Bitcoin’s Fading Allure? CoinShares Reports BTC Outflows Amid Record 12-Week Inflow Streak for Crypto Assets

Crypto investors are flipping the script—again. While Bitcoin bleeds out, the broader digital asset market just notched its 12th straight week of inflows, pushing total assets under management to fresh all-time highs. Talk about a mixed signals market.

The BTC Exodus

Institutional players seem to be rotating out of the OG crypto—whether it’s profit-taking, ETF fatigue, or just shiny-object syndrome chasing the next hot altcoin. Meanwhile, the rest of the crypto complex keeps raking in cash like a Wall Street hedge fund during QE.

The Bigger Picture

Twelve weeks. That’s three solid months of money flooding into crypto products while traditional finance pundits clutch their pearls. Assets under management? Blowing past previous records. Because nothing says 'healthy market' like divergence—BTC stumbles, but the altcoin casino stays packed.

Cynical take: Maybe institutions finally realized diversification works—even when it’s just spreading bets across different speculative tokens. Or maybe they’re just preparing for the next ‘up only’ cycle. Either way, the money printer’s still humming… for everything except Bitcoin.

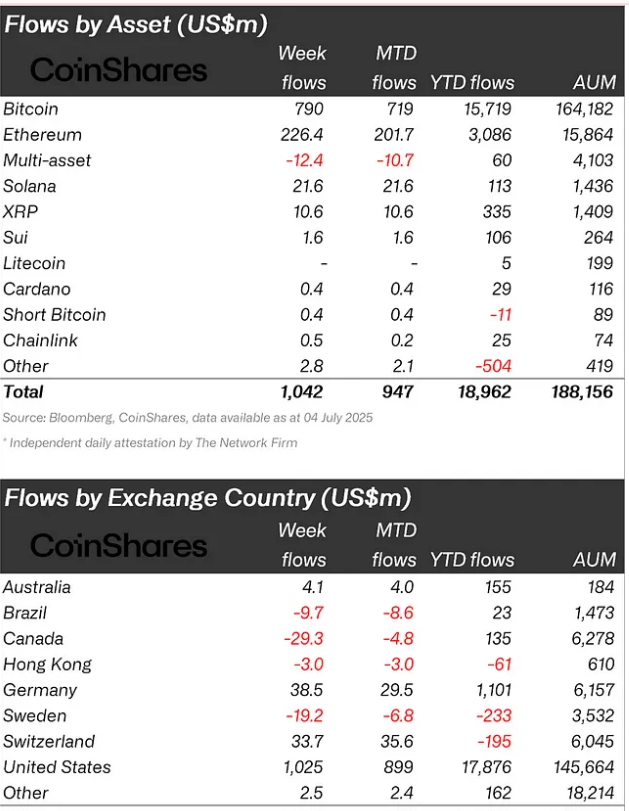

Crypto flows recorded last week by asset type and provider | Source: CoinShares

Crypto flows recorded last week by asset type and provider | Source: CoinShares

In fact, he noted that there has been a shift in investors’ attitude towards Ethereum (ETH), which recorded its 11th week of consecutive inflows with $226 million. According to the CoinShares report, weekly inflows from ETH throughout last week’s period amounted to 1.6% of the total assets under management.

Butterfill observed that this rate was significantly higher than the 0.8% contributed by Bitcoin, which he believes is a sign that more investors are warming up towards Ethereum while keeping a SAFE distance from Bitcoin.

From a regional standpoint, the United States still holds the largest share of inflows last week with $1 billion in inflows. Meanwhile, Germany and Switzerland also saw inflows with $38.5 million and $33.7 million respectively. On the other hand, Canada and Sweden experienced outflows amounting to $29.3 million and $19.2 million.

Other regions such as Hong Kong and Brazil saw modest outflows of $3 million and $9.7 million.