Crypto Markets Nosedive as US Strikes Iran Nuclear Facilities - Here’s Why It Matters

Geopolitical shockwaves hit digital assets as Bitcoin leads sharp sell-off

When the bombs drop, crypto doesn't hedge - it craters. Today's 8% BTC plunge proves even decentralized assets can't escape old-school warfare fears.

Market bloodbath spreads beyond Bitcoin

Altcoins got slaughtered harder than mainnets in a bear market. ETH, SOL, and memecoins all posted double-digit losses as traders fled to... wait for it... stablecoins. The irony writes itself.

Institutional players trigger domino effect

Whale wallets moved first - because when you've got eight figures on the line, you don't wait for CNBC to tell you it's time to exit. Retail FOMOed in at the top as usual.

Silver lining for degenerates?

This dip might just be the gift bag nobody wanted. Because nothing says 'healthy market' like geopolitical instability being your best buying opportunity. Stay greedy, folks.

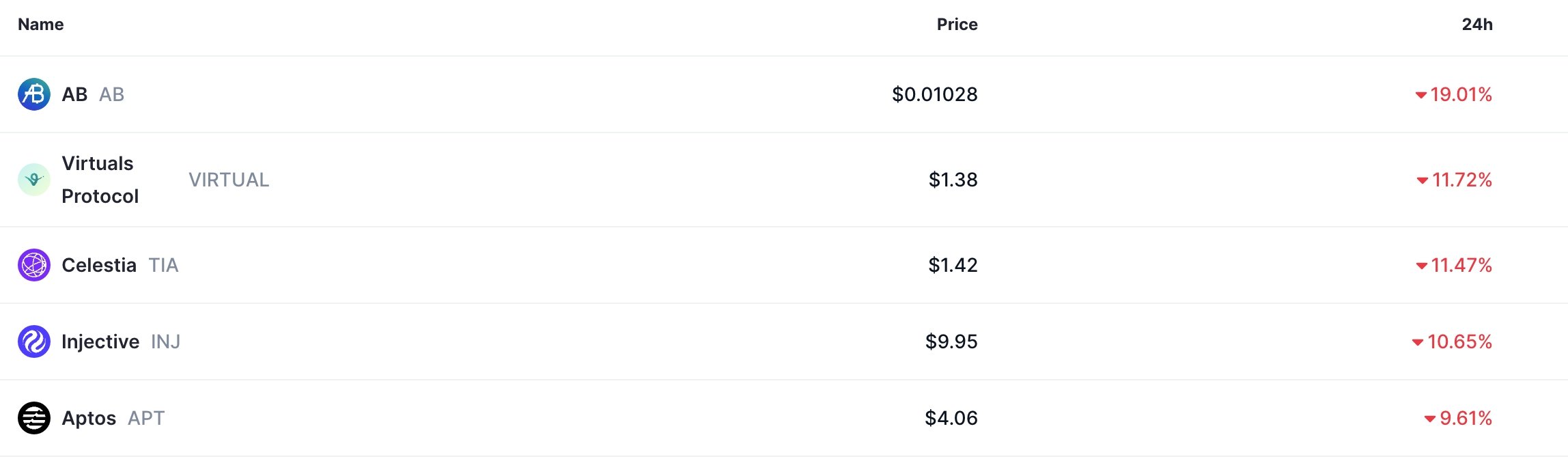

Top altcoins have crashed | Source: CoinMarketCap

Top altcoins have crashed | Source: CoinMarketCap

The total market capitalization of all cryptocurrencies tracked by CMC plunged by 1.65% in the last 24 hours to $3.15 trillion. Similarly, CoinGlass data shows that the sell-off triggered a 38% surge in liquidations to over $682 million.

Crypto market crashed as geopolitical risks rose

Bitcoin and most altcoins plunged after the U.S. launched a major bomb in Iran targeting three nuclear sites. Trump’s goal was to destroy Iran’s nuclear capabilities as its missile exchange with Israel continues.

These assets likely dropped for two main reasons. First, they dropped as investors embraced a risk-off sentiment following this attack. Historically, risky assets like stocks and cryptocurrencies retreat after a major black swan event.

| CRYPTOCURRENCY | PRICE | 7-DAY +/- |

| Bitcoin (BTC) | $102,666 | -2.4% |

| Ethereum (ETH) | $2,273.95 | -9.7% |

| Solana (SOL) | $133.11 | -8.7% |

| XRP (XRP) | $2.03 | -6.1% |

| Dogecoin (DOGE) | $0.1557 | -10.8% |

| BNB (BNB) | $630 | -2.8% |

For example, stocks and crypto fell in April after Trump launched retaliatory tariffs. They also fell in March 2020 after the COVID pandemic started, and in February 2022 after Russia invaded Ukraine. In a note to Bloomberg, Hanain Malik of Tellimer said:

“Short-term, markets such as crude oil, stocks, and crypto will pivot on whether Iran retaliates and widens the war in a way that impacts oil supply versus backing down and offering concessions on its nuclear program.”

Crisis in Iran may lead to higher inflation

The other main reason the crypto market crashed is that the Middle Eastern crisis could lead to higher crude oil and shipping prices. Brent and West Texas Intermediate oil benchmarks have already jumped by over 32% from the year-to-date low, and analystsanticipate rising prices. Shipping costs have also jumped.

The implication is that consumer inflation in the U.S. may keep rising, which will prevent the Federal Reserve from cutting interest rates.

In its meeting last week, the bank left interest rates unchanged between 4.25% and 4.50%. It hinted that it will deliver two cuts this year and four in 2026 and 2027. Bitcoin and other altcoins do well when the Fed is cutting interest rates.