Dow Jones Soars 300 Points: Weak Labor Market Sparks Fed Rate Cut Frenzy

Wall Street's bull run just got a turbocharge—thanks to a stumbling jobs market. The Dow Jones Industrial Average ripped 300 points higher as traders priced in near-certain Fed easing. Here's why the algos are partying.

### The Jobs Data That Lit the Fuse

Another lukewarm employment report sent bond yields tumbling. Suddenly, those 'higher for longer' rate hike mantras sound as outdated as a 2022 NFT portfolio.

### The Fed Put Is Back (Again)

Futures markets now bake in two full cuts by September. Because nothing says 'economic stability' like bad news being good news for equities—until the music stops.

Wall Street's addiction to cheap money continues. Meanwhile, Bitcoin hodlers smirk from the sidelines.

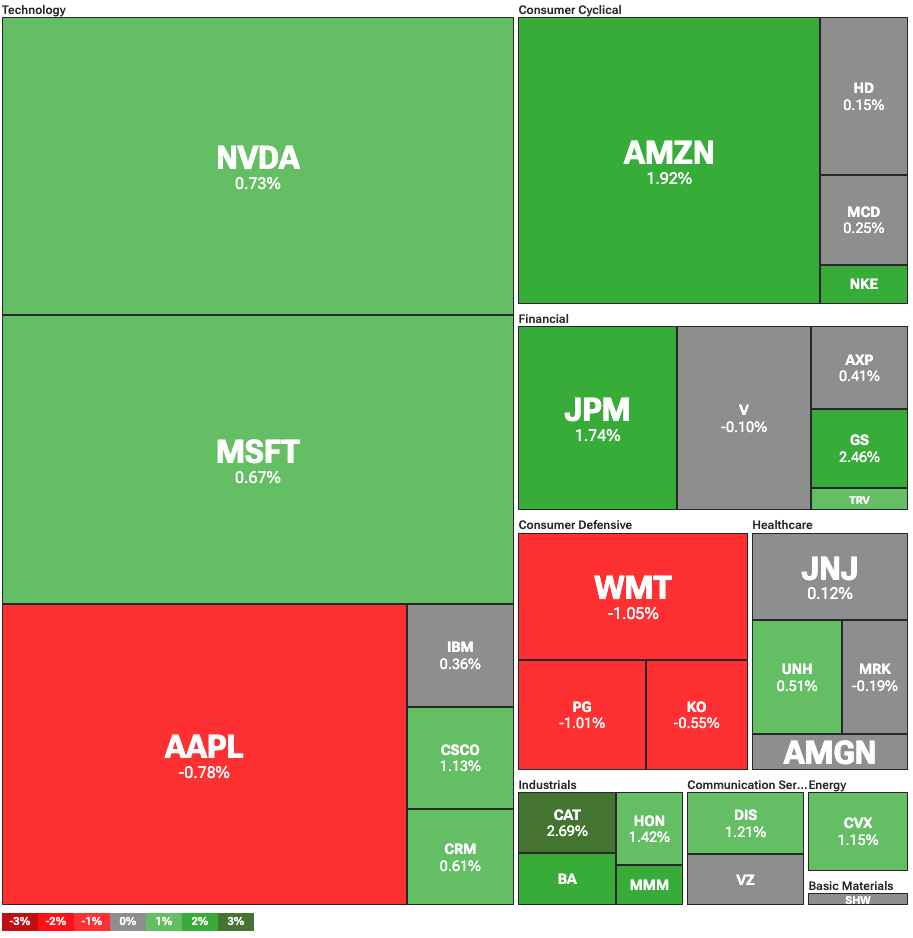

Dow Jones Industrial Average heatmap | Source: TipRanks

Dow Jones Industrial Average heatmap | Source: TipRanks

Nvidia continues to rally after reaching an all-time high on Wednesday. The company reclaimed the top spot among all global firms by market cap, surpassing Microsoft at $3.77 trillion. The stock’s surge had also triggered a rally among other semiconductor firms across Asia.

Stock markets have largely absorbed the end of Middle East tensions, and are now looking at the Federal Reserve for cues. In this context, Thursday’s labor market data was seen as a good sign, especially for risk stocks.

The Department of Labor’s survey showed that insured unemployment claims were at 1.974 million. The figure ROSE by 37,000 from the revised levels of last week. What is more, this was the highest level of insured unemployment since November 2021, at the height of the pandemic.

Fed to finally cut rates?

Weak labor market statistics, while bad for the economy in general, may push the Fed to cut interest rates. This news comes after continued pressure from U.S. President Donald Trump. On Wednesday, TRUMP stated that he was close to picking a replacement for Fed Chair Jerome Powell.

Trump openly criticized Powell for not cutting interest rates. Still, the President shied away from directly stating that he would replace Powell before the end of his term in 2026. In any case, Powell consistently resisted pressures from the WHITE House, defending the Fed’s independence.