Bonk Token Faces Potential Price Plunge as Whales and Smart Money Exit

Whales and institutional players are dumping Bonk tokens—signaling a possible downturn for the meme coin. Here’s why the market’s feeling jittery.

When big players cash out, retail traders often get left holding the bag. Will history repeat itself, or is this just another blip in crypto’s volatile saga?

Bonus jab: Another day, another ’smart money’ move that looks suspiciously like panic-selling dressed up as strategy.

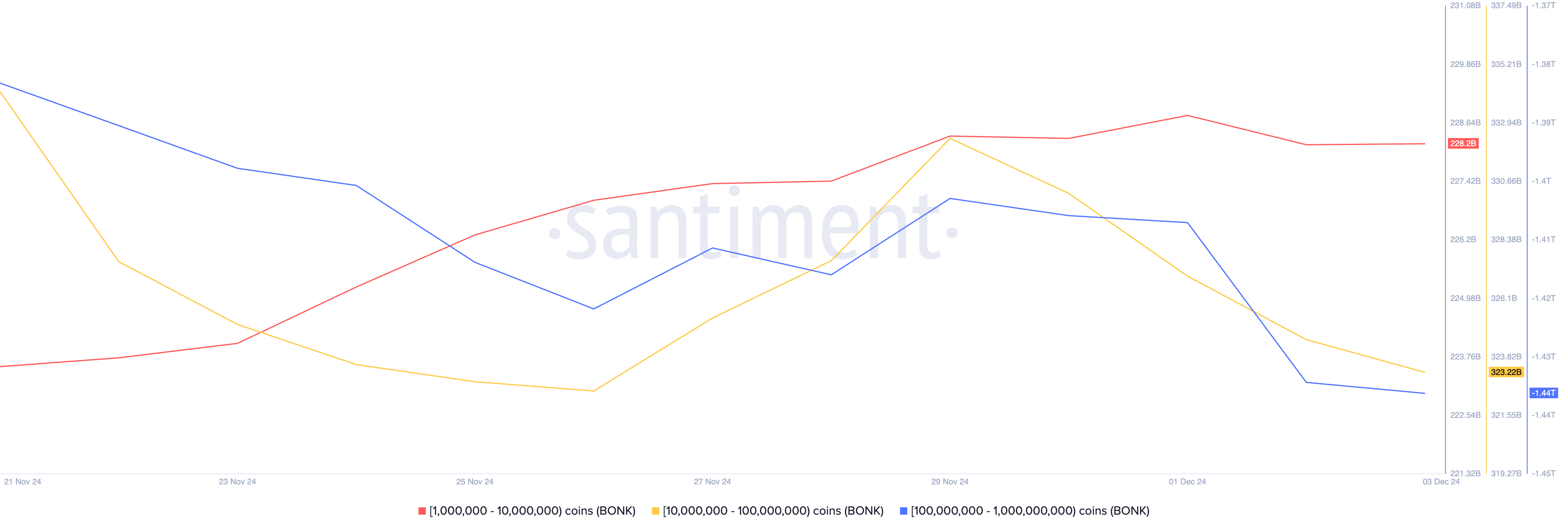

Bonk whales chart | Source: Santiment

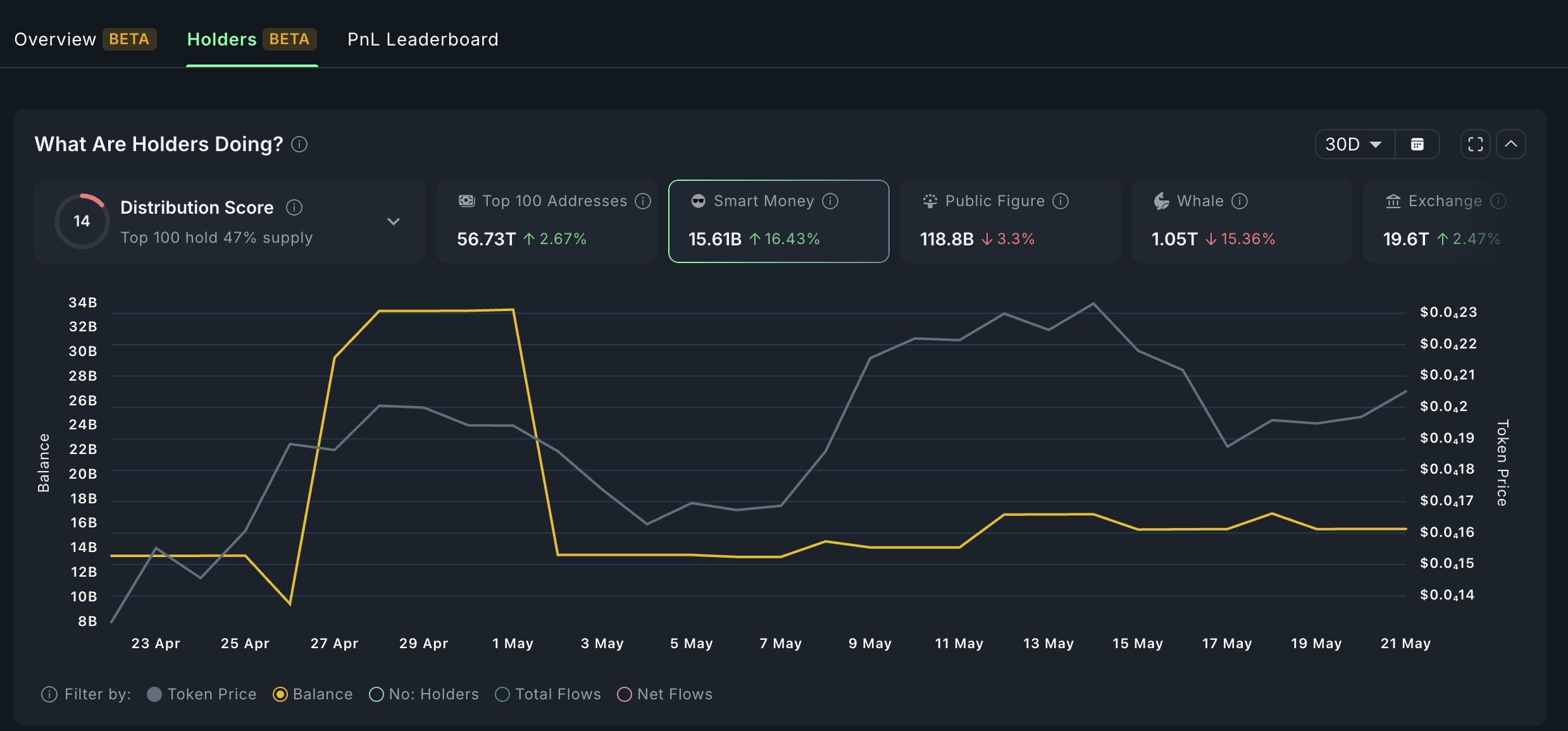

Bonk whales chart | Source: Santiment

According to Nansen, whale holdings have dropped by 15% over the past 30 days, while tokens held by smart money investors have declined from 33.4 billion in April to 15.6 billion currently.

Nansen defines smart money investors as users with a consistent history of identifying bullish and bearish trends early, typically buying before a token rebounds and selling NEAR local tops.

Additional data shows that Bonk’s exchange balances have risen to 19.6 trillion tokens, up from this month’s low of 19.4 trillion. Rising exchange balances are often viewed as bearish, as they typically suggest increased selling pressure from investors.

Bonk price technical analysis

The four-hour chart shows that Bonk peaked at $0.00002577 this month before forming a double-top pattern. The token then dropped to a low of $0.00001815, which coincided with an ascending trendline connecting the lowest swings since April 7.

Bonk has since formed a bearish pennant pattern, made up of a sharp downward MOVE followed by a symmetrical triangle. The two trendlines of this pattern are nearing a confluence, which could lead to a bearish breakdown.

The initial target for this move is $0.00001815, the lowest swing this month. A break below that level WOULD likely point to further downside, potentially toward the 50% Fibonacci retracement level at $0.00001730.