AVAX Nears Critical $15 Support—On-Chain Activity Defies Price Plunge

AVAX teeters on the edge of a $15 breakdown—while chain metrics scream bullish divergence.

Subheader: The On-Chain Frenzy Wall Street Ignores

Whale accumulations hit a 90-day high even as paper-handed traders dump positions. Smart money’s stacking, retail’s panicking—classic crypto cognitive dissonance.

Subheader: Technicals vs. Fundamentals Collide

The $15 support level looms like a guillotine, but validator stakes just hit an ATH. Because nothing says ‘healthy network’ like price-action that contradicts usage metrics.

Closing Hook: Whether this is accumulation before a rebound or dead-cat bounce territory depends on who you ask—the algos or the chain data. Meanwhile, hedge funds will pretend they saw it coming either way.

Source: TradingView

Source: TradingView

The price is now at a critical make-or-break level, where the confluence of horizontal support (~$17.80 – $18.50), the lower boundary of the descending triangle, and the recently broken ascending channel support intersect. This zone represents a major decision point for the market. A break below this confluence area WOULD likely confirm the descending triangle breakdown, opening the door for a move toward $15.00.

With RSI nearing oversold and price sitting at multi-level support, the next few daily candles will be crucial in determining whether AVAX resumes its bearish trend or attempts a bullish recovery from this confluence support zone.

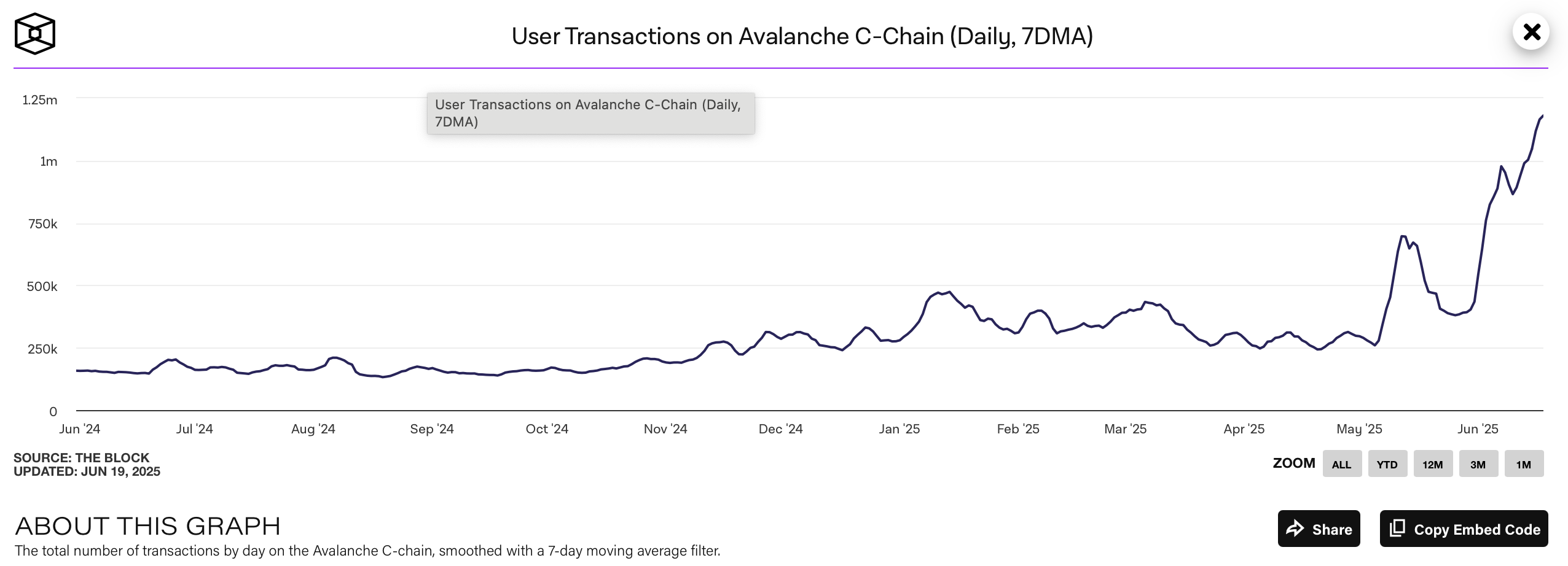

This bearish price action is unfolding despite Avalanche showing strong on-chain activity.

The recent surge in transactions — largely driven by arena.trade, a launchpad that allows users to mint tradeable ERC–404–style tokens directly from X posts using a bonding-curve mechanism — has significantly boosted network metrics. Notably, the 7-day moving average of daily transactions has surpassed 1 million, its highest in over a year.

However, this spike in activity hasn’t been accompanied by a sustained increase in active addresses, indicating that a smaller group of users is driving most of that volume.