Whale dumps Ethereum at a loss—market shrugs while bagholders weep

Another ’smart money’ player just turned into dumb money. Ethereum’s price takes a hit as a major holder offloads their stack at a steep loss—proof even crypto’s elite can’t time the market.

The move triggers predictable panic among retail traders, though chain analysts note the sell-off represents less than 0.1% of ETH’s circulating supply. Classic overreaction in an industry where ’fundamentals’ means watching Twitter feeds instead of balance sheets.

Meanwhile, traditional finance bros sip champagne—their 5% bond yields looking downright revolutionary compared to crypto’s volatility circus.

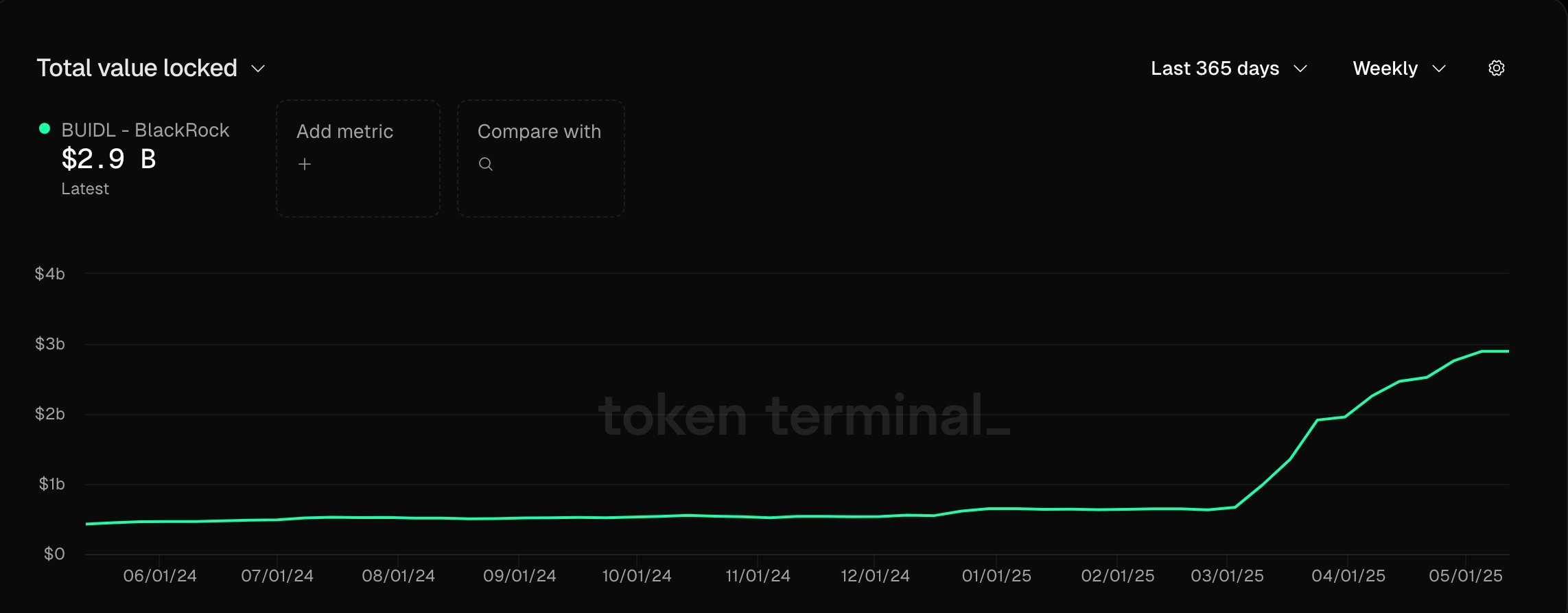

BUIDL assets are nearing $3 billion | Source: TokenTerminal

BUIDL assets are nearing $3 billion | Source: TokenTerminal

Ethereum price technical analysis

The daily chart shows that ETH bottomed at $1,380 in April before rallying to $2,732 last week. It has since pulled back as investors took profits.

Despite the drop, ETH remains above the 50-day and 100-day Exponential Moving Averages, which are on the verge of forming a mini golden cross. The current pullback occurred after the price hit the 50% Fibonacci retracement level, a sign that ETH may now be entering the second phase of an Elliott Wave pattern.

If this outlook holds, Ethereum could bounce and potentially retest the 78.2% retracement level at $3,527 over the longer term. A drop below the $2,000 support zone WOULD invalidate this bullish scenario.