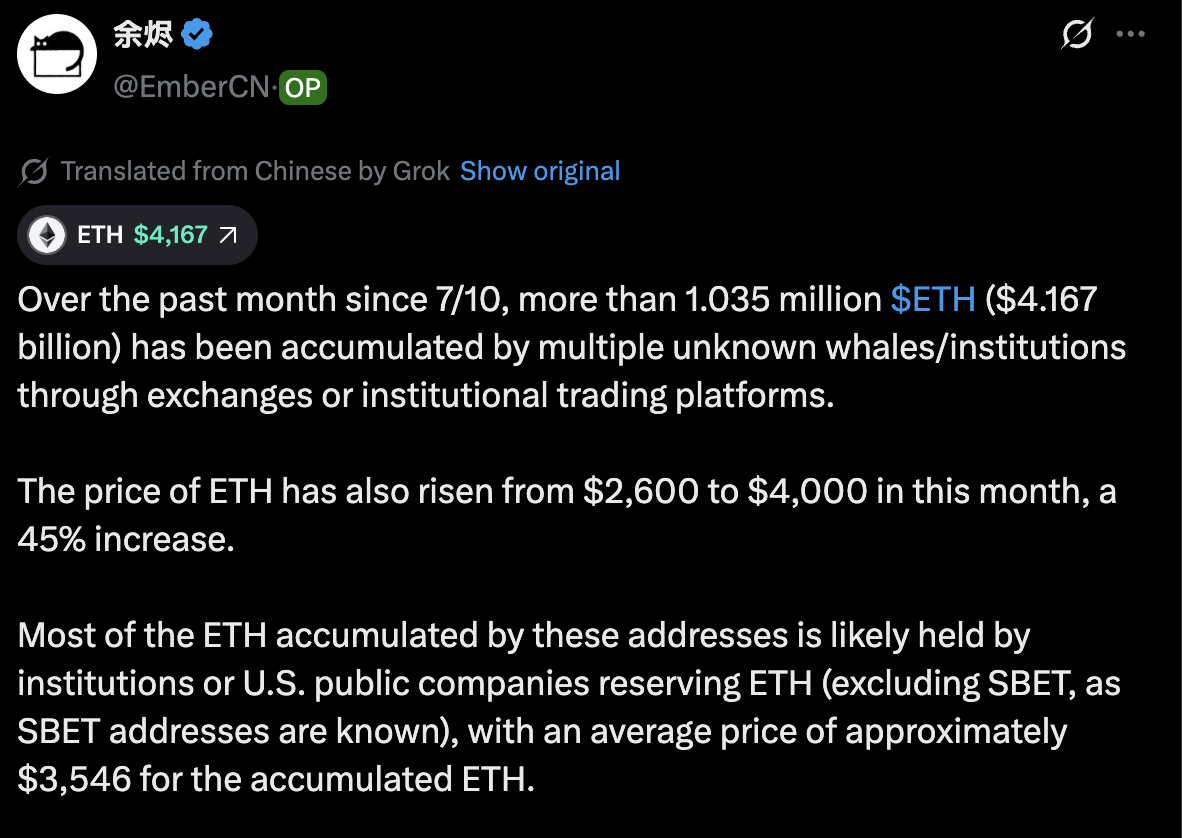

X post by analyst EmberCN

X post by analyst EmberCN

Binance moves ETH as price breaks $4,000

Arkham Intelligence data shows Binance hot wallets transferred thousands of ETH to market Maker Wintermute within hours of the price surge.

The transactions began with flows of 250 to 500 ETH per transfer before escalating to larger movements including single transactions exceeding 1,800 ETH.

The Wintermute transfers suggest institutional demand need better execution to avoid market impact. Market makers handle large orders by breaking them into smaller transactions or providing liquidity during volatile periods.

Ethereum’s 24-hour gain of 6.6% pushed the price to $4,170, approaching the previous all-time high NEAR $4,800. The 30-day performance of nearly 50% shows sustained institutional buying pressure across multiple time frames.

Technical analysts warn of overextension

Analyst Michaël van de Poppe cautioned against buying ETH at current levels. He also described the MOVE as “wild” and noting that prices have “swept the high.”

Poppe suggested the setup could lead to “a big breakout towards ATHs” but recommended allocating funds within the Ethereum ecosystem instead.

Wild move of $ETH.

It has swept the high and it is a little too risky to be buying $ETH at these highs.

It's setting up for a big breakout towards ATHs, but I think it's wiser to allocate funds within the $ETH ecosystem as it should yield a higher return. pic.twitter.com/SlydTcukqT

“It’s a little too risky to be buying $ETH at these highs,” van de Poppe posted. “I think it’s wiser to allocate funds within the $ETH ecosystem as it should yield a higher return.”

The analyst’s recommendation shows a common strategy of buying ecosystem tokens that may outperform ETH during rallies while maintaining exposure to Ethereum’s growth.

The $4.17 billion accumulation period coincides with increased institutional cryptocurrency adoption.

U.S. public companies have increasingly adopted cryptocurrency treasury strategies, with Ethereum becoming a secondary choice after Bitcoin for corporate holdings.