AAVE Surges 25% as Golden Cross Looms—DeFi’s Latest Bull Trap or Breakout?

AAVE rockets past key resistance as its 50-day MA prepares to cross the 200-day—classic trader bait. Will this DeFi darling sustain momentum or become another ’wen lambo’ gravestone?

Technical analysts are drooling over the chart setup, while skeptics note the pattern’s 60% historical accuracy (but who needs stats when hopium’s free?). The rally coincides with fresh institutional interest—just in time for the usual ’buy the rumor, sell the news’ circus.

Source: Santiment

Source: Santiment

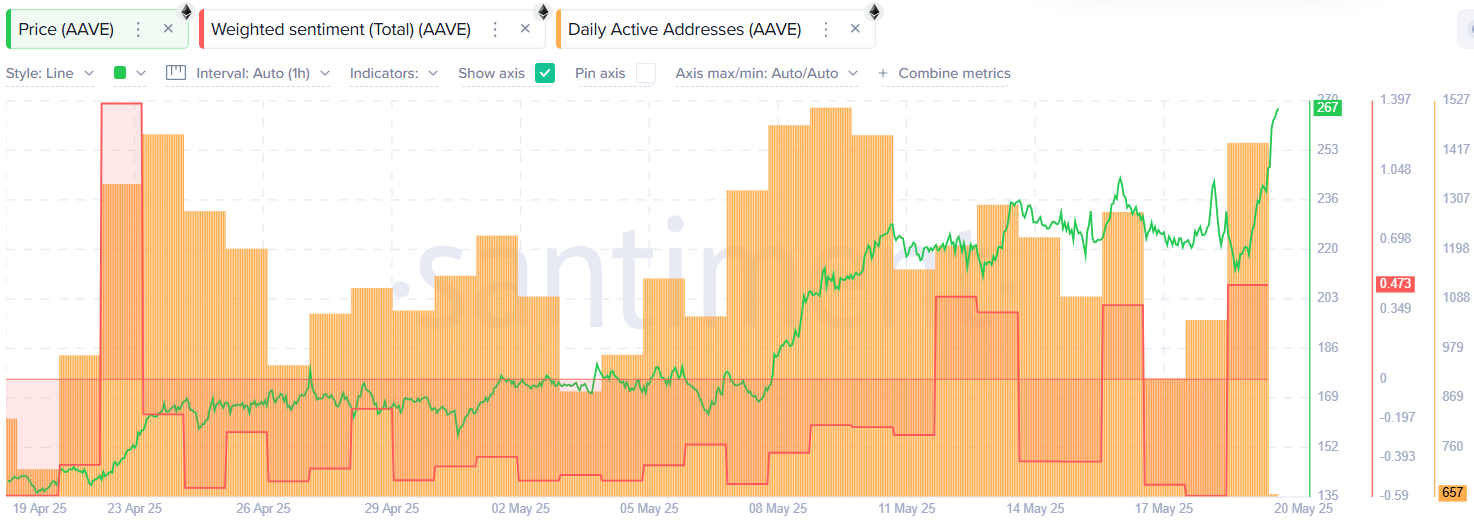

At the same time, its weighted social sentiment has also flipped positive, a sign that market participants are growing bullish on AAVE’s short-term outlook.

Potential golden cross in development

On the 1-day/USDT chart, the Aroon Up indicator is at 100% while Aroon Down sits at 0%, meaning bullish momentum is dominant. The Chaikin Money FLOW Index is reading 0.26, which signals more capital flowing into the token.

A golden cross also looks imminent on the daily chart, as AAVE’s 50-day and 200-day moving averages inch closer to a crossover, often considered a bullish signal.

The token is nearing the 61.8% Fibonacci retracement level at $271.35. A clean breakout above this level could pave the way toward the 50% retracement level at $347.19, roughly 30% higher than current levels.

On the flip side, if a pullback happens, key support lies NEAR $226.45, which could serve as a solid bounce zone before the uptrend resumes.

At press time, AAVE was trading around $267 per coin.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.