Uniswap Price Stuck in Bear Territory—Here’s What’s Dragging It Down

Despite crypto’s 2025 resurgence, Uniswap’s token can’t catch a break. Liquidity woes, regulatory shadows, and that classic DeFi ‘build-now-profit-never’ ethos keep UNI on the back foot.

The Liquidity Mirage

Even with $4B+ in TVL, UNI’s price action resembles a stale stablecoin. Blame vampire attacks and yield farmers chasing the next shiny fork.

Regulatory Sword of Damocles

The SEC’s ‘regulation-by-lawsuit’ playbook keeps institutional money sidelined—because nothing screams ‘safe asset’ like an ongoing legal battle.

Tokenomics Tragedy

Community treasury debates and vesting unlocks create sell pressure that’d make a Bitcoin maximalist blush. Pro tip: maybe don’t dilute holders faster than a meme coin.

Until Uniswap solves real-world revenue (not just ‘fee switch’ fantasies), UNI risks becoming the Kodak of DeFi—revolutionary tech, questionable investment. But hey, at least the gas fees are low now.

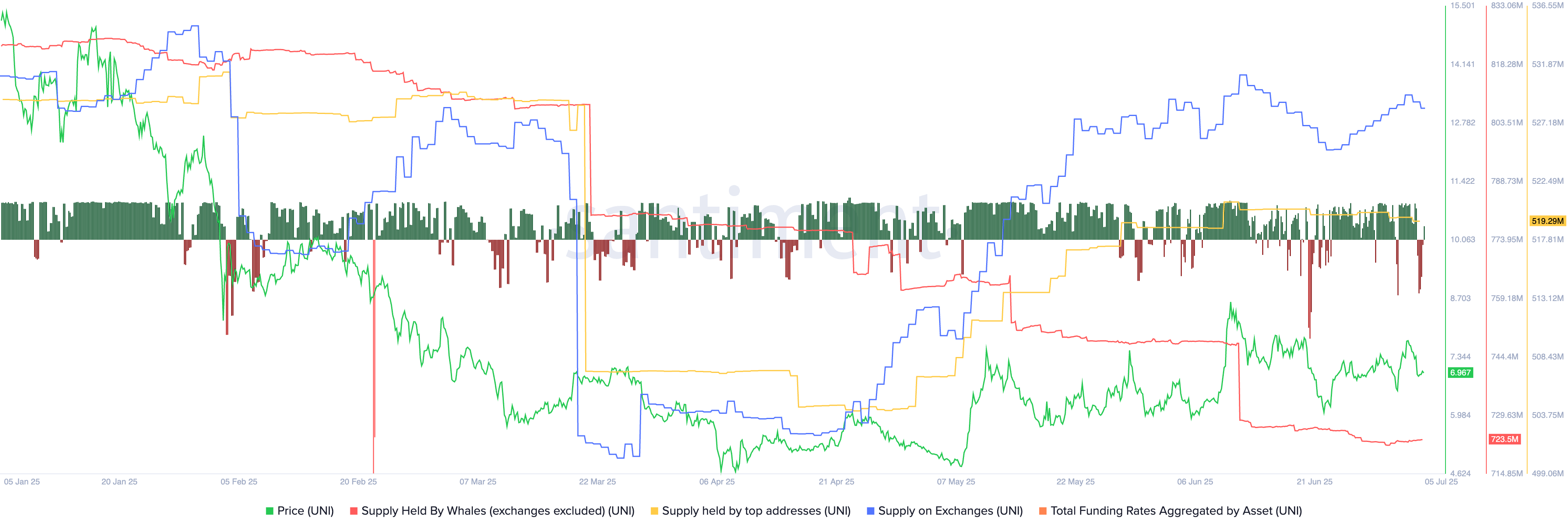

Uniswap supply in exchanges, whale holdings, funding rate | Source: Santiment

Uniswap supply in exchanges, whale holdings, funding rate | Source: Santiment

UNI’s funding rate has also moved into negative territory, implying that investors anticipate the future price to be lower than it is today.

Uniswap price technical analysis

The daily chart shows that the UNI price has crashed from a high of nearly $20 in November last year to $6.98. It has pulled back after plunging from the year-to-date low of $4.7 to the current $6.9.

The Uniswap Price has also formed a bearish flag pattern, which consists of a vertical line and an ascending channel. Therefore, the coin is likely to experience a bearish breakdown, with the next key point to watch being the year-to-date low of $4.70. A move above the important resistance level at $8.6, the highest swing in May, will invalidate the bullish view.