Arbitrum Primed for $1 Surge as Robinhood Buzz Reaches Fever Pitch

Layer 2's dark horse races toward mainstream adoption

The whispers started weeks ago—now they're a roar. Arbitrum (ARB), Ethereum's scaling powerhouse, flirts with the psychologically crucial $1 mark as speculation about a Robinhood listing reaches critical mass. Traders pile in, smelling blood in the water.

Retail's favorite playground beckons

Robinhood's infamous 'dumb money' army could soon get their mitts on ARB tokens. The zero-commission broker—better known for meme stock fiascos than crypto sophistication—would open floodgates to millions of novice traders. Volatility guaranteed.

Institutional sharks circle

Meanwhile, hedge funds quietly accumulate positions. 'The smart money's betting this partnership legitimizes Arbitrum in ways even Vitalik couldn't,' quips a Goldman Sachs alum turned DeFi degenerate. 'They'll pump it—then dump it on Robinhood users.'

Technical breakout or trap?

The charts scream bullish: ARB smashed through resistance levels like a drunk frat boy through drywall. But crypto veterans eye that $1 target warily—it's where profit-taking turns ruthless. 'This isn't investment advice,' laughs one options trader, 'but I'm buying puts at $0.99.'

One immutable truth remains: in crypto, the house always wins. Even when it's a mobile app with a cartoon confetti cannon.

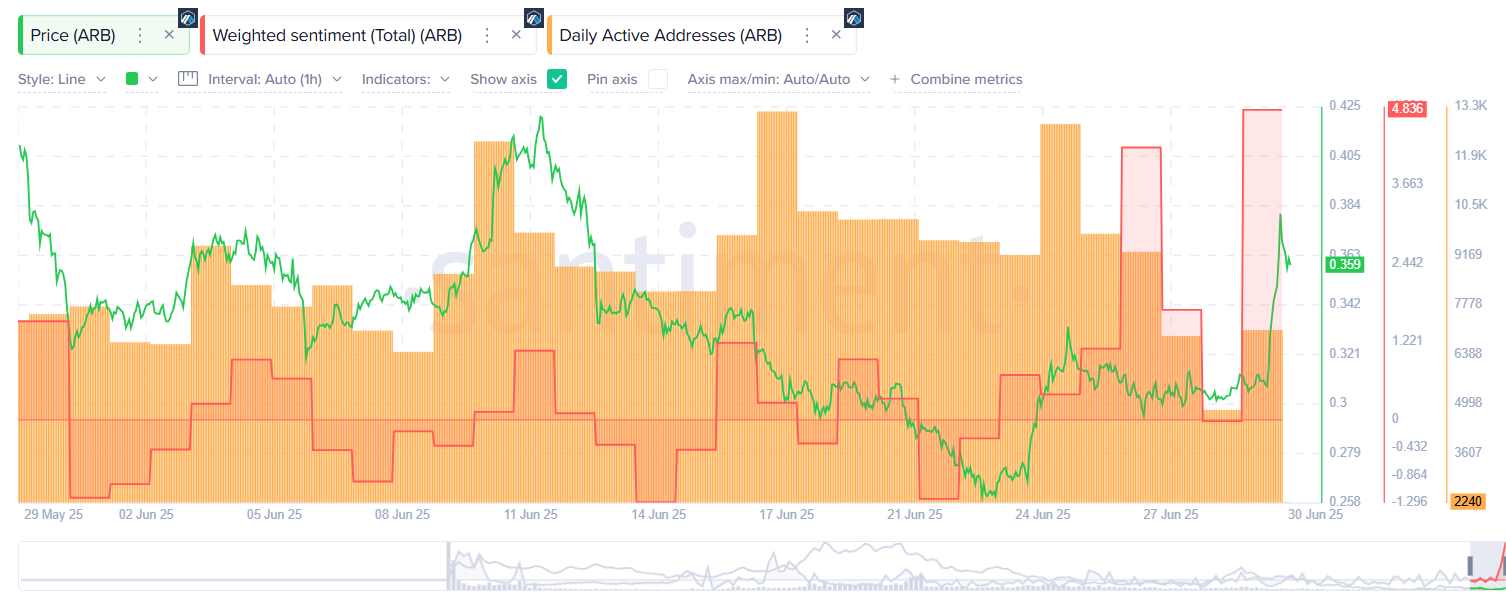

Source: Santiment

Source: Santiment

Arbitrum price analysis

On the 1-day/USDT price chart, ARB is nearing the upper boundary of a large falling wedge pattern that has been developing since January of last year. A confirmed breakout above this resistance trendline WOULD likely signal the end of its long-term downtrend and the beginning of a new bullish phase.

The token currently trades above its 50-day exponential moving average, indicating strengthening medium-term bullish momentum. Additionally, momentum indicators support this view, most notably, the MACD has flipped into positive territory, suggesting a shift in trend direction.

The Aroon Up indicator stands at 92.86%, while the Aroon Down is at 42.86% which points to a strong uptrend with declining bearish pressure, typically seen in early stages of trend reversals.

If the breakout from the wedge is confirmed, the next likely upside target for ARB lies at $0.75, which corresponds with the 23.6% Fibonacci retracement level drawn from the macro high to recent lows.

A clean breakout from that level could set it up for a rally to $1, which would represent gains of 185% from the current levels.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.