Bitcoin Battles $108K Support as $211M Gets Wiped Out in Liquidations

Crypto markets hold their breath as Bitcoin teeters above a critical $108,000 support level—while traders get steamrolled by $211 million in liquidations.

Analysts warn of a make-or-break moment for BTC’s bull run. Will institutions swoop in, or is this another ’buy the rumor, sell the news’ circus?

Funny how Wall Street always discovers volatility after their own bags are safely stashed.

Bitcoin’s price suggests caution in the short term: Bitunix

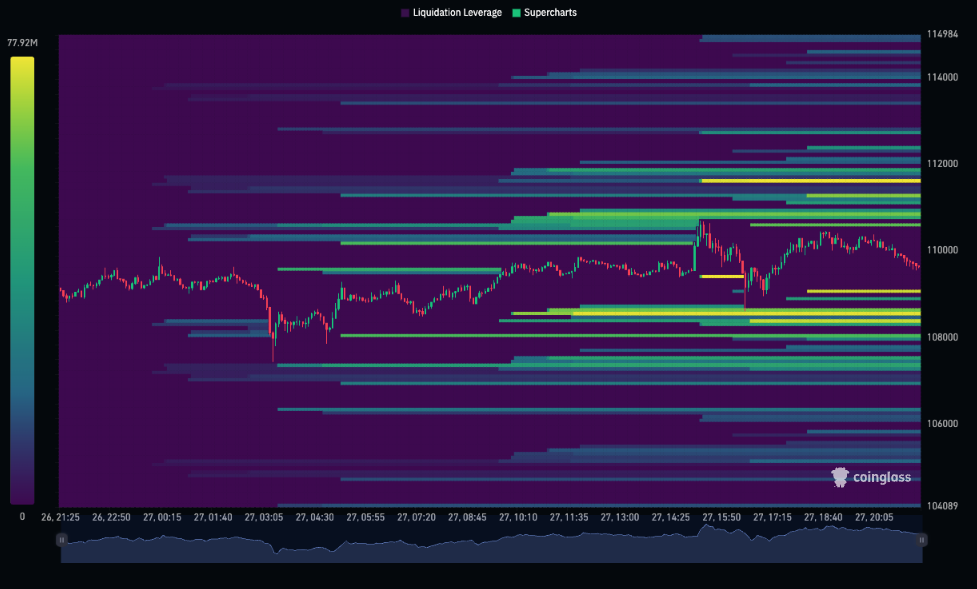

According to Bitunix, the liquidation heat map reveals a concentrated cluster of liquidations around the $108,000 level, signaling that this zone may serve as a key liquidity support area, where buyers tend to step in.

However, Bitunix analysts still believe that traders should exercise caution. Specifically, a drop below the $108,000 zone could lead to more liquidations, which could trigger further breakdown of its price.

“A drop below $108,000 could trigger a new round of liquidations. Traders are advised to exercise strict risk control as the market could weaken again if capital inflows do not resume,” Bitunix.

Despite short-term risks, there are signs that Bitcoin’s long-term outlook is strong. A May 25 report by UTXO’s Guillaume Girard and Will Owens showcases that Bitcoin’s institutional demand is currently outpacing the supply. Effectively, buyers are entering the market faster than miners can mint Bitcoins, which could escalate in the coming years.