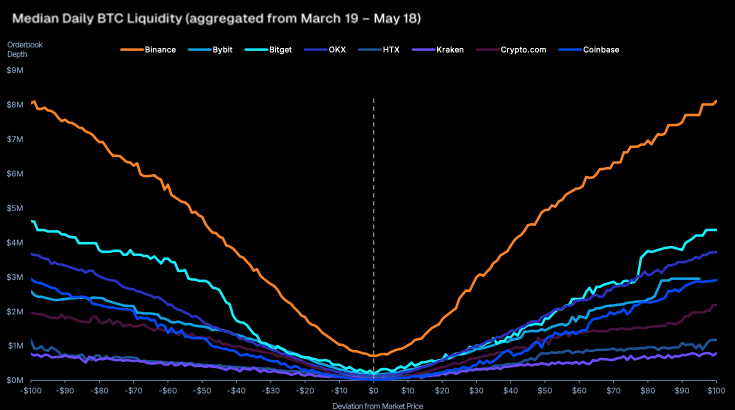

Binance Dominates Bitcoin Liquidity, But Bitget Crushes Altcoin Trading: 2025 Report

Crypto's liquidity wars just got a fresh scorecard—and the results might surprise you.

Bitcoin's Big Blue: Binance still hoards the lion's share of BTC liquidity, proving even regulatory headaches can't dethrone the king. Meanwhile, Bitget's altcoin engine is running at full throttle.

Altcoin Alley: Bitget isn't just competing—it's lapping the field when it comes to altcoin depth. Traders chasing the next 100x meme coin are voting with their wallets (and likely regretting it by morning).

The Bottom Line: Liquidity follows the degens. And right now, they're sprinting between Binance's BTC fortress and Bitget's altcoin carnival—while traditional finance still tries to figure out what a 'stablecoin' is.

Median BTC daily liquidity on major centralized exchanges, aggregated from March 19 to May 18 | Source: CoinGecko

Median BTC daily liquidity on major centralized exchanges, aggregated from March 19 to May 18 | Source: CoinGecko

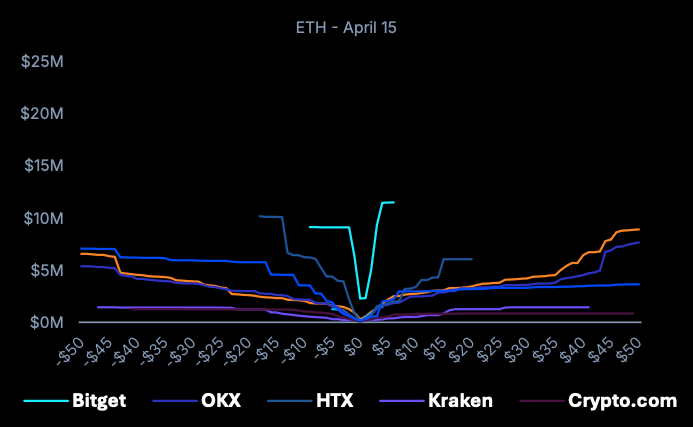

Biget challenges Binance on altcoins

Still, other exchanges are able to challenge Binance in altcoin liquidity. For instance, Bitget leads in the mid-range, where most of the trading happens. At the same time, the exchange actually outpaced Binance on several days, including April 15. Still, beyond the mid-range, Bitget’s liquidity tapers off.

The situation is similar for XRP, where Bitget retains dominance in the 0.3% trading range, after which it quickly declines. Bitget also leads in SOL liquidity, controlling 32% of the share at the 0.6% liquidity range. According to CEO Gracy Chen, Bitget has been working actively to partner with institutional liquidity providers.

“Today, institutions drive 80% of our spot volume, futures activity from professional firms has doubled, and 80% of top Quant funds trade on Bitget. Liquidity is infrastructure — and we’re building it where the market needs it most,” Gracy Chen, Bitget CEO.

Finally, the CoinGecko report notes that liquidity is healthy across all major exchanges, particularly in realistic trading ranges. This indicates a healthy state of the crypto market as it continues to mature and attract more institutional players.