Vanadi Coffee Stock Rockets 242% in 30 Days as Shareholders Greenlight $1.1B Bitcoin Treasury Gamble

Vanadi Coffee just brewed up a storm on Wall Street—and it’s not just caffeine jolting investors awake. Shareholders slammed the 'approve' button on a radical pivot: converting $1.1 billion of corporate reserves into Bitcoin. Because nothing says 'stable growth' like betting the treasury on crypto volatility.

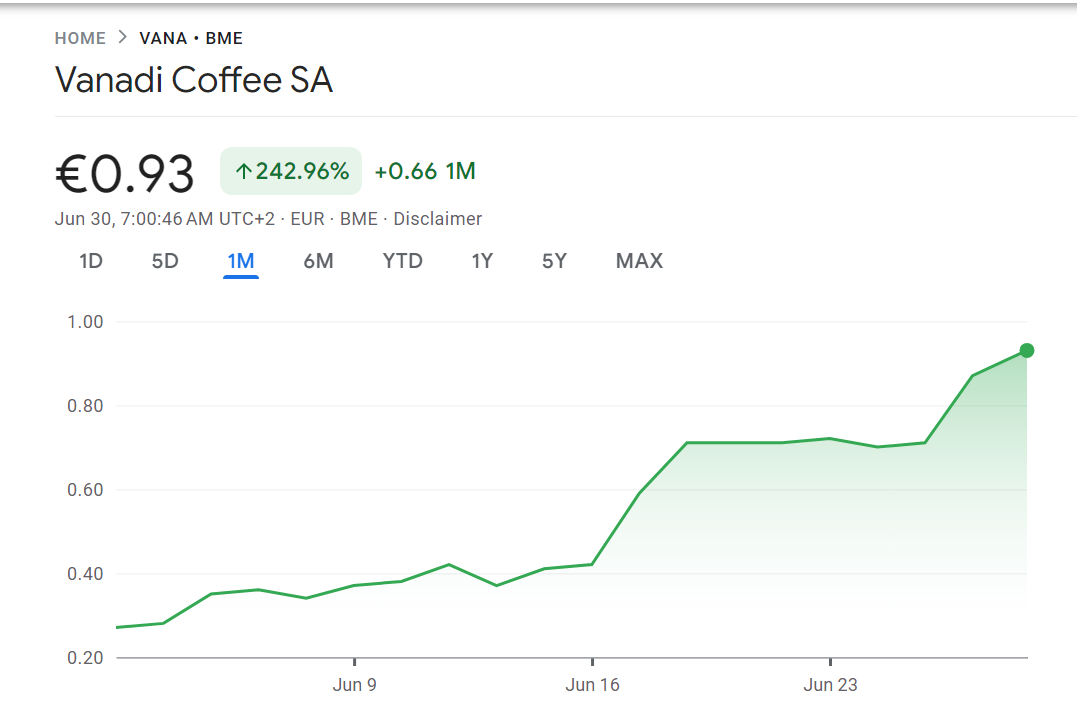

The move follows a moonshot stock surge—242% in a single month—that left analysts scrambling. Is this corporate foresight or FOMO dressed as strategy? Either way, Vanadi’s playbook now reads like a crypto maximalist’s manifesto.

One hedge fund manager quipped, 'Next earnings call: ‘Sorry, we spent the dividend fund on JPEGs.’' The market’s watching to see if this HODL turns heroic—or becomes another cautionary tweet.

The Vanadi Coffee stock has been in a rally since the company began accumulating more BTC in the past month | Source: Google Finance

The Vanadi Coffee stock has been in a rally since the company began accumulating more BTC in the past month | Source: Google Finance

News of the shareholder meeting’s pro-Bitcoin result boosted confidence in the Vanadi Coffee stock. In the past month, the Vanadi Coffee stock saw a meteoric rise of up to 242.96% following its mass acquisition of Bitcoin throughout the month of June. Shortly after the press release was published, the Vanadi Coffee stock saw another boost to its stock of 6.62%, rising from

Since April 2024, Vanadi Coffee has adopted several financial strategies to support its Bitcoin strategy, which involvws investing more of its corporate capital into BTC. Now, it plans to use Bitcoin as a strategic store of value in its new business model.

“Vanadi Coffee is redefining its business model by using Bitcoin as its primary reserve asset, and will accumulate significant amounts of Bitcoin as part of its treasury management,” wrote the company in its press release.

The company claimed that it was inspired by overseas companies like Strategy or Metaplanet, which have made major leaps in implementing a corporate Bitcoin treasury strategy. Many other companies have followed suit by making similar moves.

Previously, other European companies like Norway’s Green Minerals, the Smarter Web Company in the U.K., and The Blockchain Group have begun accelerating their efforts to raise large amounts of capital to buy more Bitcoin.