🚀 CryptoPunks Rockets to $200k Amid Controversy: Gondi’s $PUNKS Loaner Accused of Chandelier Bidding Shenanigans

CryptoPunks just shattered records—again. The iconic NFT collection surged to a jaw-dropping $200k per punk, proving digital blue chips still dominate. But not everyone’s celebrating.

Behind the scenes, whispers of market manipulation swirl. Gondi, the $PUNKS loaner platform, faces allegations of facilitating chandelier bids—artificially inflating prices while pretending to be the crypto version of 'organic demand.' Classic Wall Street playbook, just with more JPEGs.

The Pump Before the Dump?

Sources claim Gondi’s lending mechanisms let whales borrow punks, bid up prices, and vanish before the music stops. Sound familiar? It’s the same old game—pump, hype, exit—wrapped in blockchain 'transparency.'

The Irony of 'Decentralized' Markets

For all the talk of cutting out middlemen, crypto’s elite keep finding new ways to rig the game. Maybe Satoshi should’ve coded a 'no greed' clause into Bitcoin.

One thing’s clear: when a pixelated punk costs more than a Manhattan penthouse, someone’s either a genius—or about to get rekt.

CryptoPunks loaner Gondi under fire

The NFT lending marketplace Gondi has come under fire due to allegations that the platform has been facilitating “private loans” used to boost chandelier bids for PUNKS.

One trader even accused the platform of letting one of its advisors, Gfunk, borrow ETH (ETH) using PUNKS tokens as collateral, including tokens staked in the PUNKS staking contract. Even though, the trader alleged that the staked PUNKS tokens did not belong to Gfunk.

“Gondi created a private loan for PUNKS tokens ahead of the 16 CryptoPunks auction. It was done so Gfunk (a Gondi Advisor) could borrow ETH against PUNKS tokens,” wrote Venture Capitalist for GM Capital and PUNKS collector Beanie on his X account.

Gondi created a private loan for PUNKS tokens ahead of the 16 CryptoPunks auction. It was done so Gfunk (a Gondi Advisor) could borrow ETH against PUNKS tokens. The collateral used included tokens from the PUNKS staking contract. This enabled Gfunk to get funds to run up the bid. pic.twitter.com/E52unvBZPw

— Beanie (@beaniemaxi) July 29, 2025In a screenshot he shared, the Gondi user vault held a repayment with 194 ETH in debt, occurring after a principal loan of 194 ETH in the same time period made one month ago.

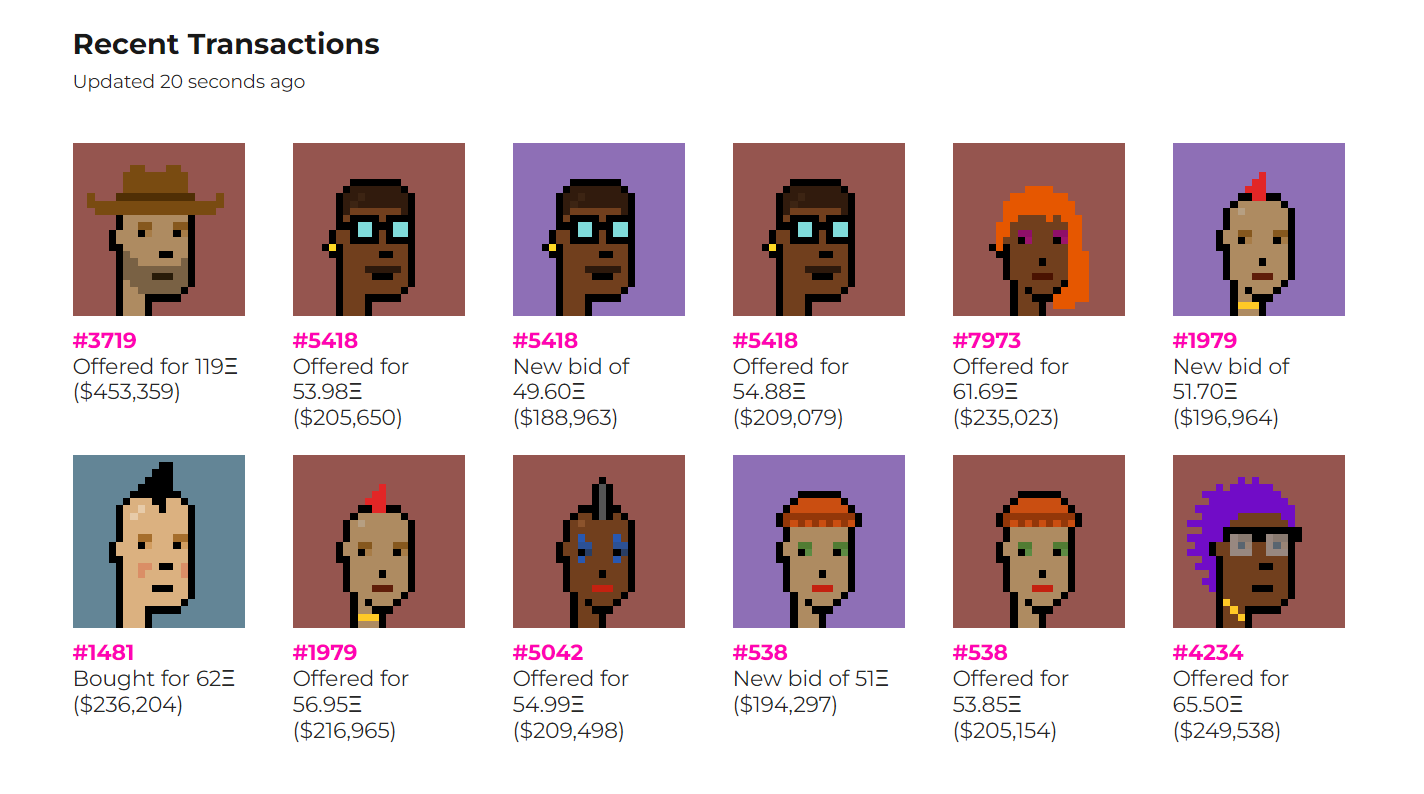

On July 29, the floor price for the OG crypto collection of 10,000 unique CryptoPunks (6,039 male and 3,840 female) climbed well above the $200,000 threshold. This is the highest peak it has ever reached within 2025 alone. It now occupies to top spot among NFT sales on CryptoSlam, beating out Courtyard and Moonbird.

At press time, the floor price for PUNKS has gone up by 4.6% in the past 24 hours. The floor price is currently standing at 53.85 ETH or worth around $205,154 for one CryptoPunk, with many of the recently sold CryptoPunk NFTs rising in sales by 372.34% in the past day of trading.

According to data from CryptoSlam, 38 PUNKS were sold within the span of 24 hours, indicating a 375% increase in the number of transactions for the renowned ethereum NFT. The value of sales made in the past 24 hours has amounted to $8.44 million.

“The collateral used included tokens from the PUNKS staking contract. This enabled Gfunk to get funds to run up the bid,” continued Beanie.

He described the alleged stunt as being similar to how AAVE (AAVE) operators were able to leverage staked tokens on its platform in order to facilitate a loan. Which should not have been possible considering the admin keys to Aave were burned.

This collateral backed loan occurred before the CryptoPunks #16 auction, presumably giving Gfunk ETH liquidity to actively bid or support the auction. So far, there have been no statements addressing the accusations.

However, the official account recently posted a “Notable Loan” for a Wrapped CryptoPunk #2545, which originated from a 100,000 USDC (USDC) loan.

“That’s 5 Punk loans today alone. Liquidity isn’t slowing down, it’s accelerating,” wrote Gondi on its official X account.

Echoing this sentiment, the floor price for the CryptoPunks NFT continues to climb, reaching its highest level since March 2024.