Wormhole Soars on Ripple Partnership—But Can This High-Stakes Rally Build a Sustainable Bridge?

Wormhole's token defies gravity after the Ripple deal—yet skeptics whisper about gaping smart contract risks. Cross-chain bridges promise the moon, but deliver turbulence.

Price pumps aside, the protocol's 'trustless' claims face stress tests. One exploit could drain liquidity faster than a crypto hedge fund's bankruptcy filing.

Bull case: Institutional adoption via Ripple validates interoperability tech. Bear case: Another bridge hack waiting to happen. Place your bets—just don't mortgage your NFT portfolio.

Source: CoinGecko

Source: CoinGecko

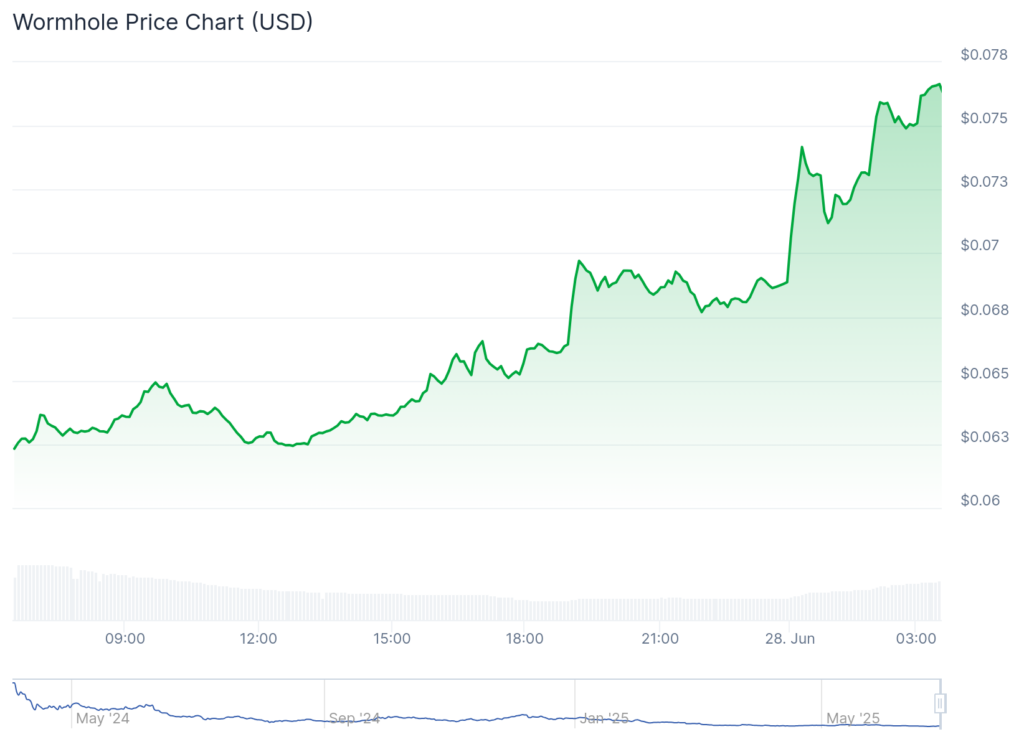

The Wormhole token has also increased in value as the number of transacting users rose this month. Its users rose to 47,600 this month, up from last month’s low of 38,000. It has jumped to its highest point since April.

The total value locked on Wormhole has also jumped to $2.8 billion, up from $2.5 billion in March.

The Wormhole price has also jumped as open interest rose to $30 million, its highest level since March 24. A rising open interest is a sign of demand from investors in the futures market.

However, the ongoing surge faces two key risks. First, its weighted funding rate has turned red in the past two days, a sign that investors anticipate the future price to be lower than the current one.

The other risk is that the bridge volume has plunged in the past few months. Its volume dropped to $426 million this month, down from $2.48 billion in December.

Wormhole price analysis

The daily chart indicates that the W token bottomed at $0.051 on June 23 and subsequently rebounded to $0.074. It has formed a double-bottom pattern with a neckline at $0.01180, its highest point on May 14. A double bottom is one of the most bullish patterns in technical analysis.

Wormhole is attempting to MOVE above the 50-day moving average, while the Relative Strength Index has crossed the neutral point of 50. The two lines of the MACD have made a bullish crossover.

Therefore, the price may continue to rise, with the next target being the double bottom’s neckline at $0.1180. A drop below the year-to-date low of $0.0511 will invalidate the bullish view.