Stellar Lumens (XLM) Price Alert: Funding Rate Plunge Signals Market Turmoil

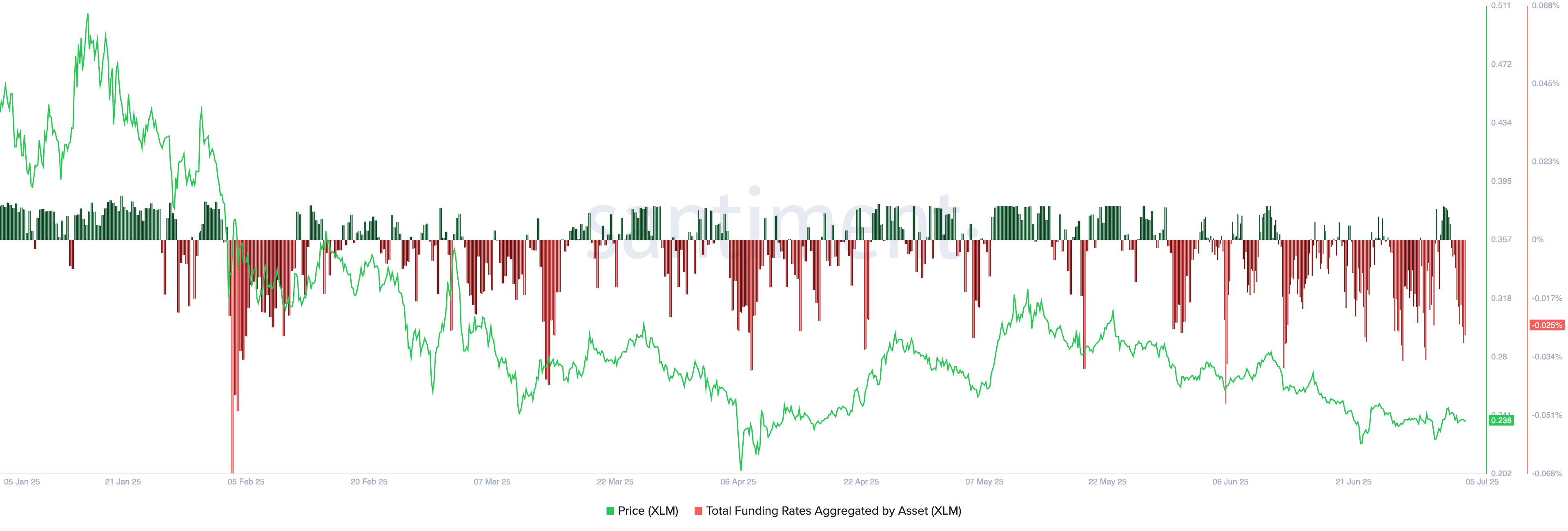

Stellar Lumens traders are hitting the panic button as XLM's funding rate nosedives—a classic crypto liquidity red flag.

Bearish bets pile up while leveraged longs scramble. Is this a temporary shakeout or the start of a deeper correction?

Meanwhile, institutional players sip lattes watching retail traders relearn the oldest lesson in finance: leverage cuts both ways.

Stellar funding rate | Source: Santiment

Stellar funding rate | Source: Santiment

Still, on the positive side, third-party data shows that the network is doing well. According to Artemis, the number of operations on Stellar ROSE to 197 million in June, while the stablecoin supply soared to a record high of $667 million.

Additional data indicates that the total value locked in real-world asset tokenization has risen to $487 million. It has jumped in the last five consecutive months, helped by the Franklin OnChain US Government Money Market Fund.

Meanwhile, Nansen data shows that the number of transactions jumped by 11% in the last seven days to 18.2 million. The number of active addresses in the network rose by 10% to 146,700.

XLM price technical analysis

The daily chart shows that the Stellar Lumens token price dropped to a key support level at $0.2175, a notable point that coincided with the lowest point in April, when most altcoins also plummeted.

The support level was the lower side of the descending triangle pattern, a popular bearish continuation pattern. It has moved below the 61.8% Fibonacci Retracement level, where most rebounds happen.

XLM price has dropped below the 50-day and 100-day Exponential Moving Averages. Therefore, a MOVE below the lower side of the triangle will indicate further downside, with the next key level to watch being at $0.15, which is 36% below the current level.