XRP Primed for a 50% June Rally—Here’s Why

Market whispers turn to shouts as XRP shows bullish signals that could send it soaring this month. Forget hopium—these catalysts have teeth.

1. Regulatory fog lifts: A key ruling clears the way—no more legal overhang strangling price action.

2. Whale accumulation spikes: On-chain data reveals addresses holding 10M+ XRP just hit a 6-month high. Smart money talks.

3. Exchange supply crunch: CEX reserves drop 15% in May while derivatives open interest explodes. Squeeze potential builds.

4. Macro tides shift: The Fed’s pivot sends institutional flows flooding back into crypto—and XRP’s liquidity profile makes it a prime beneficiary.

Of course, Wall Street will claim they saw it coming—right after they finish dumping their bags. The charts don’t lie though: this setup screams June fireworks.

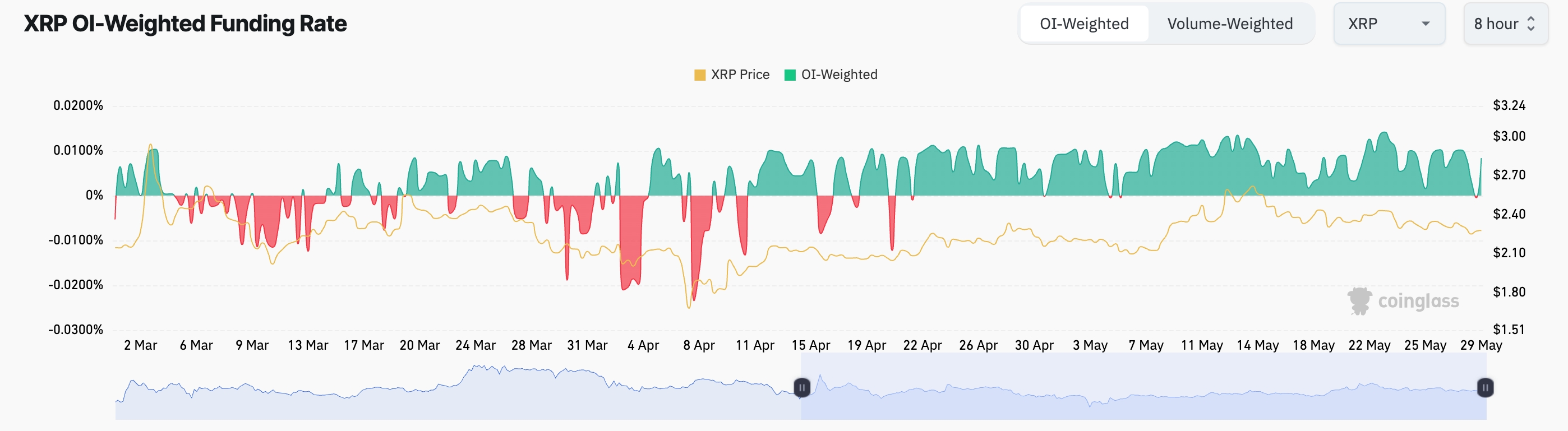

XRP funding rate | Source: CoinGlass

XRP funding rate | Source: CoinGlass

XRP technicals

The accumulation and distribution indicators point to increased accumulation. This means that XRP may now be in the accumulation phase of the Wyckoff Theory.

It will MOVE to the markup, which has higher demand than supply.

The xrp price has remained slightly above the 200-day moving average. It has also formed a giant bullish pennant pattern, comprising a vertical line and a triangle. A pennant often leads to a strong bullish breakout.

XRP has also formed an inverse head-and-shoulders pattern. As such, a breakout will see it retest the resistance at $3.3842, up almost 50% from the current level.