Injective Price Pulls Back After ETF Frenzy—What’s Next for the Crypto Darling?

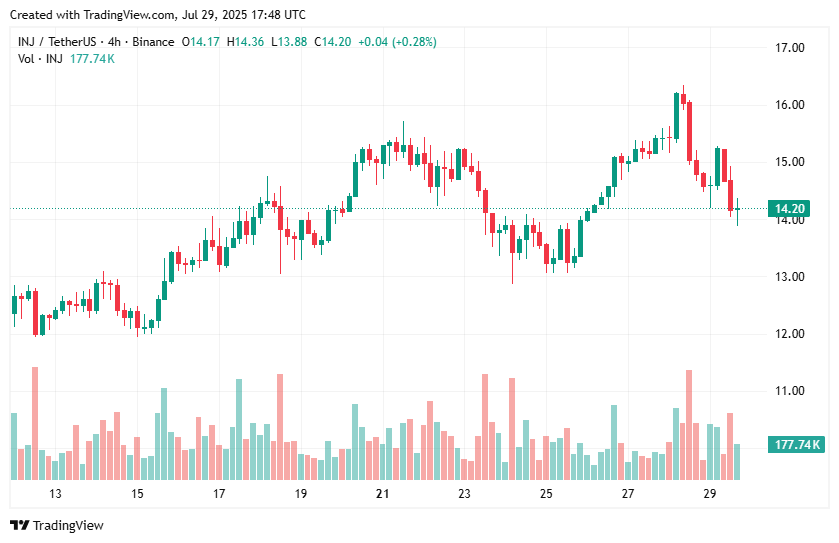

Injective's rally hits a speed bump as ETF hype cools—traders now weigh whether this is a healthy correction or the start of something uglier.

The ETF sugar rush wears off

Like clockwork, the crypto market proves once again that every institutional-driven pump gets met with profit-taking. Injective's 30% surge last week now looks like just another trading desk play.

Technical warning signs flash

The daily chart shows exhaustion candles at key resistance—classic 'buy the rumor, sell the news' behavior from traders who actually read the fine print on those ETF filings.

As always in crypto, the 'next big thing' turns out to be the same old game: Wall Street takes its cut while retail chases the momentum. Will this time be different? (Spoiler: Probably not.)

Why did Injective surge?

Injective’s gains came as traders reacted to news that Cboe, the largest options exchange in the United States, had filed with the U.S. Securities and Exchange Commission for approval to list the Canary Capital’s Staked Injective exchange-traded fund.

https://twitter.com/injective/status/1950236609334620249The filing meant Canary’s staked Injective ETF joined other major staked crypto ETF flings – ethereum (ETH) and Solana (SOL). It also points to the growing interest in Injective by institutional investors, which follows Canary’s registration of Delaware trust for the INJ ETF.

As the market reacted to the filing news, INJ price rose. However, like in many instances across the ecosystem, buy the rumor and sell-the-news scenario appears to have allowed for profit-taking.

INJ is not down by much, but price is hovering NEAR a key level and fresh declines will push it support around $13.20.

Despite the declines, analysts have pointed to Injective protocol’s price as signaling a bullish pennant on higher time frames.

Injective longs liquidated

Data from Coinglass shows a total of over $982,000 in Injective positions have been liquidated in the past 24 hours.

Of this, the vast majority are bullish bets at more than $895k. This liquidation hit for longs, with only $87k in shorts wiped out, also sees a decrease in open interest.

Coinglass data also indicates a decline of 10.4% in Injective OI, currently at around $167 million. Meanwhile, derivatives volume has fallen 16% to $413 million.