Dow Jones Plunges 100 Points as Trump’s Tariff Threats Rattle Markets

Wall Street's fear gauge spikes as traders brace for another round of economic whiplash.

Tariff tremors shake markets

The Dow's triple-digit drop reveals how quickly 'America First' policies can become 'Investor Worst Nightmare'—with algorithmic traders and human investors alike scrambling to price in the coming trade war volatility.

Meanwhile, crypto markets barely flinch—because when you're used to 10% daily swings, a mere 100-point Dow drop is basically market noise. Just another Wednesday in decentralized finance.

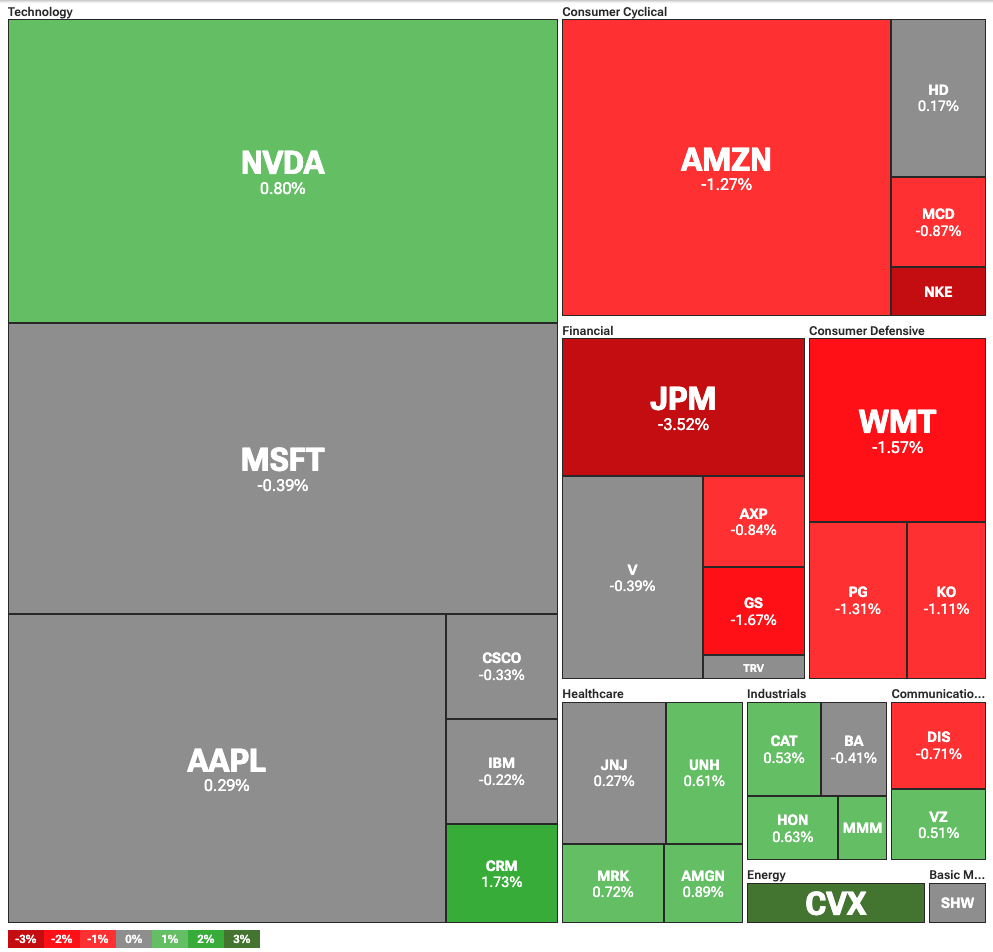

Dow Jones Industrial Average heatmap on July 8 | Source: TipRanks

Dow Jones Industrial Average heatmap on July 8 | Source: TipRanks

At the same time, crypto markets were also relatively unchanged, with Bitcoin (BTC) rising 0.47% in the last 24 hours. The overall crypto market cap was up just 0.13%, while Ethereum (ETH) was a standout performer, with a 2% gain.

Markets eye Trump’s next moves on Trade

Investors remain focused on shifting trade dynamics, as signals from the White House remain mixed. On Tuesday, President Donald TRUMP extended the July 9 deadline for reinstating punitive tariffs on U.S. trading partners to April 1.

Still, tensions escalated as Trump threatened South Korea and Japan with new tariffs, while China responded with warnings of its own. Beijing cautioned against the implementation of new tariffs and indicated it may retaliate against countries entering trade agreements with the U.S.

The warning is significant, since Trump threatened further retaliation against countries that side with “anti-American” policies or the BRICS bloc. While the President did not specify what WOULD constitute a hostile policy, he has previously warned the bloc against creating its own currency.

Further escalation could lead to a broader decoupling of global trade, with the U.S. and BRICS nations forming increasingly separate economic and geopolitical spheres.