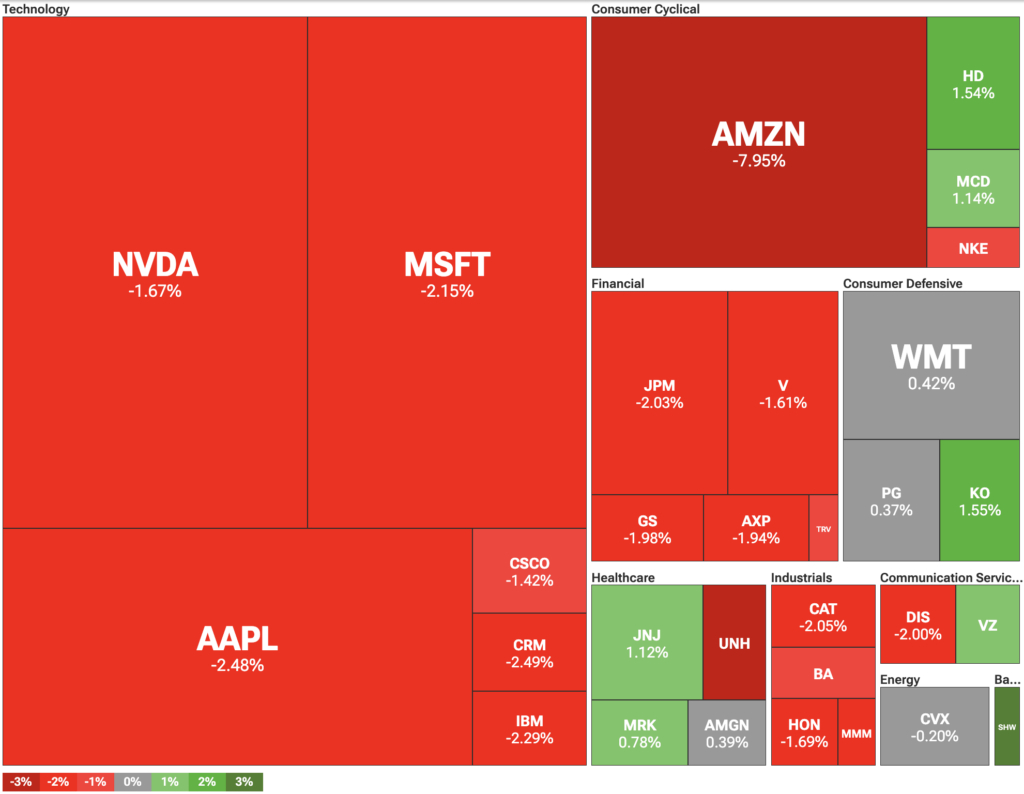

Dow Jones Plummets 600 Points as Rate Cut Bets Explode Amid Hiring Collapse

Wall Street's fear gauge spikes as traders price in emergency Fed moves.

Hiring data tanks—market now pricing 75% chance of September rate cut.

Another day, another overreaction by algos to backward-looking data.

Dow Jones Industrial Average heatmap | Source: TipRanks

Dow Jones Industrial Average heatmap | Source: TipRanks

Amazon’s earnings also exceeded expectations, with earnings per share of $1.68 compared to the $1.33 estimate. However, the company’s third-quarter guidance was relatively modest. This fell short of investor expectations, especially following the company’s multibillion-dollar investment in AI. As a result, its stock was among the biggest losers, falling 8%.

Fed may have to cut rates on weak jobs data

While tech stocks took a beating, there may be a silver lining. Specifically, the weak labor market could force the Federal Reserve to cut interest rates. CME FedWatch futures markets are now pricing in an 83% chance of a rate cut in September, up sharply from 38% just a day earlier—likely due to the disappointing employment data.

The Fed has a dual mandate to maintain low inflation and high employment. So far, the central bank has resisted pressure from President Donald Trump’s WHITE House to lower rates, despite a split among FOMC members.