Bitcoin and Altcoins: June Rally or Crypto Ice Age?

Crypto markets teeter on a knife’s edge—will June bring a surge or send hodlers scrambling for parkas?

The Bull Case: Institutional inflows hit record highs last month, and Bitcoin’s halving supply shock hasn’t fully played out. ETH spot ETF approvals loom, while memecoin degenerates keep dumping paychecks into degenerate gambling tokens.

The Bear Trap: Macro headwinds could crush risk assets as central banks extend their ’higher for longer’ monetary sadism. Tether’s printer hasn’t roared lately—always a worrying sign for artificial liquidity.

One thing’s certain: Wall Street will take its cut either way, whether through futures contango or those sweet, sweet 2% management fees on your doomed leveraged ETF.

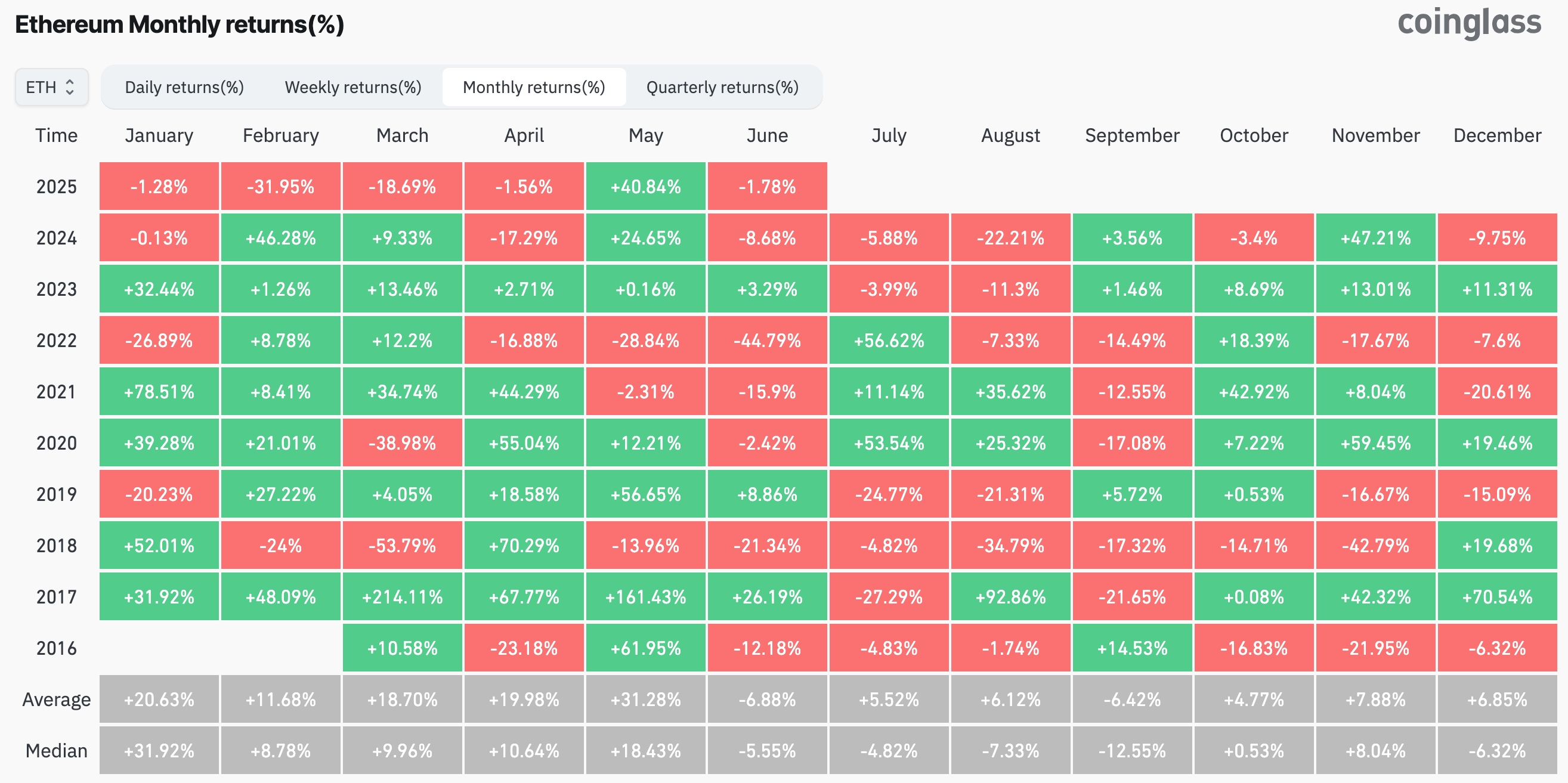

ETH price action by month | Source: CoinGlass

ETH price action by month | Source: CoinGlass

Therefore, if history repeats itself, a crypto winter may likely occur in June. This period is characterized by falling or stalling prices and reduced trading activity. It is also marked by a neutral fear and greed index.

Bitcoin price action to determine crypto winter

Bitcoin, the largest cryptocurrency, will determine whether the crypto winter happens. A strong surge to new record highs may lead to renewed demand for altcoins, including meme coins.

The daily chart shows that BTC has pulled back from its all-time high of $111,900 in May to $104,000. This pullback is likely part of the handle formation in a cup-and-handle pattern, a common continuation setup.

The cup has a depth of about 32%, suggesting the coin may eventually surge to over $144,600. This target is derived by measuring the same distance from the upper side of the cup.

Therefore, Bitcoin may drive a crypto winter as it continues forming the handle section. If this occurs, most altcoins may continue falling in June. Fortunately, due to the cup-and-handle pattern, the crypto winter will likely give way to a crypto spring once Bitcoin rebounds.