XRP Price Primed for a Parabolic Rally—Here’s the $10 Case for 2025

Forget sideways action—XRP’s chart is flashing signals that could send it rocketing to double digits. A perfect storm of regulatory clarity, institutional adoption, and pent-up demand might just be the fuel for a historic breakout.

Why $10 isn’t a pipe dream:

- Ripple’s legal battles finally fading? Check. Liquidity corridors expanding? Check. The crypto’s utility in cross-border payments—now with fewer lawsuits attached—could trigger a re-rating from ’crypto pariah’ to ’market darling.’

- The last bull run saw XRP flirt with $3. If history rhymes (as Wall Street loves to claim while ignoring every bubble warning), a 3x from ATH seems almost conservative.

Cynical bonus: Banks will hate how much they’ll need to buy once their ’blockchain not crypto’ talking points crumble under shareholder pressure.

XRP price chart points to an eventual surge

One potential catalyst for the xrp price is supportive technicals that may trigger a strong breakout in the coming months.

First, the coin formed a giant cup and handle pattern at $1.966 between April 2021 and November last year. This pattern features a rounded bottom followed by consolidation at the top. The cup section has been completed, and the coin is now forming the handle.

The cup has a depth of about 85%, and projecting the same distance from its upper edge gives a target price of $3.66.

Second, XRP has also formed a bullish pennant pattern, consisting of a vertical rally followed by a symmetrical triangle. A breakout appears likely as the two trendlines approach confluence.

Additionally, Ripple is supported by both short- and long-term moving averages. A bullish breakout WOULD be confirmed if the price rises above the year-to-date high of $3.4. A move above that level could open the door to further gains, potentially reaching the psychological threshold at $5, an increase of 117% from the current level.

Flipping $5 would bring the next key psychological level at $10 into view. A rally to $10 would mark a 335% surge from current levels, a plausible scenario given XRP’s nearly 500% jump in November.

Potential catalysts for Ripple surge

Several catalysts could push XRP to $10 this year. First, on the macro front, analysts expect the Federal Reserve to begin cutting interest rates in September. Such a move would likely lift Bitcoin (BTC) and altcoin prices.

Second, there are rumors that BlackRock is preparing to enter the XRP ETF race, joining firms like VanEck and Franklin Templeton. That would be a significant bullish signal, given BlackRock’s influence in the ETF space.

The odds that the SEC will approve XRP ETFs are over 80% on Polymarket. If approved, these products could see strong inflows, as evidenced by the Leveraged XXRP ETF, which has amassed $112 million in assets in under two months.

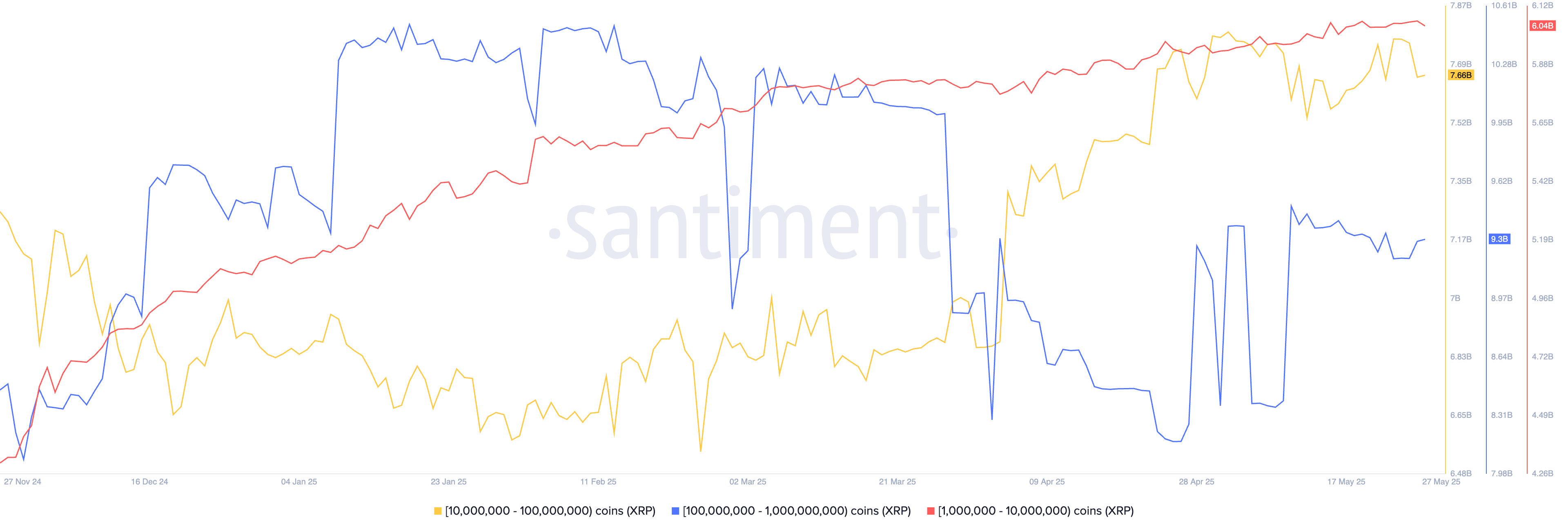

Meanwhile, data shows that XRP whales are accumulating. Addresses holding over 1 million XRP have acquired billions of tokens in recent months, positioning for a continued rally.

Further, Ripple Labs is aiming to onboard more U.S. companies to the RippleNet ecosystem following the end of its legal battle with the SEC. This, along with the HiddenRoad acquisition, is expected to drive increased activity on the XRP Ledger network.