Arbitrum Crashes 20% Post-Robinhood Deal—’Buy the Rumor, Sell the News’ Strikes Again

Layer-2 darling Arbitrum defies hype with brutal selloff

Partnership paradox

Robinhood's stamp of approval triggers 20% plunge—retail traders left holding bags as whales cash out. The 'institutional adoption' narrative collides with crypto's oldest truth: liquidity events become exit liquidity.

Market mechanics exposed

Futures open interest hit ATH before announcement, perpetual funding rates turned negative within hours. Degens now face margin calls while Wall Street's algo traders feast on predictable volatility.

Silver lining playbook

Network activity spikes 300% as bargain hunters swarm. Developers keep shipping—Arbitrum's tech stack remains Ethereum's scaling workhorse. Just don't tell that to the leveraged longs.

Another day, another 'when Lambo' dream sacrificed at the altar of efficient markets. At least the blockchain doesn't charge $38 for order flow.

Source: Nansen

Source: Nansen

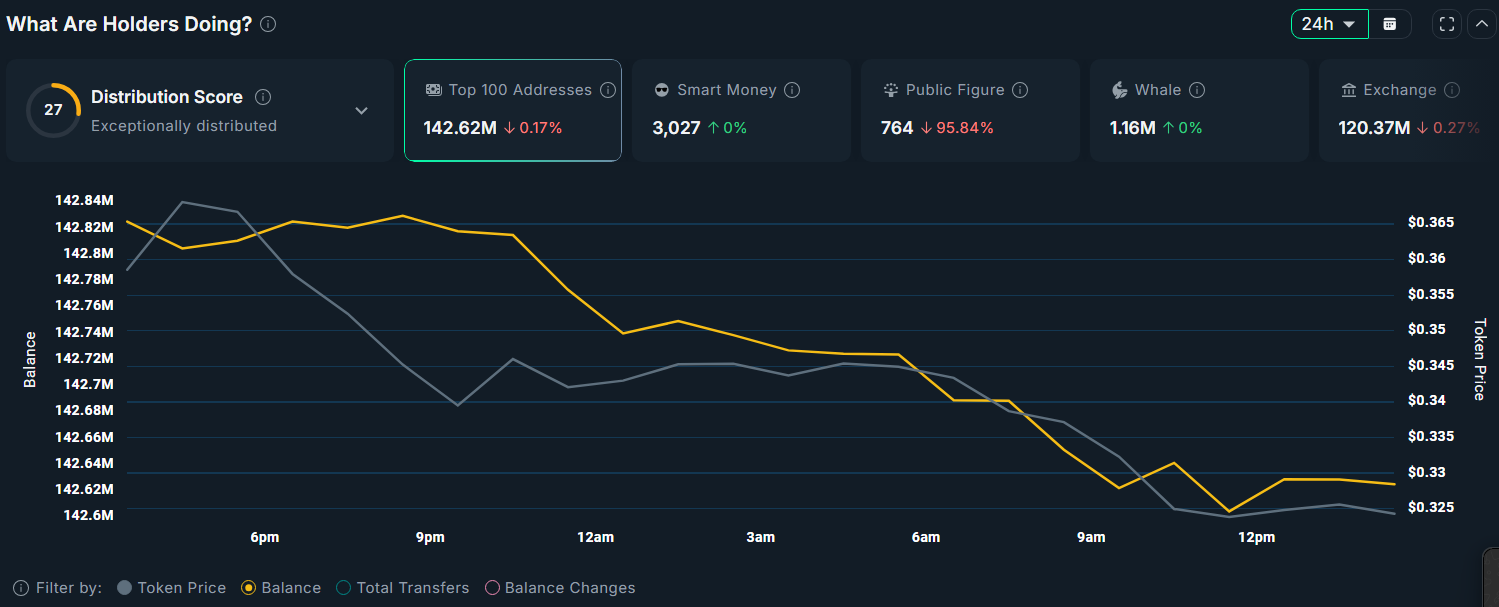

These conditions have yet to ease, as Nansen data also shows that ARB exchange balances have increased by 17% over the past week, indicating continued inflows to trading platforms likely intended for selling.

ARB price analysis

On the 4-hour/USDT chart, Arbitrum (ARB) is showing multiple bearish technical signals that point to a likely continuation of its downward trajectory.

The 50-day Simple Moving Average appears to be on the verge of crossing below the 200-day SMA, a formation commonly referred to as a “death cross.” Such a pattern is widely regarded by traders as a strong bearish indicator, often preceding extended periods of price weakness.

Momentum indicators further support the bearish outlook. The MACD line has crossed below the signal line, typically interpreted as a sell signal that reflects waning bullish momentum. In addition, the Chaikin Money FLOW index has dropped sharply from 0.45 to 0.08, which signals a significant reduction in buying pressure and a possible shift toward net capital outflows.

Given these confluences, ARB is likely to continue its decline toward the immediate support level at $0.31.

A breakdown below this level could expose the token to further downside, with the next major psychological and structural support resting at $0.28.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.