Flare Price Surges to New Highs as Key Metric Smashes ATH – But Is the Rally Sustainable?

Flare's native token just caught fire—literally. A make-or-break network metric just punched through its all-time high, sending prices soaring. But crypto veterans know: ATHs are equal parts opportunity and trap.

Behind the pump: On-chain activity suggests institutional players might finally be paying attention. Or it could just be another algo-driven liquidity grab. The charts don’t lie—but they do exaggerate.

Risk check: Volatility remains tighter than a trader’s stop-loss during a flash crash. And let’s be real—half these 'key metrics' get invented by projects desperate to distract from their token unlocks.

Bottom line: This isn’t your grandma’s bullish breakout. Trade accordingly—and maybe keep one finger hovering over that sell button. After all, in crypto, 'ATH' often just means 'All-Time Hazard.'

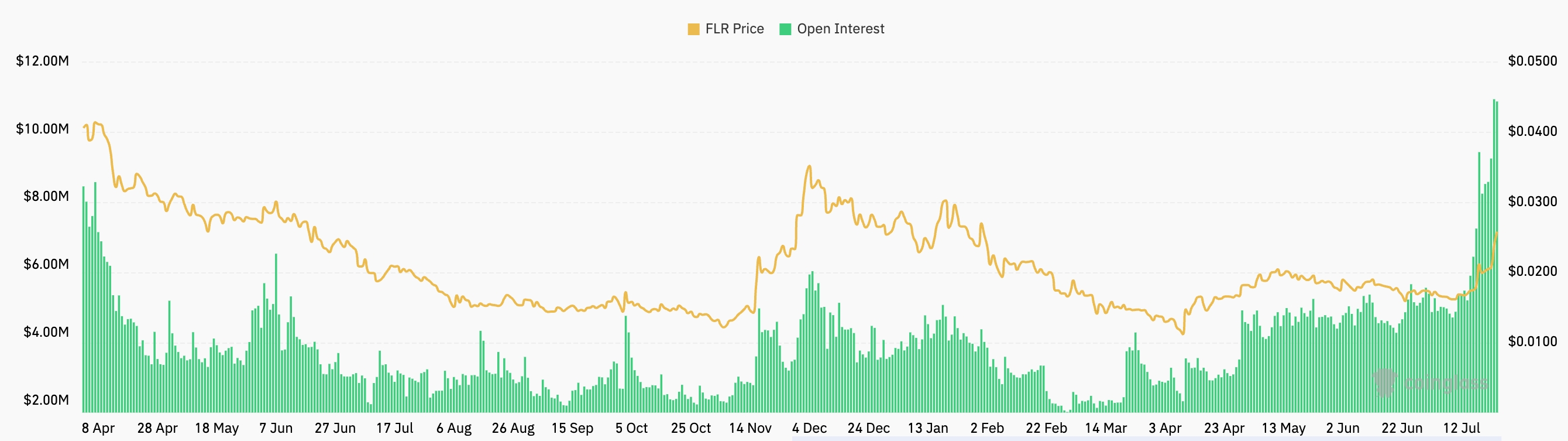

Flare futures open interest hits all-time high

The Flare price accelerated this week as demand for the token jumped. Its daily volume in the spot market soared by 535%, making it one of the most actively traded tokens in the cryptocurrency market.

Most notably, the same trend happened in the futures market, where its open interest rose to a record high of $10 million. This interest has been steadily increasing after bottoming at $1.7 million in February this year.

A surging open interest is a sign of high demand and liquidity, which is a highly bullish catalyst.

FLR token price faces risk as funding rate turns negative

However, the ongoing Flare Price jump faces some potential risks that may affect its recovery. First, data shows that the weighted funding rate has remained in the red in the past few days.

A negative funding rate means that short position holders are paying long holders, leading to a high short interest. It signals that these traders anticipate the future price to be lower than the current one.

The other main risk is that Flare’s ecosystem is not doing well despite the ongoing crypto market rally. For example, Tether’s supply in the network has dropped by 23% in the last 30 days to $64 million. Similarly, the USD Coin supply has plunged by 30% to $18 million in the same period.

Flare’s decentralized exchange volume has also been in a downtrend in the past few months. The volume stands at $91 million this month, down from $122 million in June and $167 million in May.

Flare crypto price technical analysis

The daily chart indicates that the Flare price has experienced a strong surge over the past few days. This rally happened after it formed a falling wedge pattern, a popular bullish reversal sign. A wedge comprises two descending and converging trendlines.

The Flare crypto price has formed a golden cross as the 200-day and 50-day weighted moving averages have crossed each other. This crossover explains why it has experienced a recent surge.

The Relative Strength Index and the Stochastic Oscillator have both moved to the overbought level. Therefore, the token will likely pull back to the psychological point at $0.20 and then resume the uptrend.