Solana Soars to Highest Price Since May 2025—Here’s Why Traders Are FOMOing In

Solana's native token just punched through resistance levels not seen since Terra collapsed—and the charts scream 'bullish.'

### The SOL Surge: More Than Just Meme Hype

No fluke here. Network upgrades slashed transaction fees by 40% last quarter, while NFT volumes quietly doubled. Institutional wallets? Stacking SOL like it’s 2021.

### Liquidity vs. Leverage: The Hidden Risk

Open interest hit $2B this week—great until a whale dumps. Remember kids: parabolic moves attract both Lambos and liquidations.

Solana’s rally defies the ‘altcoin graveyard’ narrative—for now. But as any degens knows, what goes up must 10x… or get rekt. *Cough* LUNA flashbacks *cough*.

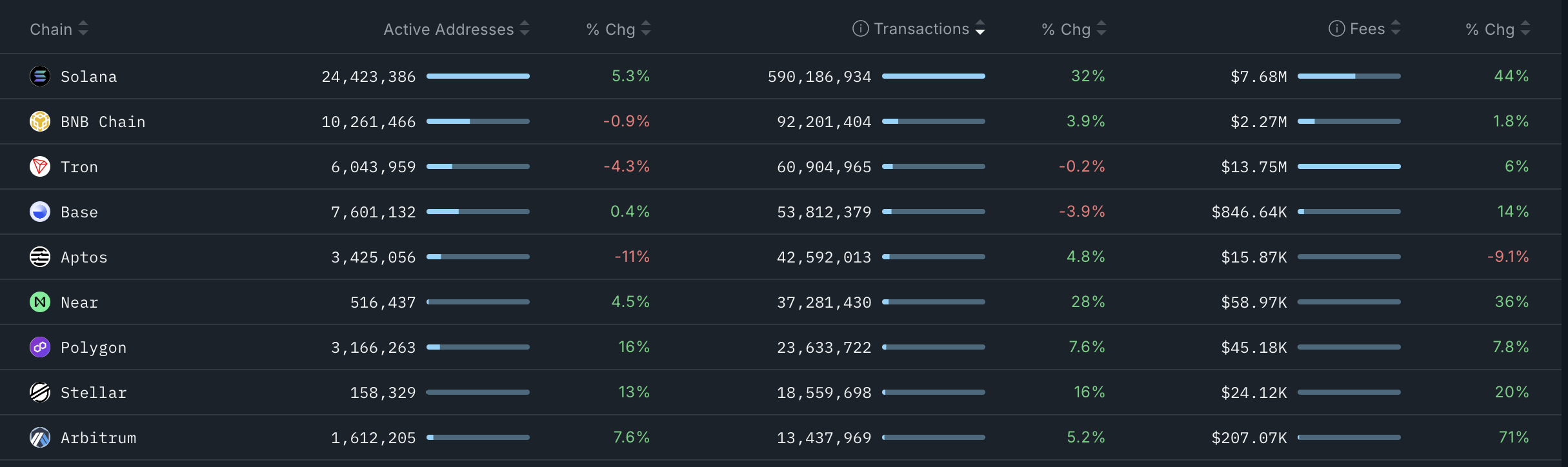

Top blockchains ranked by transactions and active addresses | Source: Nansen

Top blockchains ranked by transactions and active addresses | Source: Nansen

Meanwhile, the recently launched REX-Osprey SOL + Staking ETF continues gaining traction among investors as its assets have jumped. Its assets stood at over $72 million by Thursday, a good amount for a two-week ETF.

The main benefit for the SSK ETF is that it offers an exposure to Solana and its accompanying staking rewards. StakingRewards datashows that Solana stakers receive a yield of about 7.5%.

Solana also jumped as its ecosystem did well, with its meme coins gaining traction. The market capitalization of all these coins has jumped to over $12.4 billion from the April low of $6 billion.

Further, Solana’s stablecoin supply stood at $10.7 billion, while its addresses pumped by 15% to 3.4 million. The number of transactions and adjusted volume ROSE by 29% and 45%, respectively.

Solana price technical analysis

The daily timeframe chart shows that the SOL price bottomed at $94.3 in April and then bounced back. It moved to the top of the trading range of the Murrey Math Lines at $162.

The Solana price jumped above the 50-day and 200-day moving averages, as well as the 23.6% Fibonacci Retracement level. It has also moved above the ascending trendline that connects the lowest point in April and June.

Therefore, the token will likely continue rising as bulls target the key point at $187, the highest point in May. This target is about 15% above the current level. A break above that level will point to more gains, potentially to the Murrey Math Lines ultimate resistance at $200.