Useless Coin’s Rally Teeters as Whales and Smart Money Cash Out—Is This the Top?

Whales are dumping. Smart money is fleeing. And Useless Coin's parabolic rally looks ready to snap.

After a gravity-defying run, the memecoin's chart is flashing red as deep-pocketed traders take profits. The question now: Is this a healthy pullback—or the start of a brutal reckoning?

When the so-called 'diamond hands' start paper-handing, retail always pays the price. Just ask the bagholders of 2023's vaporware tokens.

One hedge fund manager quipped: 'Useless Coin proving its name again—useless at holding value.' Ouch.

Useless Coin smart money transactions | Source: Nansen

Useless Coin smart money transactions | Source: Nansen

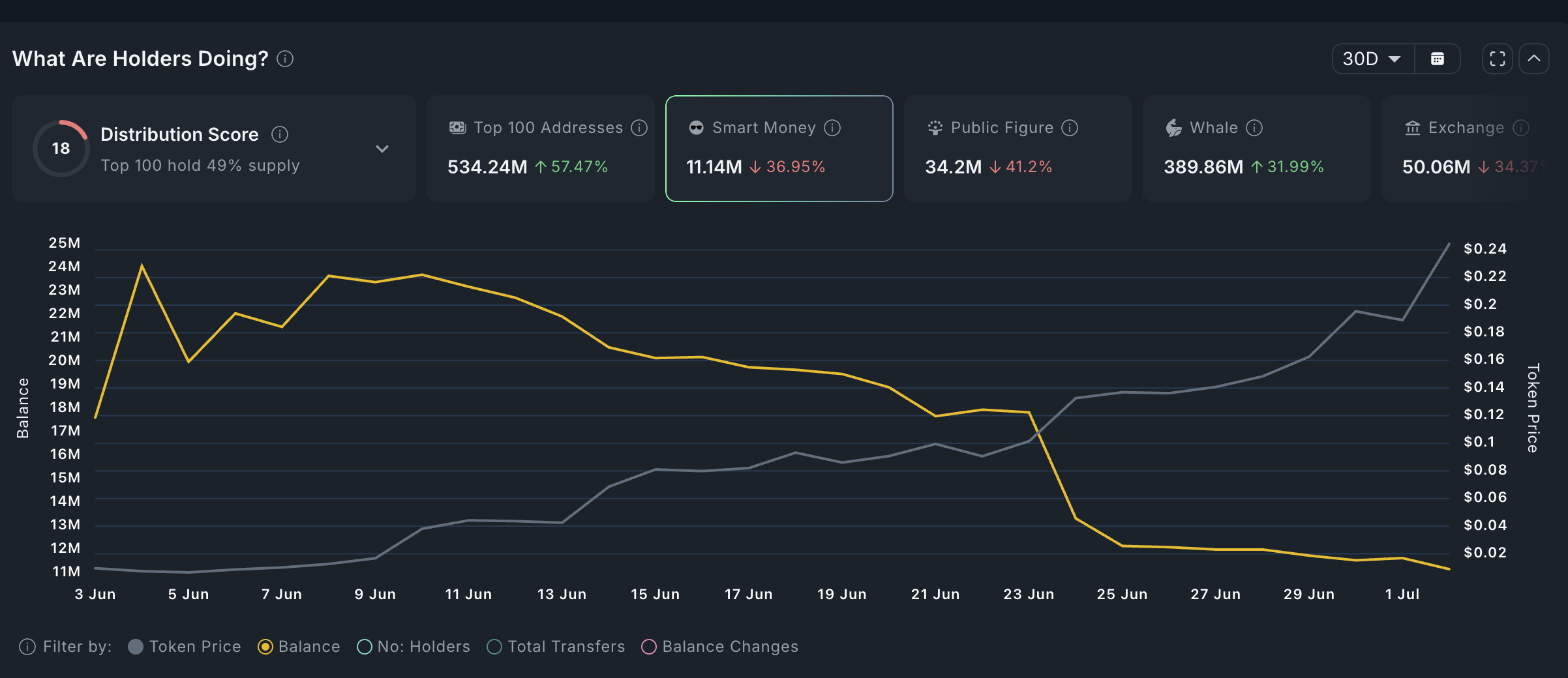

Nansen defines “smart money” as individual or institutional wallets with a strong track record of profitable trading. Additional data shows that public figures have also trimmed their USELESS holdings. Their total now stands at 32.4 million tokens, down from 70.96 million in June.

Whale activity shows a similar trend. Whale holdings have declined from a peak of 433 million tokens in June to 389 million currently. These reductions across sophisticated investor segments suggest increasing sell pressure, which could trigger a reversal.

Another bearish signal comes from the futures market. According to CoinGlass, the weighted funding rate has remained in negative territory throughout the recent rally. A negative funding rate indicates that traders expect the token’s price to decline.

Useless Coin price analysis

The eight-hour chart shows that Useless Coin has been in a sustained uptrend over the past few weeks. As a result, it now trades well above its 50-period moving average, increasing the risk of mean reversion. Mean reversion refers to an asset returning to its historical average after an extended move.

Additionally, the Relative Strength Index has formed a bearish divergence pattern, developing a descending channel even as price has moved higher. Taken together, these signals suggest that a reversal is likely as selling intensifies across whales, retail traders, and smart money. If this plays out, the next key level to watch will be $0.10.