Ethereum ETF Inflows Soar—But These Hidden Risks Could Derail the Rally

Ethereum's price surge faces a make-or-break moment as institutional money floods into ETFs—while looming regulatory threats and network congestion lurk in the shadows.

The ETF Effect: Fueling the Fire

Wall Street's sudden love affair with crypto isn't altruism—it's a calculated bet on ETH becoming the backbone of decentralized finance. But remember 2021's 'institutional adoption' hype? Exactly.

The Other Side of the Trade

Gas fees spiking during rallies? Check. SEC Chair's 'non-security' comments looking shakier by the day? Double check. This isn't FUD—it's the market's dirty little checklist for a correction.

The Bottom Line

Smart money's playing both sides: stacking ETH while quietly building short positions. Because in crypto, the only thing more predictable than a pump is the dump that follows.

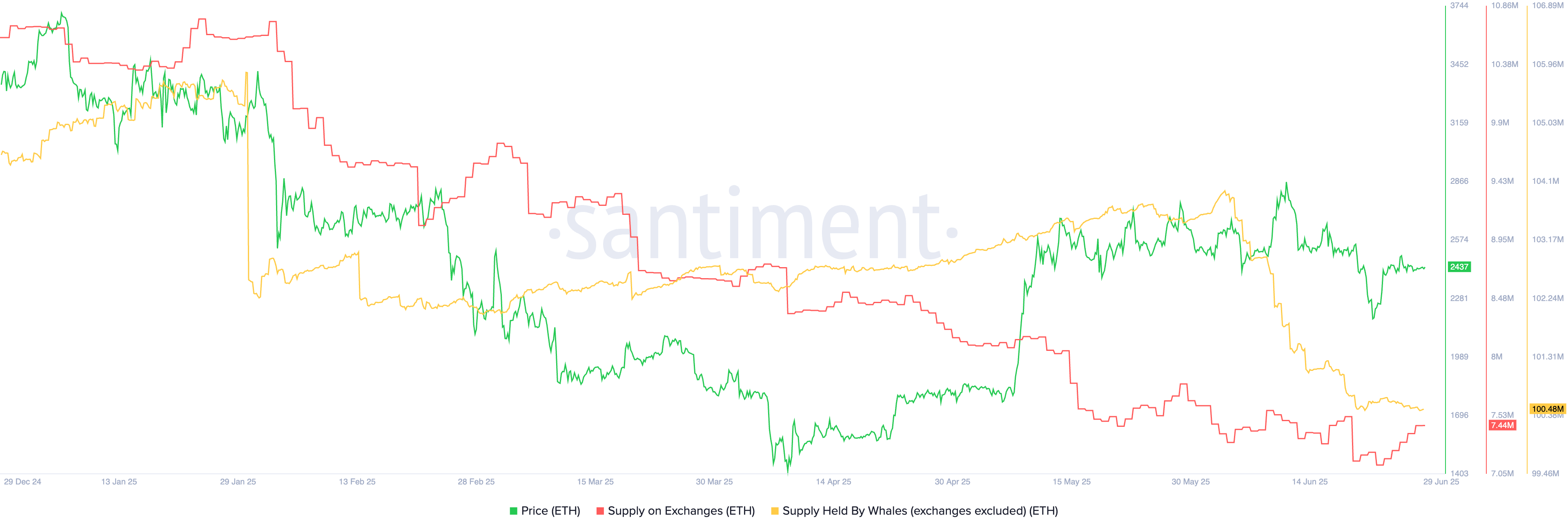

ETH whales and exchange supply | Source: Santiment

ETH whales and exchange supply | Source: Santiment

Ethereum price analysis

The other risk is that ETH price has dropped below the 200-day Exponential Moving Average, a sign that bears have prevailed. The last time ETH fell below the 200-day moving average was in February, and it subsequently crashed by over 55%.

Ethereum price also invalidated the bullish flag pattern by moving below the lower side of the flag section. It has then retested this price, signaling that a potential continuation is possible. Therefore, there is a risk that the token will drop below $2,000 in the near future.