Grayscale Shakes Up Q3 Top 20: AVAX and MORPHO Break Into Elite Crypto Portfolio

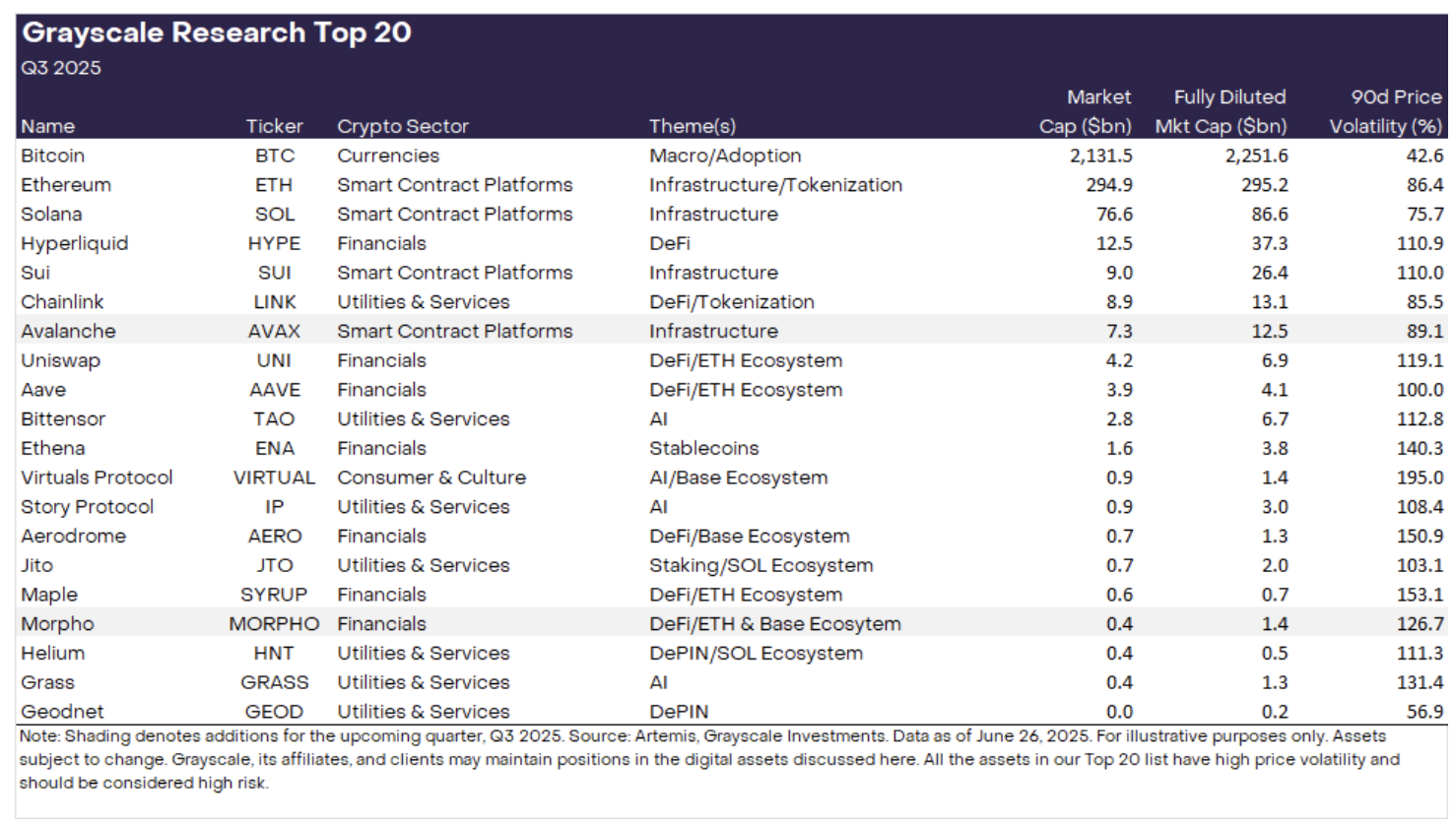

Grayscale just reshuffled the deck—and the crypto world is taking notes. The digital asset giant’s latest Top 20 update for Q3 2025 has two fresh faces: Avalanche (AVAX) and Morpho (MORPHO), now rubbing shoulders with Bitcoin and Ethereum.

Why it matters: Grayscale’s picks often signal institutional confidence. When they add a token, Wall Street’s algo-traders start salivating—even if half couldn’t explain the tech behind it.

The newcomers: AVAX’s scalable smart contracts and MORPHO’s lending protocol upgrades clearly passed Grayscale’s sniff test. Meanwhile, some legacy tokens are sweating—this list isn’t a participation trophy.

The cynical take: Nothing gets traditional finance excited like a ranked list they can throw money at. Bonus points for Grayscale charging 2% fees to hold bags others would HODL for free.

Bottom line: In crypto’s Darwinian ecosystem, making Grayscale’s cut is survival of the shiniest. Just don’t ask what happens when the next rebalance hits.

Source

: AVAX and MORPHO added to Top 20 for Q3 2025

| research.grayscale.com

Source

: AVAX and MORPHO added to Top 20 for Q3 2025

| research.grayscale.com

Morpho was included for its rapid expansion as a decentralized lending protocol, now the second-largest by Total Value Locked, with over $4 billion and growing fee revenue. Grayscale also highlighted the launch of Morpho V2 last month, aimed at bridging DeFi with traditional financial institutions.

More generally, the company sees strong potential in on-chain lending and believes lending-focused assets like Morpho, AAVE (AAVE) and Maple Finance (SYRUP) (also on its Top 20 list) are well positioned to capture a meaningful share of future growth in the sector.

To make room for AVAX and MORPHO, Lido (LDO) and Optimism (OP) were removed despite their core roles in staking and Layer 2 scaling, respectively. Grayscale flagged regulatory uncertainty around staking that could pressure Lido’s fee revenue, while Optimism’s token has struggled to capture economic value despite widespread tech adoption.

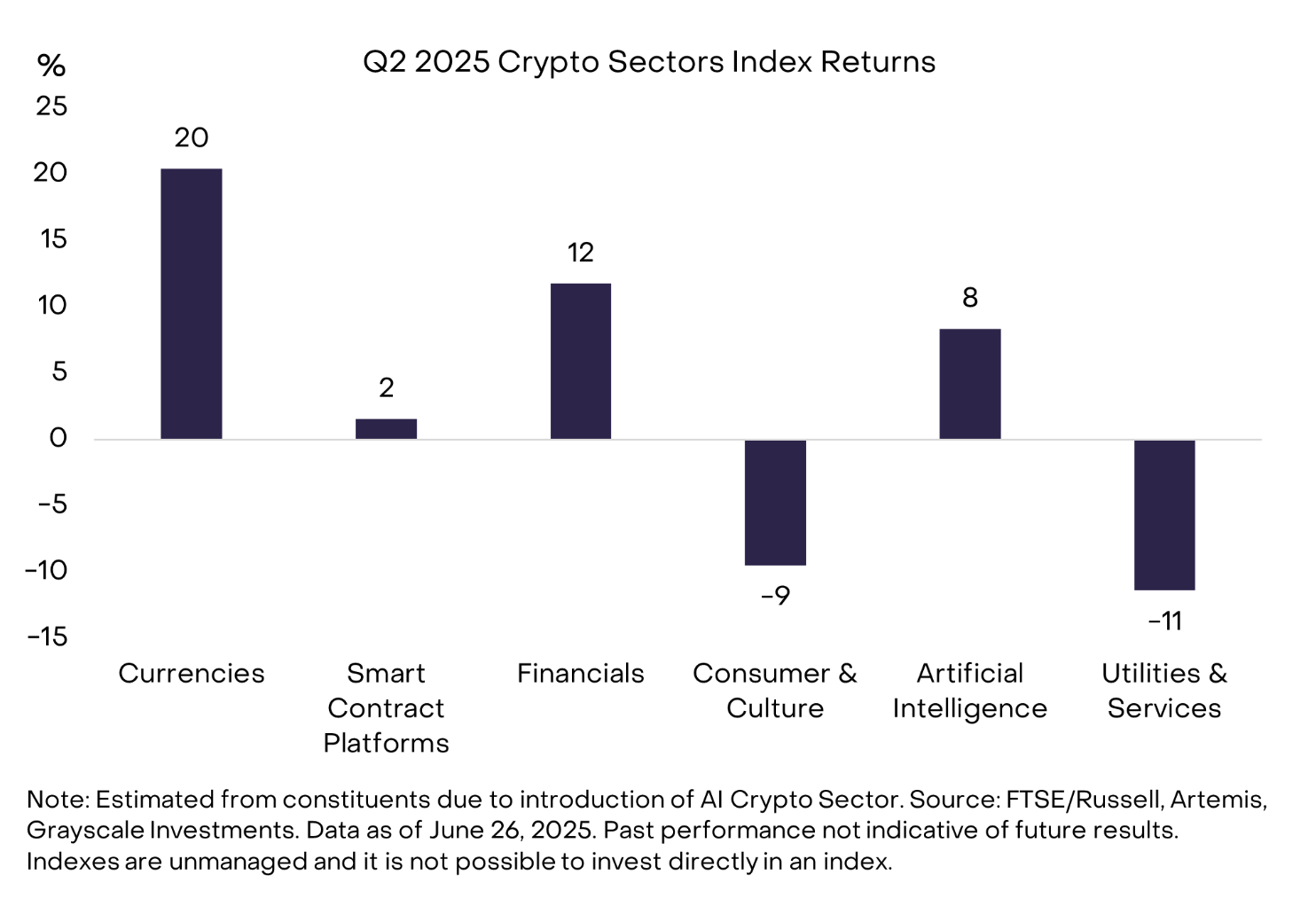

The report also covered broader crypto sector trends. Q2 2025 saw mixed returns across segments, with Bitcoin leading gains in the Currencies sector. Smart Contract Platforms recorded a rise in transaction volume, but fee revenues fell as memecoin activity cooled. Grayscale highlighted growing interest in decentralized AI, DeFi lending, and smart contract platforms despite broader macro and regulatory uncertainty.

Additionally, the company finalized the launch of its AI Crypto Sector, tracking 24 AI-related tokens now worth $15 billion, led by Bittensor (TAO).