Institutional Giants Now Control Over 35% of Bitcoin’s Circulating Supply – Is Retail Being Priced Out?

Wall Street''s crypto land grab hits hyperdrive as new data reveals institutional investors now hold more than a third of all circulating Bitcoin. The digital gold rush has officially gone corporate—while Main Street scrambles for scraps.

The Big Money Takeover

Forget the ''people''s currency'' narrative. Bitcoin''s circulating supply is being vacuumed up by hedge funds, ETFs, and crypto-native institutions at a pace that''d make JP Morgan blush. The 35% threshold isn''t just a milestone—it''s a flashing neon sign that traditional finance has fully weaponized decentralization.

Liquidity Squeeze Ahead?

With over a third of Bitcoin locked in institutional vaults, available supply shrinks faster than a trader''s patience during a 20% correction. Market makers now face their toughest challenge yet: sourcing coins without sending prices parabolic.

The Irony Taste Test

Nothing says ''anti-establishment'' like BlackRock''s Bitcoin wallet balance rivaling small nations'' GDP. The revolution will be institutionalized—and fee-monetized.

Source: Bitcoin Adoption, Volatility, and Market Cap | Gemini and Glassnode’s Report

Source: Bitcoin Adoption, Volatility, and Market Cap | Gemini and Glassnode’s Report

The report also notes that over the past two years, Bitcoin balances on CEXs have declined, which has frequently been mistaken for an imminent supply shortage. However, the majority of that BTC has shifted to ETFs and funds, especially U.S. spot ETFs.

Since June 2021, the total BTC held by this spot trading sector has remained relatively stable, fluctuating between 3.9 million and 4.2 million BTC. This stability indicates that the decrease in exchange balances reflects a structural redistribution of custody rather than a reduction in overall supply. The increasing share held by ETFs signals greater adoption by TradFi, yet the total liquidity available to spot buyers has stayed largely consistent.

The report also highlighted that the creation of the U.S. Strategic Bitcoin Reserve has significantly boosted institutional confidence in Bitcoin as a sovereign-grade asset. Following the SBR announcement, public and private companies have significantly increased their Bitcoin purchases.

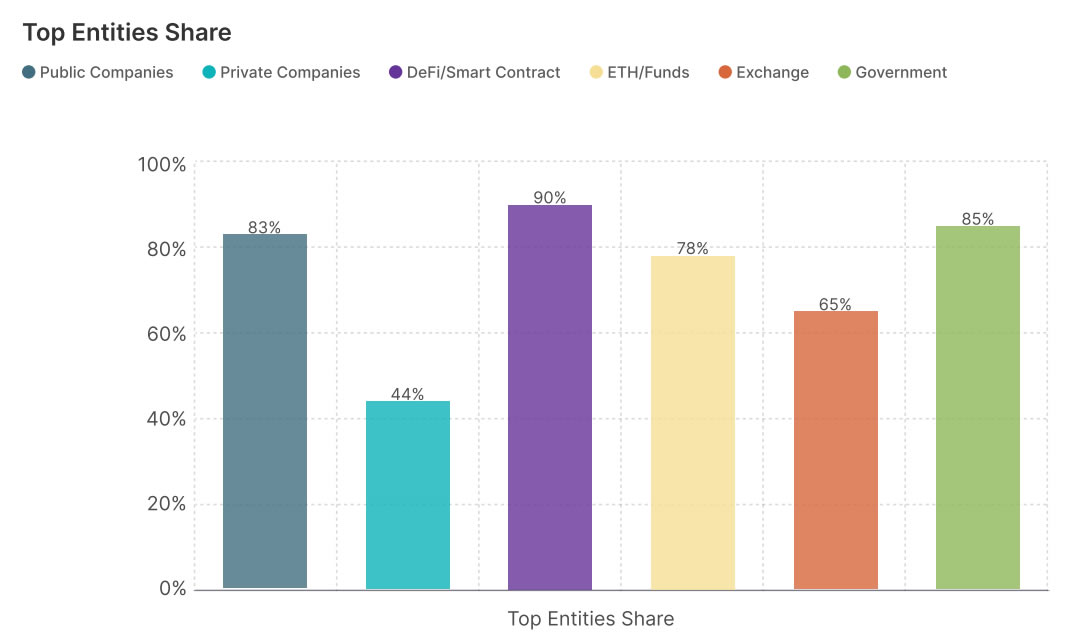

The report concludes that with over 30% of Bitcoin’s circulating supply held by centralized entities, the market has undergone a structural shift catalyzed by long-term investments and strategic custody. While early adopters continue to dominate holdings, Bitcoin’s acceptance as a sovereign-grade asset—marked by the SBR—has boosted institutional confidence. Even as custody moves from exchanges to ETFs and other custodians, the overall supply available for spot trading has remained stable.