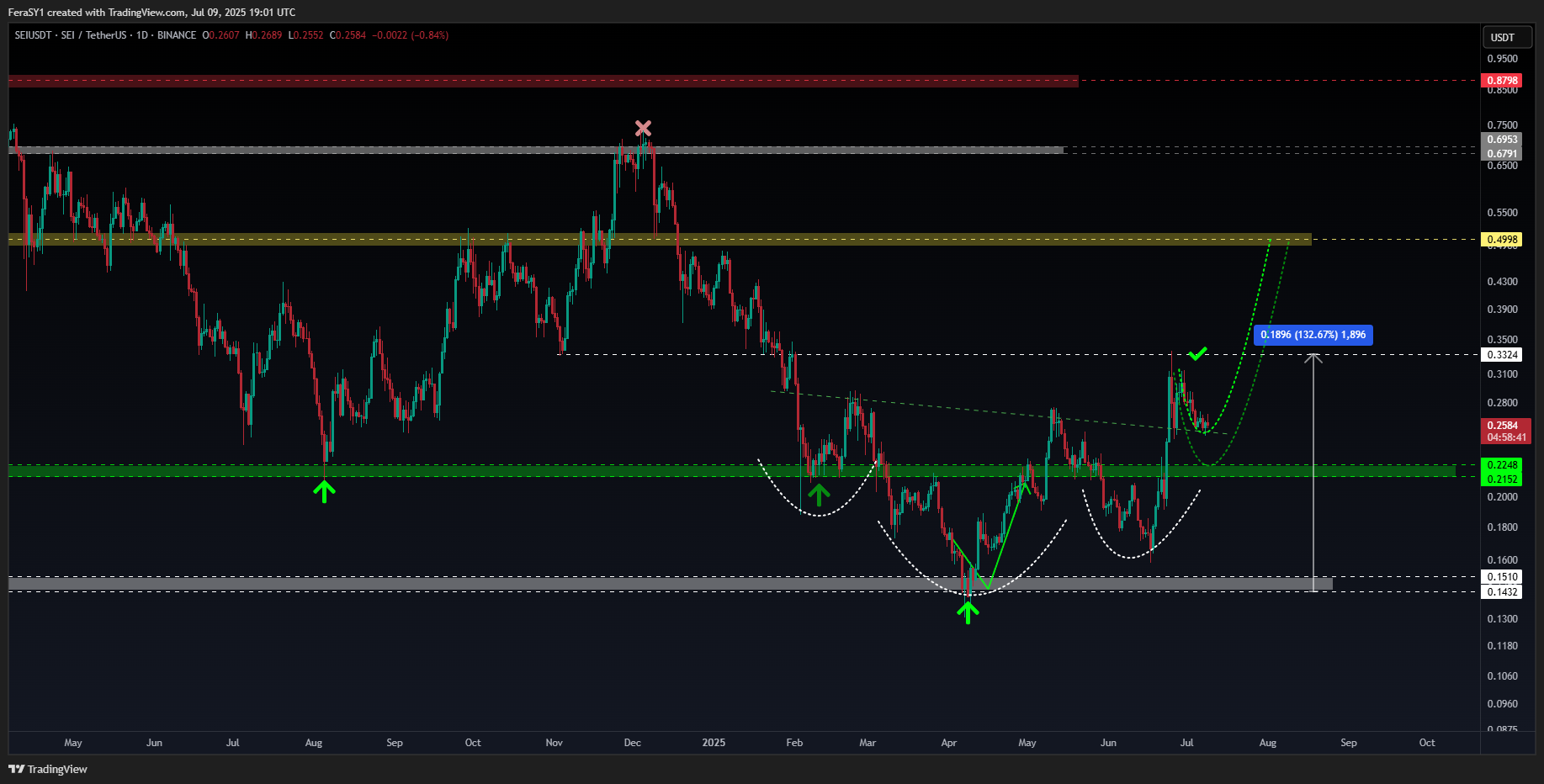

SEI Primed for 55% Surge as Native USDC Integration Triggers Inverse H&S Breakout

SEI's chart just flashed a bullish signal Wall Street would kill to ignore. The crypto asset smashed through a key technical pattern—fueled by its new native USDC support—and now eyes a 55% rally.

Inverse head-and-shoulders? More like inverse bearish sentiment. The breakout confirms what traders suspected: SEI's infrastructure upgrades are finally being priced in.

Meanwhile, legacy finance still can't decide if stablecoins are securities or the future. Good luck shorting this momentum.

Source: X/CryptoFeras

Source: X/CryptoFeras

Bullish sentiment is also being echoed by other market analysts, with some projecting that SEI could reach as high as $1.50 by year-end, should macro and ecosystem developments remain favorable.

Multiple bullish catalysts in play

Momentum indicators seem to favour a continuation of the rally at least in the short term. The MACD line has crossed above the signal line, and RSI has continued to trend upward. This means buyers are currently dictating short-term price action..

Adding to that, derivatives data further supports this outlook. According to CoinGlass, open interest in SEI futures has surged by more than 210% over the past three weeks, rising from under $50 million in mid-June to approximately $318 million as of press time. Traders are likely positioning themselves in anticipation of a breakout.

Meanwhile, data from DeFiLlama shows total value locked across Sei’s DeFi protocols has reached a new all-time high of $1.4 billion. The scale of capital inflow points to sustained user activity across decentralised applications beyond just speculative interest in the SEI token alone.

As more liquidity anchors into the network, Sei stands to benefit from deeper markets, greater pricing stability, and improved conditions for developers building DeFi infrastructure.

Further support for Sei’s growth outlook may come from institutional positioning. Circle’s IPO prospectus, filed recently with U.S. regulators, confirms a holding of 6.25 million SEI tokens. This level of exposure suggests that Circle views Sei as a meaningful component in its broader blockchain strategy.

Moreover, Sei is currently one of eleven blockchain networks under review by the Wyoming Stable Token Commission for the upcoming WYST stablecoin project. A final decision is expected on July 17.

Should Sei qualify for the selection, it WOULD mark another big step toward regulatory alignment and could further reinforce the network’s credibility as a compliant, institution-ready blockchain infrastructure in the U.S.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.