Dow Jones Soars 500 Points as Iran-Israel Ceasefire Sparks Rally—Powell Holds Rate Cuts Hostage

Markets breathe fire as geopolitical tensions cool—for now.

Risk-on mode activated: The Dow's 500-point surge proves Wall Street still trades on headlines, not fundamentals. Traders celebrated the Iran-Israel ceasefire like it's 2021 stimulus season.

Powell plays chicken with rate cuts: The Fed chair keeps markets guessing—because why give Main Street relief when bankers can feast on volatility? Classic 'data-dependent' theater.

Cynical take: Nothing fuels a rally like two nations pausing their war... until the next 'unexpected' escalation. Buy the rumor, sell the drone strike.

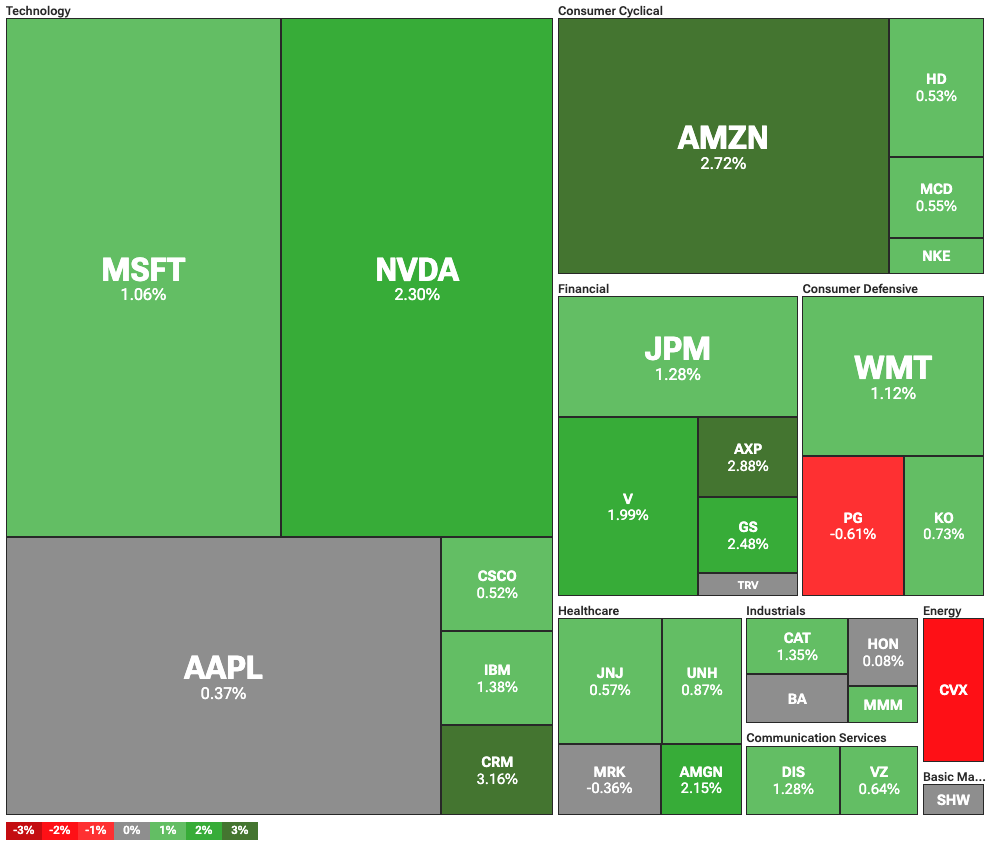

Dow Jones Industrial Average heatmap | Source: TipRanks

Dow Jones Industrial Average heatmap | Source: TipRanks

Driving the markets were hopes that the conflict between Iran and Israel would cease for now. U.S. President Donald TRUMP announced a ceasefire between the two countries. Moreover, he pressured Israel to stop its attacks against Iran, which promised hope for an end to the war.

The escalation of a broader conflict threatened the global oil economy. This was particularly true after the U.S. got directly involved with its own strikes on Iran’s nuclear facilities. After these strikes, Iran even threatened to push the price of oil to its historic levels by closing the Strait of Hormuz.

The price of crude oil dropped back down to $64 per barrel, down 5.33% in just one day. Crude oil traded NEAR $75 at the height of the crisis, the highest price since January this year. Lower oil prices are good news for the global macro outlook as they could lead to cooling inflation.

Fed can afford to wait with rate cuts: Powell

With de-escalating tensions in the Middle East, focus is once again on the Federal Reserve and interest rates. In his testimony before Congress, Fed Chair Jerome Powell said that the Fed will wait for more information before making changes to the interest rates.

In particular, Powell is concerned by the potential effects of Trump’s tariffs, which could both push inflation up and lower growth. What is more, effects on inflation could be either short-lived or persistent, which WOULD require a different response.

In any case, Powell stated that rate cuts could come sooner if inflation stays low or if the unemployment rate picks up.