Bitcoin Holds Strong at Critical Support—Next Stop: All-Time High?

Bitcoin bulls dig in as BTC defends a make-or-break price zone. The stage might be set for a run at record highs—if Wall Street doesn't screw it up first.

Key support holds against bearish pressure

Like a crypto Hodor holding the door, Bitcoin's price action refuses to buckle below a crucial technical level. Traders are watching this defensive line like hawks—break it, and the bears take control. Hold it, and we're looking at a potential springboard toward ATH territory.

The bull case remains intact (for now)

Despite recent volatility—and let's be honest, some absolutely shameless whale manipulation—the fundamental setup still favors upside. The market's behaving like a coiled spring, with liquidity pools building just above current levels. When—not if—BTC punches through resistance, things could get explosive.

Watch these levels like your portfolio depends on it

Because it does. The current consolidation pattern mirrors previous pre-breakout formations. Institutional money's lurking at these levels too—though whether they're building positions or just baiting retail traps remains to be seen. Typical finance sector behavior: talk about 'market integrity' while front-running your orders.

Bottom line? Bitcoin's price action suggests the bulls aren't done yet. But keep one hand on your wallet—this market eats the overconfident for breakfast.

Key technical points

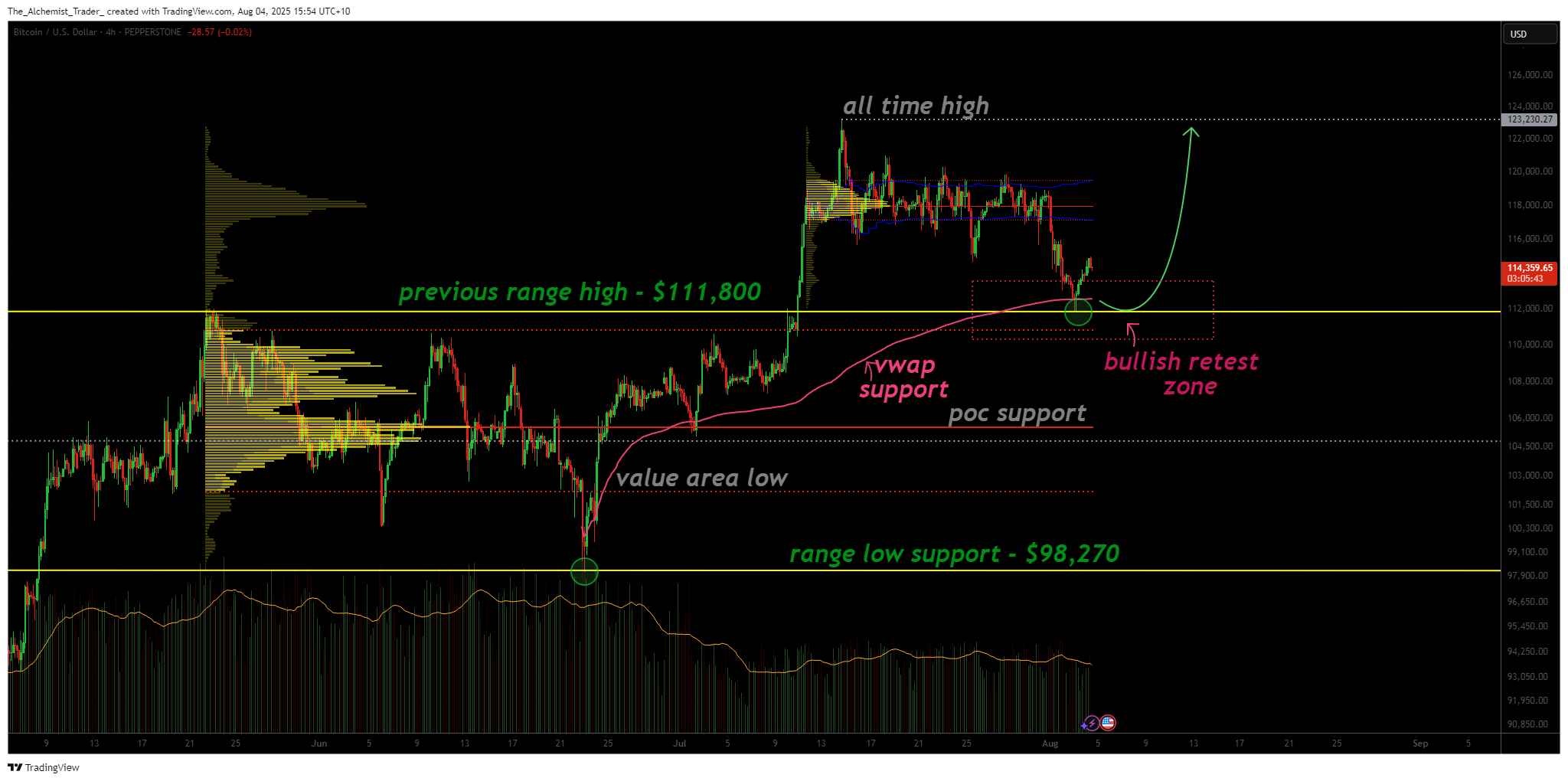

- Critical Support at $111,800: Former range-high resistance now acting as support with strong technical confluence.

- Confluence Zone: Support aligned with point of control, value area high, VWAP, and 0.618 Fibonacci retracement.

- Volume Confirmation: Increasing volume above support suggests active demand and potential reversal underway.

From a structural perspective, bitcoin remains in a clear uptrend, and this latest corrective move has tested but not broken the bullish formation. Price has now retraced into a high-probability zone for continuation, supported by the point of control, value area high, VWAP, and the 0.618 Fibonacci retracement. This gives the $111,800 level strong credibility as a base for the next wave higher.

Price action has respected this support closely, with a clean reaction and bounce from the level, showing that demand is present. This sets up a scenario where a higher low is being confirmed, strengthening the case for further bullish continuation toward the recent all-time high.

The volume profile is also beginning to confirm the bullish case. There has been a visible uptick in volume as price hovered above support, suggesting that buying interest is returning. If this volume sustains, it will validate demand and increase the probability of an upward breakout.

The next target remains the $123,230 all-time high. If that is broken, price could quickly MOVE into new price discovery with resistance levels between $130,000 and $135,000 based on Fibonacci extensions and historical pivots. However, if the $111,800 level fails and price gains acceptance back into the previous range, then the structure shifts and $98,200 becomes the next critical support target.

What to expect in the coming price action

Bitcoin’s bullish structure remains intact as long as $111,800 holds. A continuation above this level, especially with increasing volume, could trigger a rally to new all-time highs. Failure to hold WOULD invalidate the setup and shift the bias toward deeper retracement.