Whales Go Shopping: Pepe Coin Primed for Rebound as Rare Bull Pattern Emerges

Big money moves in as PEPE flashes a textbook reversal signal—just as crypto's favorite meme coin needed a win.

Forget diamond hands—this is whale territory. On-chain data shows deep-pocketed investors loading up on PEPE while retail traders nap. The trigger? A near-perfect bullish technical formation that even Wall Street would grudgingly respect.

Chartists are circling the rare pattern like sharks. When this setup last appeared in March, PEPE ripped 300% in three weeks. Now trading desks whisper about 'symmetry plays' and 'liquidity grabs'—finance-speak for 'we might actually make money this time.'

Of course, in meme-coin land, fundamentals are whatever you can plot on a 15-minute chart. But with Bitcoin stabilizing and altcoins waking up, PEPE's 45% monthly drop looks more like a discount than a disaster.

Just remember: In crypto, 'rare patterns' happen every Tuesday—and whales always eat first.

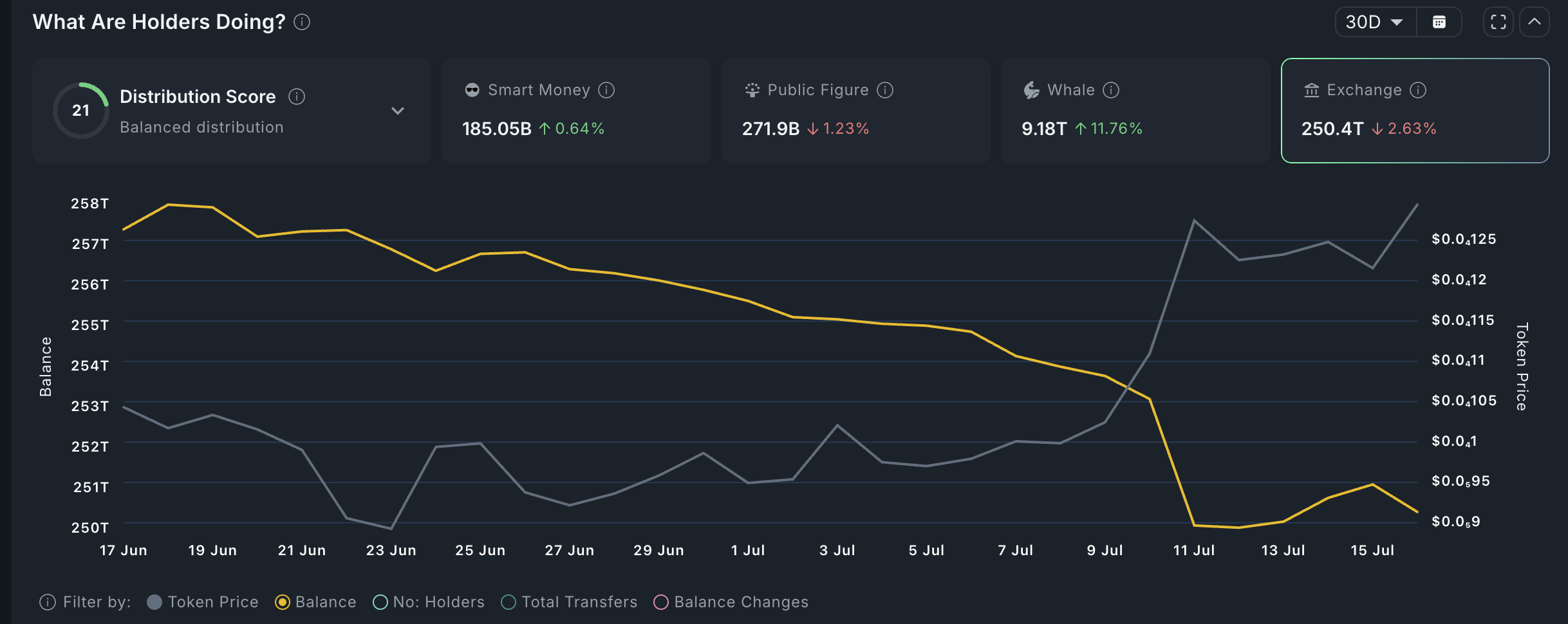

Pepe supply on exchanges | Source: Nansen

Pepe supply on exchanges | Source: Nansen

The main catalyst for the Pepe Coin price is the Ethereum (ETH) breakout. As crypto.news wrote, there are high chances that ethereum price will go parabolic and hit the psychological point at $4,000 in the coming months.

An ethereum rally to $4,000 would be highly bullish for Pepe and other meme coins within its ecosystem.

Pepe Coin price technical analysis

The daily chart shows that PEPE has further upside potential in the months ahead. It has already broken out above the upper boundary of a falling wedge pattern, a classic bullish reversal indicator.

Pepe is now approaching the 38.2% Fibonacci retracement level at $0.000014 and a major support/resistance level based on the Murrey Math Lines tool.

Most notably, the token has formed a golden cross pattern, which happens when the 50-day and 200-day Exponential Moving Averages cross each other.

The Average Directional Index is pointing upward, indicating strengthening momentum. As a result, Pepe is likely to continue rising, with bulls eyeing the key resistance at $0.00001624, its highest level in June. A drop below support at $0.000010 WOULD invalidate the bullish outlook.