Moonpig Crashes 33.91%—Bargain Hunt or Dead Cat Bounce?

Another day, another 'growth stock' getting mauled by the market. Moonpig’s nosedive has traders scrambling—is this the dip to buy or just another overhyped ticker running out of steam?

Let’s be real: a 33% haircut isn’t a correction, it’s a bloodbath. The question isn’t whether Moonpig’s fundamentals justify the plunge (spoiler: they probably do), but whether the algos have finished dumping bags on retail yet.

Pro tip: If your 'bottom fishing' strategy relies on CNBC analysts’ price targets, maybe stick to index funds. Just saying.

Key Technical Points

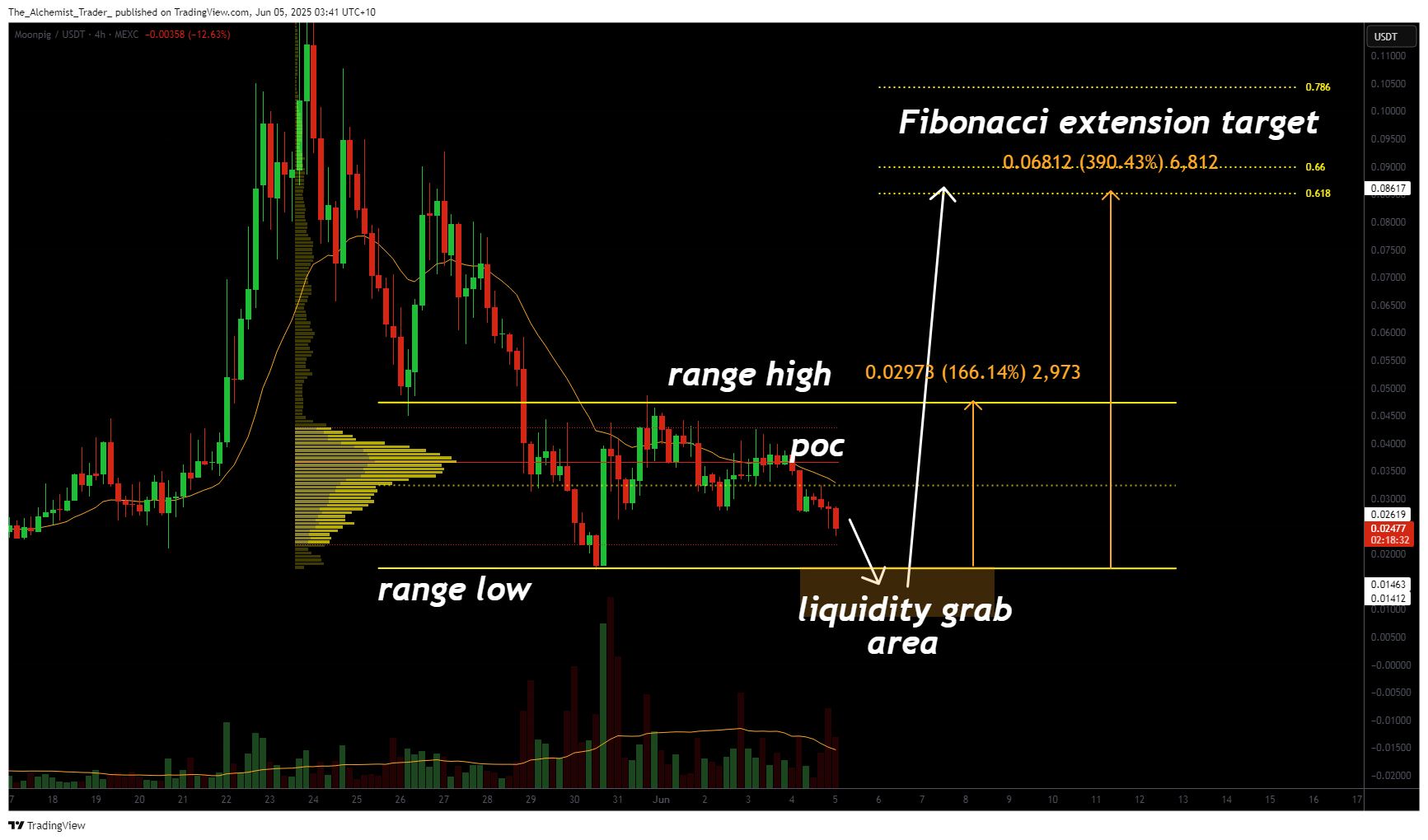

- Range Low Liquidity Zone: Price is hovering above the local range low, where a sweep of liquidity could lead to a bullish SFP reversal back into the range.

- Point of Control Resistance: The POC within the range has historically acted as resistance; breaking and holding above it could set up a grind toward the range high.

- Fibonacci Extension Target: If the range high is breached with momentum, the next target lies 390% higher based on Fibonacci extension projections.

Moonpig’s 33% decline has brought it close to the bottom of its well-defined trading range. If the current local low is breached, it may result in a classic swing failure pattern, where price momentarily dips below support to grab liquidity before snapping back inside the range. This pattern is often used by experienced traders as a high-probability long setup.

At present, the market is not showing a bullish structure. Instead, price action remains rotational, trading within a 166% wide range. Until there’s a structural shift, the base assumption is for continued range-bound behavior.

Within this range, the point of control sits below the range high and has been a strong reaction zone in the past. Price has repeatedly wicked into this area, only to rotate lower. If price action can reclaim and consolidate above the POC, the probability of a move toward the range high increases substantially.

A breakout beyond the range high WOULD open the door for a much larger move, targeting a Fibonacci extension level over 390% above current levels. However, until that occurs, volatility within the current range should be expected, with the bias favoring mean-reversion setups.

What to expect in the coming price action

Moonpig remains in a large consolidation phase. If price sweeps the current range low and reclaims it, this could be the first signal of a structural shift and bullish reversal.

Traders should watch for an SFP confirmation and a reclaim of the POC to validate upside potential. Until then, rotational price action within the range remains the most likely scenario.