Solana Crashes to 30-Day Low as Memecoin Mania Runs Out of Steam

Solana’s native token takes a nosedive—turns out ’doge-but-faster’ wasn’t the bulletproof investment thesis Wall Street hoped for.

The hype cycle bites back

After weeks of unsustainable memecoin speculation propping up SOL’s price, reality hits like a cold shower. Trading volumes evaporate faster than a shitcoin liquidity pool.

VCs start sweating

The ’Ethereum killer’ narrative looks shaky when your blockchain’s most compelling use case is hosting tokens named after anime characters. Meanwhile, Bitcoin maximalists smugly adjust their diamond hands.

Another reminder that in crypto, gravity always wins—except when the Fed prints more money.

Solana’s correction deepens

Solana fell to a low of $153.90, down 17.6% from its highest level in May. If the sell-off continues, it may MOVE into a technical correction.

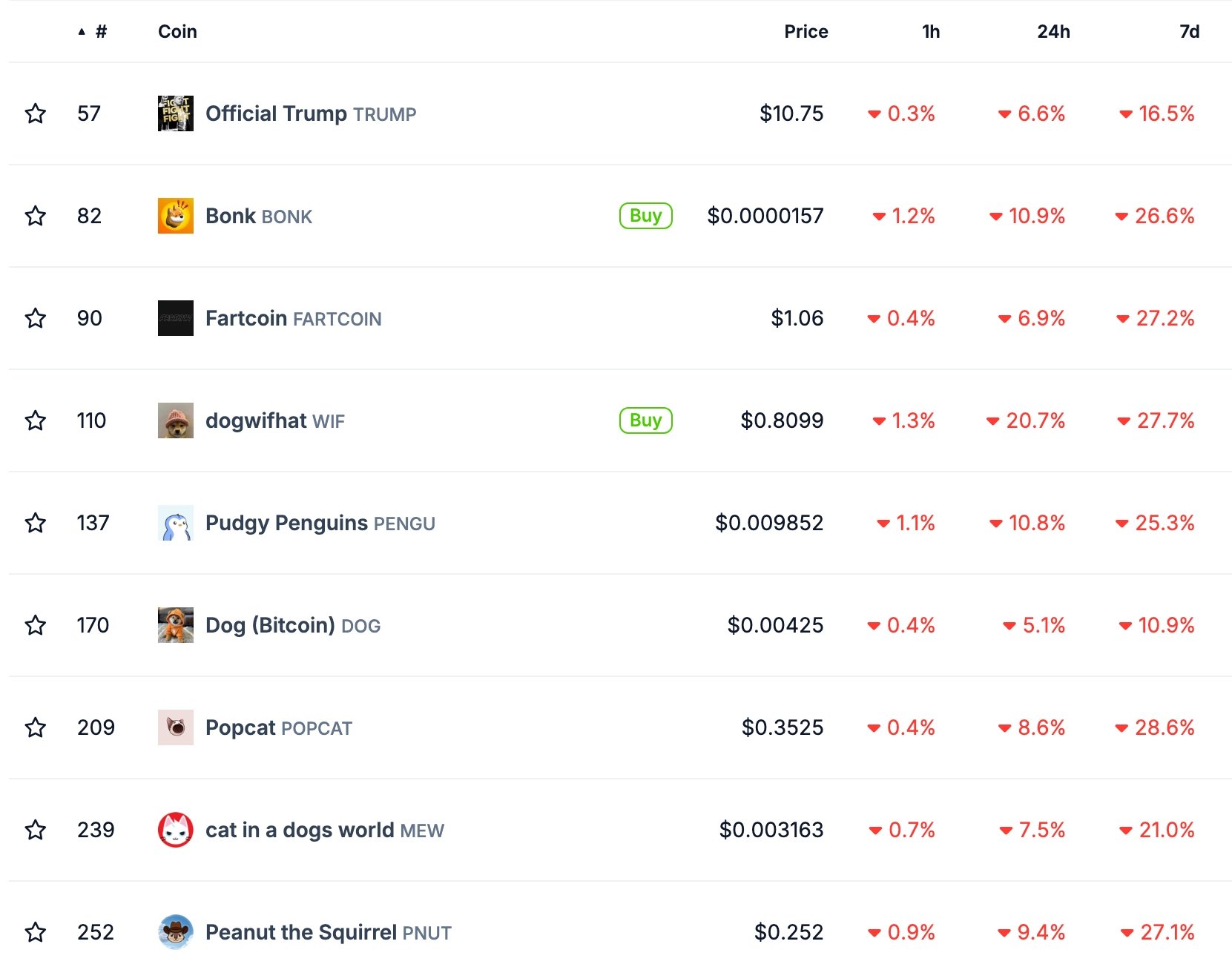

Solana meme coins have been some of the worst-affected as their market capitalization fell from over $15 billion mid-month to $10 billion.

Dogwifhat price tumbled by 20% in the last 24 hours, while SPX6900 (SPX) fell by 18%, as we predictedOther top Solana meme coins like Fartcoin (FARTCOIN), Pudgy Penguins, and Popcat have tumbled by over 20% in the same period.

The ongoing Solana meme coin sell-off has also affected its ecosystem. For example, the volume handled by protocols in its DEX ecosystem has tumbled in the past few days. The volume stood at $2.4 billion in the last 24 hours, lower than ethereum and BSC $2.98 billion and $12.1 billion.

Solana and meme coins in its ecosystem have tumbled because of profit-taking, as most of them were up by over 100% from their lowest levels in April.

SOL price technical analysis

The daily chart below shows that Solana has dropped sharply in the past few days, moving from $185 on May 23 to $154. It has moved below the 38.2% Fibonacci Retracement level.

The coin has also crashed below support at $159.45 and the neckline of the double-top pattern at $184.25. A double-top is one of the riskiest chart patterns in technical analysis.

Solana has dropped below the 50-day Exponential Moving Average, while the Relative Strength Index and the MACD have all pointed downwards.

Therefore, the coin will likely continue falling. The initial target is the 23.6% retracement point at $140, down 8.50% from the current level. If the coin rises above the double-top point at $185, more upside, potentially to $200, will be invalidated.