Bitcoin vs. Blue Chips: The Ultimate Hedge Against Traditional Finance’s Slow-Motion Crash

Wall Street’s darlings or digital gold? As legacy markets wobble under inflationary pressures, savvy investors are flipping the script.

The case for crypto’s flagship asset

Bitcoin isn’t just outperforming traditional stocks - it’s rewriting the rulebook. While S&P 500 companies chase quarterly earnings, BTC operates on internet time, delivering 200%+ returns since last year’s banking crisis.Strategy stocks? More like nostalgia plays

Those ’stable’ dividend payers can’t compete with an asset class that laughs at inflation. Funny how the ’safe’ choice now means tying your money to institutions that still run on COBOL and fax machines.The verdict? This isn’t 2020 anymore. In a world where central banks print money like Monopoly currency, Bitcoin isn’t just an alternative - it’s becoming the main event.

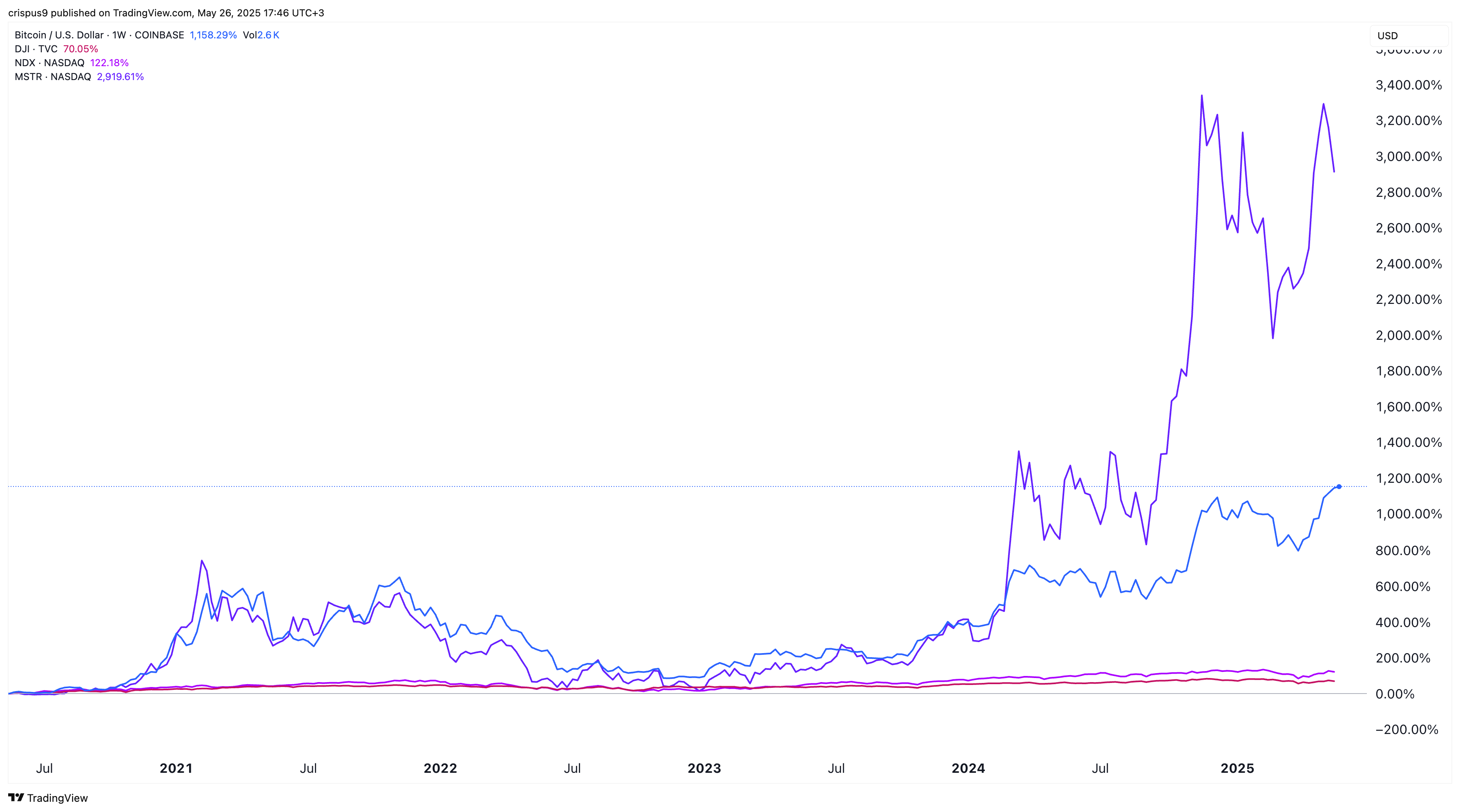

Bitcoin vs Strategy stock vs Dow Jones vs Nasdaq 100 | Source: crypto.news

Bitcoin vs Strategy stock vs Dow Jones vs Nasdaq 100 | Source: crypto.news

How the Strategy model works

Investors interested in bitcoin today have at least three main options. First, they can take the most straightforward route: buying Bitcoin and storing it on exchanges or in self-custody wallets.

Second, they can invest in spot Bitcoin ETFs, which now hold over $131 billion in assets. These ETFs offer direct exposure to Bitcoin but charge a small management fee.

Third, there’s Strategy, which has become the largest corporate holder of Bitcoin with over 580,250 BTC on its balance sheet. Investors place a premium on its model, with its current market cap of $101 billion standing at 1.58x the value of its Bitcoin holdings.

Strategy has acquired 4,020 BTC for ~$427.1 million at ~$106,237 per bitcoin and has achieved BTC Yield of 16.8% YTD 2025. As of 5/25/2025, we hodl 580,250 $BTC acquired for ~$40.61 billion at ~$69,979 per bitcoin. $MSTR $STRK $STRF https://t.co/eAd03GIKam

— Michael Saylor (@saylor) May 26, 2025Strategy’s approach has been effective because its net asset value (NAV) premium amplifies Bitcoin price increases. A higher share price, in turn, makes it easier for the company to raise funds and accumulate more Bitcoin.

At the same time, the rising bitcoin price helps offset share dilution by increasing the firm’s BTC holdings at a faster rate, resulting in higher Bitcoin-per-share for investors.

However, fears of further dilution have raised concerns. The company’s plan to raise $84 billion through share sales has put pressure on its stock. While Bitcoin is trading NEAR its all-time high, Strategy stock is down over 12% from its 2025 peak.

Bitcoin vs Strategy stock: which is a better buy?

Analysts remain bullish on Bitcoin’s long-term outlook. BlackRock predicts BTC could reach $700,000, while Ark Invest sets a more aggressive target of $2.4 million. If either forecast proves accurate, both Bitcoin and Strategy stock WOULD likely deliver strong long-term returns.

At BlackRock’s $700,000 target, Bitcoin would gain about 536% from current levels, giving it a market cap of at least $13.9 trillion.

Assuming Strategy holds 576,230 BTC at that point, its Bitcoin holdings would be worth $403.36 billion. Applying the historical NAV premium of 1.58x suggests Strategy’s market cap could reach over $637 billion.

If Bitcoin’s rally continues and the NAV premium holds, Strategy stock would outperform Bitcoin in relative returns.