CertiK Stablecoin Report 2025: The Top 5 Fort Knox-Level Tokens Dominating the Race

The stablecoin wars have a new sheriff—and its name is security. CertiK’s 2025 report drops the mic on which tokens are actually built to last (unlike some *cough* algorithmic experiments). Here’s the breakdown.

The Unshakeable 5: No Backdoors, No BS

Forget ‘too big to fail’—these stablecoins are too armored to hack. CertiK’s audit team sliced through code like a hot knife, grading reserves, smart contracts, and governance. The winners? Heavyweights with transparency that puts banks to shame (not that it’s hard).

1. The Gold Standard (Literally)

Tokenized dollars with 1:1 audits—real ones, not ‘trust me bro’ spreadsheets. Daily attestations? Check. Bulletproof mint/burn mechanics? Double-check. Bonus points for surviving the 2024 ‘Stablepocalypse’ without breaking peg.

2. The DeFi Darling

This chain-agnostic workhorse powers 60% of decentralized exchanges. How? By treating smart contract upgrades like nuclear codes—multisig, time locks, and a paranoid community of white-hats.

3. The Regulator’s Pet

Yes, it’s boring. Yes, it’s got a CEO in a suit. But when the SEC came knocking, this one didn’t sweat—because its reserves aren’t ‘creative accounting’ wrapped in an IOU.

4. The Dark Horse

Zero-name recognition outside crypto circles, 100% uptime during three black swan events. How? By treating collateral like a doomsday prepper: overcollateralized, diversified, and always liquid.

5. The People’s Pick

Decentralized governance that actually works (shocking, we know). Proposal thresholds high enough to stop trolls, low enough to adapt. DAO votes settle peg disputes faster than Congress passes a budget.

The Bottom Line

In a world where ‘stable’ coins moon and crater weekly, these five sleep soundly. Meanwhile, Tether’s lawyers bill another 10,000 hours.

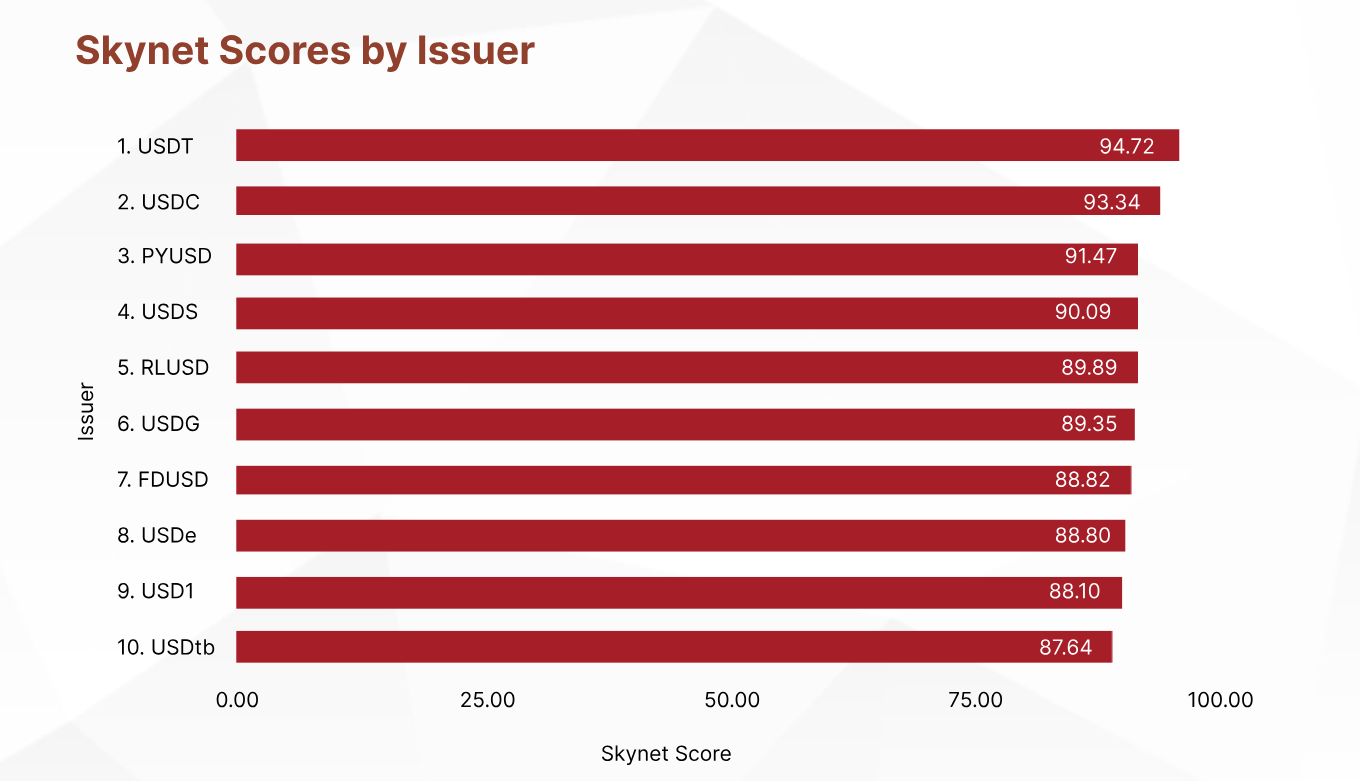

Chart displaying CertiK’s Skynet stablecoin score distribution based on security and other factors | Source: CertiK

Chart displaying CertiK’s Skynet stablecoin score distribution based on security and other factors | Source: CertiK

In fourth place is USDS by Sky with 90.09. The rebranding of DAI into Sky has helped to expand the token into multiple chains. Since its launch on Solana, it has grown to become the fifth largest stablecoin.

Ripple’s RLUSD (RLUSD) stands at number five with a Skynet framework score of 89.89. Although it still ranks below USDT and USDC in terms of supply and security mechanisms in place, CertiK noted that the token has experienced zero security incidents since its launch.

Other notable tokens mentioned in the top 10 include First Digital USD (FDUSD), USDG by Paxos, Ethena’s USDe (USDE) and USDtb, as well as World Liberty Financial’s own USD1.

The impact of security incidents on stablecoins

According to blockchain security firm CertiK, as many as 344 crypto security incidents occurred in the past year. These incidents led to the theft of $2.47 billion worth of crypto assets industry-wide. Though these incidents are not always linked to stablecoins directly, they often bear the brunt of exploits, more so than regular tokens.

For instance, First Digital USD saw its price plummet to $0.76 amid rumors about whether or not its reserves were secure. It was only able to recover its $1.00 value after the issuer disclosed audited holdings to prove that its reserves were safe. This case shows just how easily the cookie crumbles when it comes to stablecoins.

Causes leading to stablecoin value drops in the past 10 years

Price depegs (Total: 14):- Compliance events

- Problems with asset liquidity

- Delisting from exchanges

- Suspected asset mishandling

- Company halts issuance

- Token contract vulnerability

- Other contract vulnerability

- Chain vulnerability

- Design failure

- Insufficient reserve asset

Due to the nature of fiat-pegged tokens, its reserves are considered sacred in a way that differs to other tokens. One wrong MOVE could result in the 1:1 ratio backed by real currencies to dip and lead to the token’s downfall.

CertiK’s report showed that exploits in the crypto space, such as hacks, death spirals, and price depegs, were mostly caused by operational failures compared to technical flaws in the system. According to the study, vulnerabilities in systems where stablecoins are the primary asset made up a large portion of the losses.