PancakeSwap Outflanks Uniswap in DEX Wars—But at What Cost?

In the high-stakes arena of decentralized exchanges, PancakeSwap just pulled off a coup—flipping Uniswap in daily volume while its token price stumbles. The irony? Traders chase yield like caffeinated greyhounds, even as CAKE's valuation deflates faster than a meme coin post-hype cycle.

Behind the numbers: PancakeSwap's BNB Chain dominance and lower fees keep retail hooked, but purists sneer at its 'copycat' rep. Meanwhile, Uniswap's ETH-centric model faces gas-guzzling headwinds—proving decentralization isn't always the profit play.

Final twist? Both platforms rake in fees while users front-run each other into oblivion. Ah, DeFi—where the house always wins, even when there isn't one.

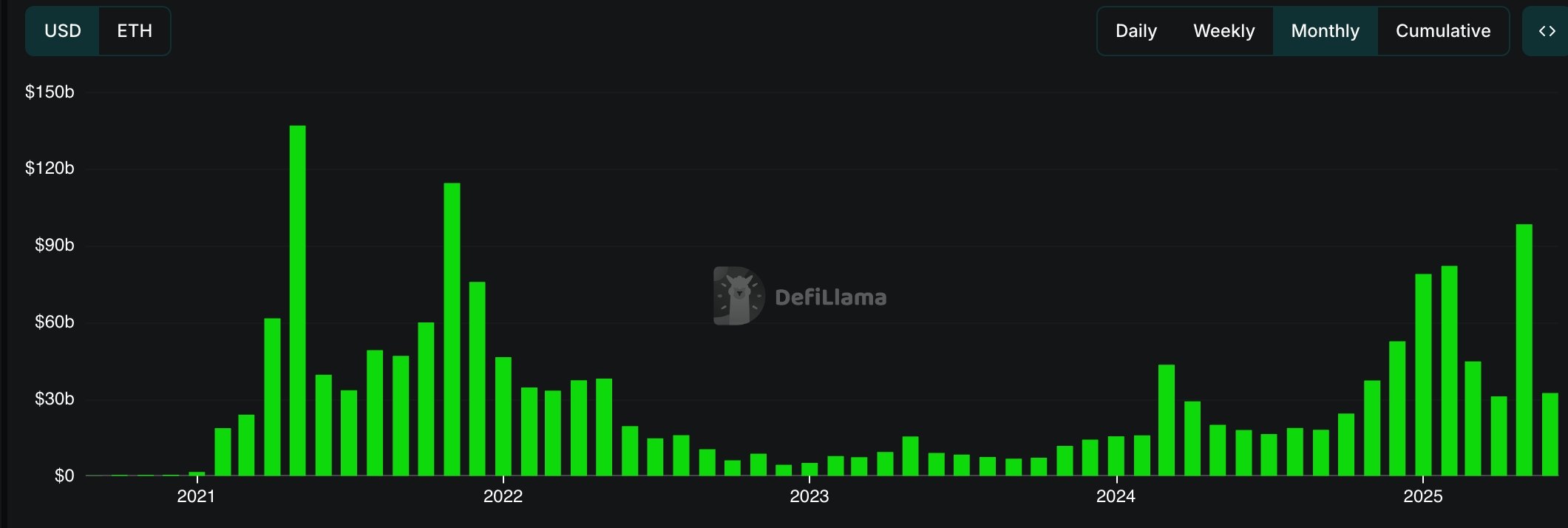

PancakeSwap DEX volume | Source: DeFi Llama

PancakeSwap DEX volume | Source: DeFi Llama

This growth led to a big increase in fees and revenue. Its monthly fees rose to $131 million in May from $57 million a month earlier. Its revenue rose to $32 million from $14 million. More metrics on active CAKE addresses and staking have also jumped.

CAKE price analysis

CAKE has remained above the ascending trendline that connects the lowest levels since May 11. It also remains above the 50-day and 100-day moving averages.

The risk, however, is that the token has formed a small head and shoulders pattern. This pattern comprises a head, left and right shoulders, and a neckline, where it is today.

Therefore, a break below these support levels will point to more downside, with the next point to watch being at $2. That implies a 13% drop below the current level.