Zebec Network (ZBCN) Price Stumbles as Funding Rates Flash Red—Is a Crash Imminent?

Zebec Network’s token ZBCN is painting a concerning picture as funding rates dip into negative territory. Traders are bracing for volatility—will this be a healthy correction or the start of a deeper plunge?

Market sentiment sours as shorts pile up. The protocol’s real-time settlement tech hasn’t immunized it against crypto’s favorite pastime: irrational price swings.

Remember folks, in decentralized finance, the only thing more predictable than hype cycles is how quickly ’fundamentals’ get ignored when leverage flips. Watch those liquidation levels.

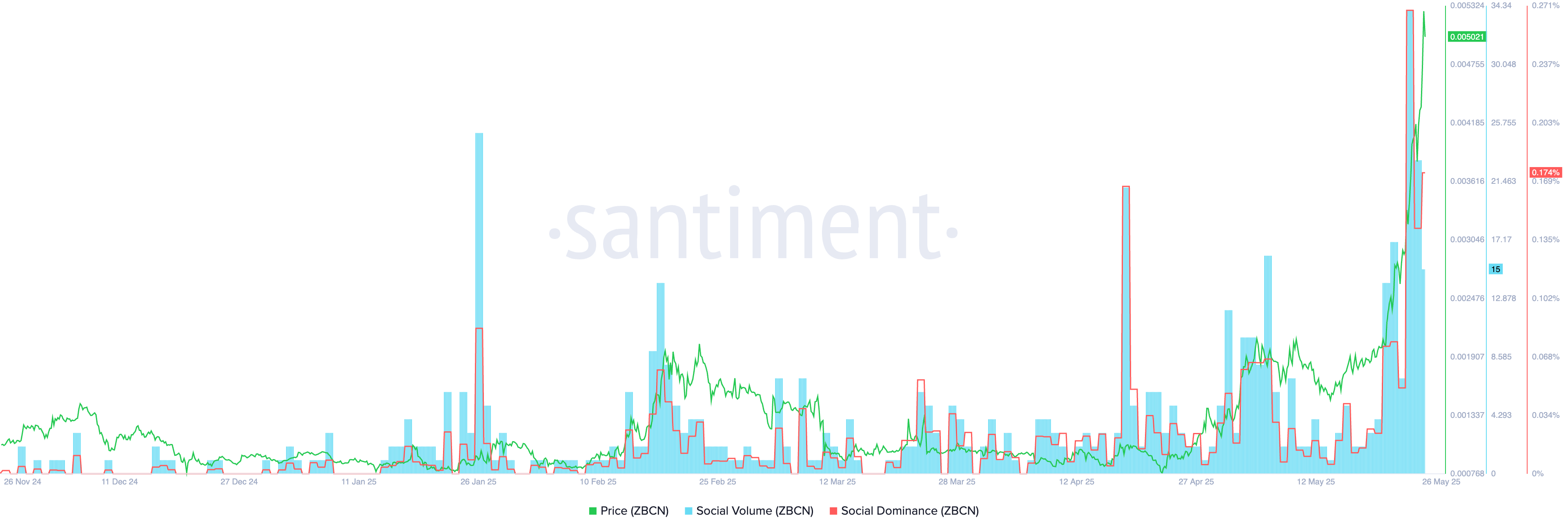

Social dominance | Source: Santiment

Social dominance | Source: Santiment

That is a sign that it could be experiencing fear of missing out, or FOMO, among retail traders. This is also shown by the fact that the number of holders has continued rising, reaching an all-time high of 58,776. It had less than 50,000 holders earlier this month.

Zebec Network is a payments-focused company offering solutions such as a Mastercard-enabled debit card and cross-border remittance tools. According to its website, it serves over 50,000 monthly users across 138 countries.

The company is also active in the payroll processing sector, supported by its 2023 acquisition of Paybridge. Zebec now helps more than 250 partner companies streamline and reduce the cost of payroll services.

Zebec Network price analysis

The daily chart shows that ZBCN has gone parabolic in recent sessions. It broke above a key resistance level at $0.002137, the upper boundary of a cup-and-handle pattern, a classic bullish continuation signal. The token has also surpassed the pattern’s target price of $0.0035.

However, the risk is that ZBCN has entered extremely overbought territory. The Relative Strength Index is now at 90, while the Stochastic Oscillator and momentum indicators are also at elevated levels.

In addition, Zebec’s funding rate has remained negative since May 21, suggesting that investors expect a pullback. As a result, the most likely scenario is a short-term drop, a retest of the cup’s upper boundary, and a potential continuation of the uptrend. This “break-and-retest” pattern is commonly seen as a bullish confirmation.