Russia’s Largest State Bank Questions CBDC Use—So Why the Relentless Push?

When Russia’s biggest state-backed bank shrugs at central bank digital currencies, you’d expect the project to stall. Yet here we are—barreling ahead anyway. Why?

The Skepticism Behind the Scenes

Even as governments worldwide race to launch CBDCs, Russia’s financial heavyweight sees little practical use for them. No efficiency gains. No game-changing benefits. Just another bureaucratic experiment.

Follow the Money (Or the Control?)

Could this be less about innovation and more about tightening the grip? CBDCs offer unprecedented oversight—every transaction traceable, every wallet monitored. Convenient for regulators, chilling for privacy.

A Cynic’s Take

Of course they’re pushing forward. When has a central bank ever passed up the chance to expand its power—especially under the guise of 'modernization'? The real question: Who’s left to stop them?

Cashbacks, but for lenders

Still, the Bank of Russia continues to highlight what it sees as long-term benefits. It plans to begin mass adoption of the digital ruble on September 1, 2026, and expects the system to become a regular part of financial life within five to seven years.

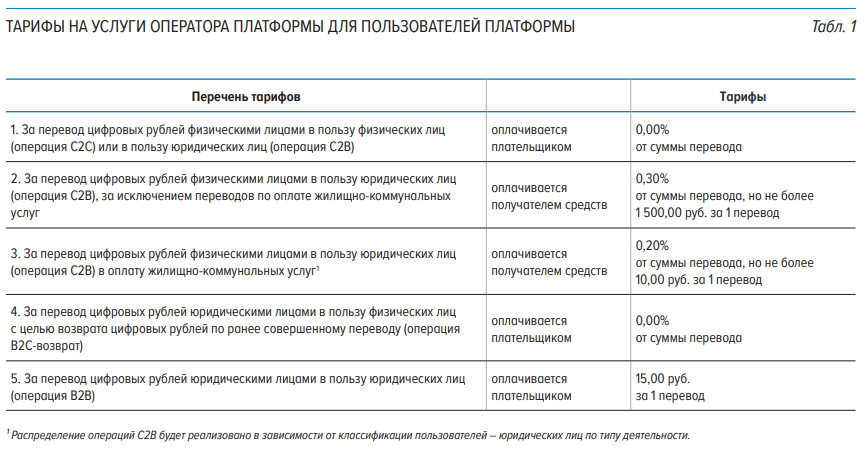

To make the digital ruble more appealing — especially for everyday users — the central bank is waiving all fees on transfers between individuals. Businesses still have to pay commissions, but they’re lower than what current payment systems or card services charge.

For example, sending money from a private user to a business comes with a max fee of 1,500 rubles (around $19) or 0.3% of the transfer amount. Utility payments cost even less, capped at 10 rubles or 0.2%.

The central bank also offers incentives to banks and other participants helping to operate the digital ruble platform. These partners will receive small commissions for facilitating various types of transactions, although the amounts are tightly regulated. Payments are made in digital rubles and handled directly through the platform’s centralized accounting system.

Long shot

The Bank of Russia insists this is about the future. The digital ruble isn’t just another payment tool, the central bank says, emphasizing that it’s a step toward a more modern and flexible financial system. Officials believe the platform could make government payments more efficient, help track public funds more transparently, and even pave the way for new types of smart contracts and automation in finance.

But the Sberbank CEO isn’t convinced, at least not yet. There’s still time for the picture to shift.

The pilot phase for the digital ruble has been ongoing since August 2023, and more functionality is being tested gradually. Some might suggest that the real value of the digital ruble may only become apparent as international payment systems become more fragmented, and Russia seeks new tools to bypass sanctions and simplify trade with select foreign partners.

In that scenario, the digital ruble might not change everyday life for most Russians, but could still become a useful instrument for the state. One way or another, the Bank of Russia appears determined to stay the course, even as some of the country’s most powerful bankers openly question what it’s all for.