Cardano Whales Go Shopping—But Is ADA’s Price Signaling a Trap or a Treasure?

Cardano's price action has traders scratching their heads—just as crypto whales start loading their bags. Mixed signals dominate the charts, but one thing's clear: big money sees opportunity. Here's why.

Whales Dive In

While retail investors hesitate, deep-pocketed players are snapping up ADA at levels that scream 'accumulation phase.' The move comes amid shaky technicals—but since when did whales care about RSI?

Price Puzzle

ADA's chart paints a contradictory picture: bullish divergences clash with bearish volume patterns. Traders betting against the whale activity might want to remember Wall Street's oldest lesson—'follow the smart money... until it stops being smart.'

Finance Jab

Meanwhile, traditional analysts still can't decide if Cardano's 'peer-reviewed' blockchain is genius or just academia's revenge on traders who skipped college.

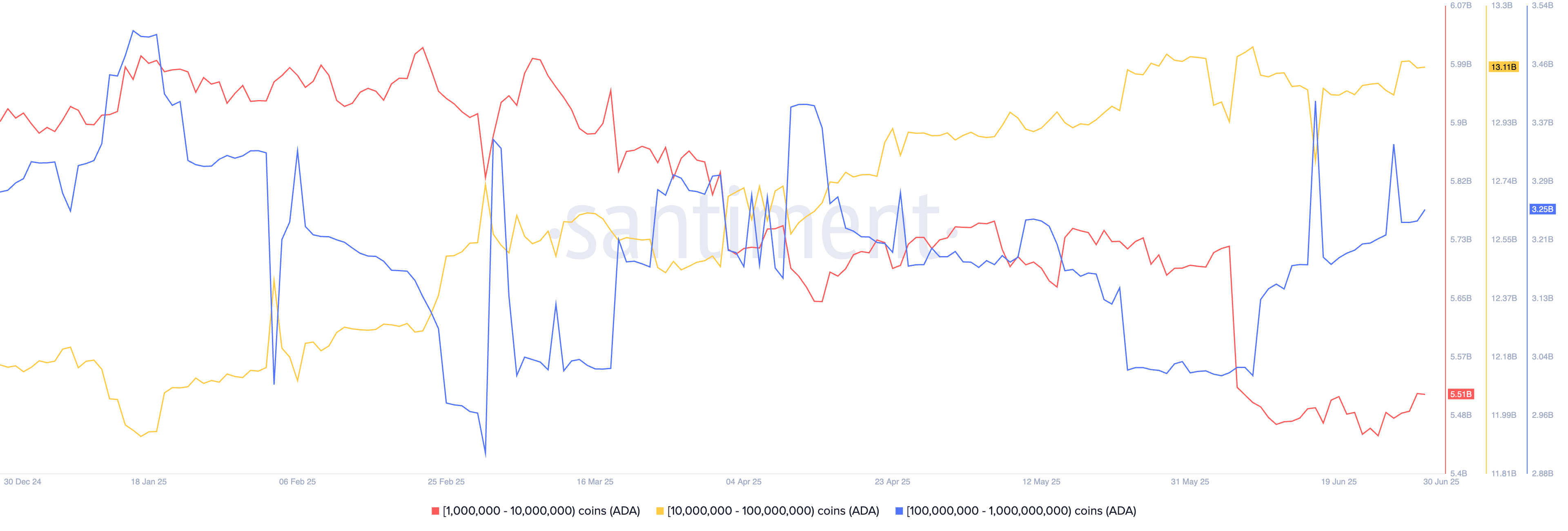

ADA whale transactions | Source: Santiment

ADA whale transactions | Source: Santiment

A possible reason for the ongoing ADA accumulation is the upcoming Midnight airdrop.

Cardano price technical analysis

The daily chart shows that the ADA price is sending mixed signals after falling to the key support at $0.519. On the positive side, this could be a sign that this is a double-bottom whose neckline is $0.863. This pattern often leads to a bullish reversal.

However, this pattern could be an inverse cup-and-handle pattern, a popular continuation sign. It is now forming the handle section.

Cardano has also remained below the 50-day and 100-day moving averages. Therefore, a drop below the support at $0.519 will confirm the inverse C&H pattern and point to more downside.