🚀 SEI and KAIA Primed for Explosive Breakout: Chart Watch June 2025

Crypto traders, buckle up—SEI and KAIA are painting the most bullish pattern since Bitcoin's last halving.

### The Setup: Coiling Springs

Both tokens have been consolidating in textbook symmetrical triangles for weeks. Volume's drying up just as volatility spikes—classic breakout precursor behavior. No fancy indicators needed here; the charts are screaming 'imminent move.'

### Liquidity Zones to Watch

SEI's battling the $0.85 resistance like a bull trying to break through a barn door. Clear that level, and there's zero technical resistance until the $1.30 all-time high. KAIA's playing a tighter game—$2.40 is the make-or-break level that either triggers a 50% surge or sends bagholders back to 2024 prices.

### The Elephant in the Room

Of course, this could all be another fakeout before the Fed's next 'higher for longer' speech tanks crypto—again. But for once, the technicals actually align with the on-chain data (shocking, we know).

Bottom line? These charts look juicier than a VC's seed round pitch deck. Just maybe keep one finger near the sell button—Wall Street's algo wolves haven't exactly been playing nice with crypto lately.

SEI and KAIA price analysis

SEI traded at $0.1948 early on Friday, with modest gains. The token added 6% to its value in the past seven days, as seen on TradingView.

SEI’s closest support and resistance levels are S1 at $0.1582, the June 17 low and R1 at $0.2494, the upper boundary of an FVG on the daily price chart.

Technical indicators RSI and MACD support a bullish thesis. RSI reads 50 and is sloping upwards. MACD shows underlying positive momentum in Sei Price trend on the daily timeframe.

SEI could see a daily candlestick close above R1 and test resistance at $0.2750, the May 11 peak for the token.

Conversely, higher volatility could usher a correction in SEI, sending the token to collect liquidity at $0.1303 support, as seen in the SEI/USDT price chart.

KAIA hovers above the $0.19 level on Friday. The token posted over 2% gains and extended its value on Friday. KAIA has observed nearly 9% increase in its value in the past seven days. The KAIA/USDT daily price chart shows strong potential for further increase in the token’s price.

RSI signals the token is currently overvalued, however until it dips under the 70 level, it does not typically generate a sell signal. MACD flashes increasingly taller green histogram bars, meaning there is an underlying positive trend in Kaia price.

The closest resistance is R1 at $0.2054, the upper boundary of the FVG on the daily price chart. Next hurdle on the path to re-test 2025 peak at $0.2665 is R2 at $0.2525.

Conversely, KAIA could sweep liquidity at the February 3 low of $0.08. Another key support is the lower boundary of the FVG at $0.1077.

Market volatility in response to quadruple witching

Crypto market capitalization is down 2.3% in the last 24 hours. The quadruple witching event has traders on edge, expecting higher volatility and price swings in Bitcoin and altcoin prices. Volatility may have subsided for now, with most altcoins ending the week in green, geopolitical tensions over the weekend could impact liquidity and trader sentiment.

Traders have previously remained neutral, and crypto prices have shown resilience in the face of tariff uncertainty, wars, and missiles. However, it remains to be seen how the market will react to short-lived volatility this weekend.

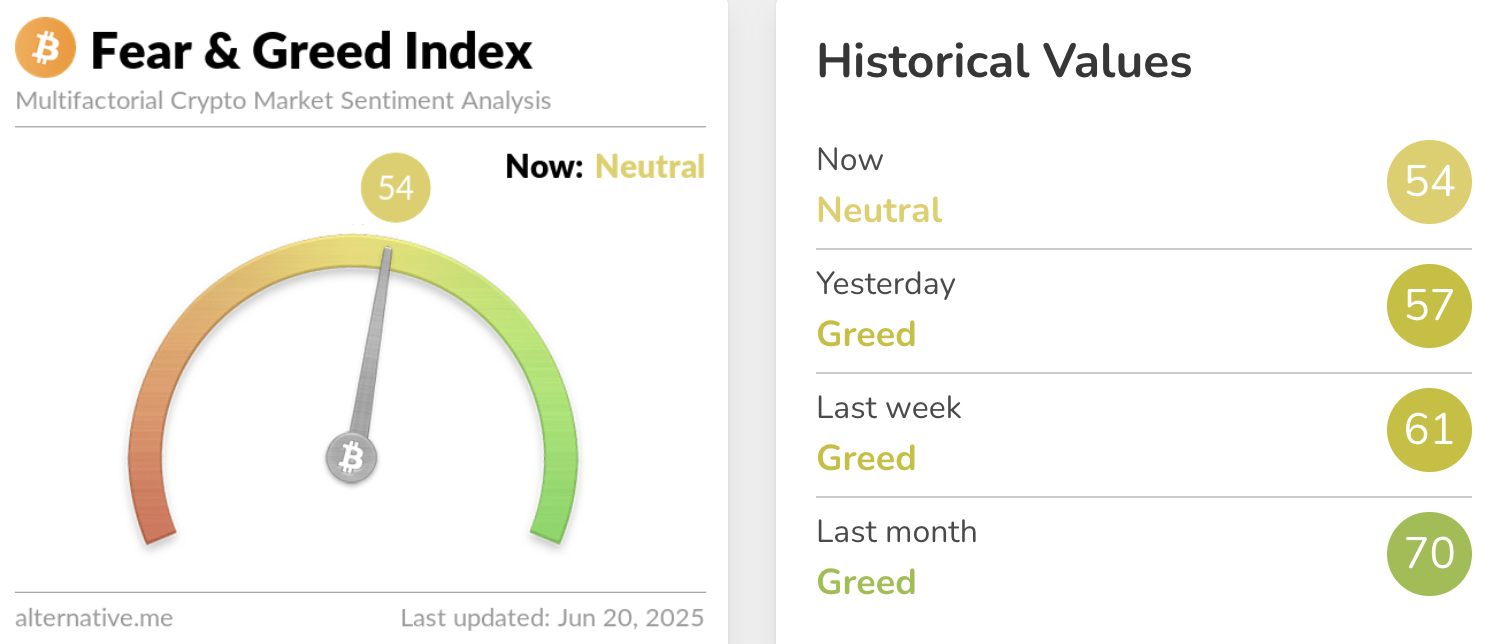

Traders remained neutral on Friday, sentiment reads 54 on a scale of 0 to 100, suggesting a neutral outlook towards the market.

Trump-era optimism

The optimism that Trump ushered in with his election victory and Bitcoin’s new all-time high could keep altcoins afloat during times of uncertainty. Even as traders turn risk-averse, Bitcoin price defended the $100,000 milestone and failed to sweep under the level even in the face of escalating conflict between Israel and Iran.

In short, macroeconomic headwinds have failed to shake the resolve of crypto traders, perhaps due to the passage of the GENIUS Act in the Senate, the resolution of the SEC v. Ripple lawsuit, and the SEC’s leniency toward the crypto sector.

Altcoin market capitalization is testing key support at $1.09 trillion. If prices remain relatively stable and traders defend the support, altcoins like SEI and KAIA could survive the short-lived market volatility without erasing prior gains.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.