HBAR Stumbles—But Hedera’s Got Triggers Pulled for a Comeback

Hedera’s native token takes a hit—market jitters or just another Tuesday in crypto? Meanwhile, the network’s real-world enterprise traction (and a few sleeping giants in the pipeline) suggest this dip’s more appetizer than main course.

Bulls eyeing the charts: HBAR’s fundamentals didn’t suddenly rot. The DLT darling’s still processing transactions faster than Wall Street can print a ’market correction’ press release. Partnerships? Check. Regulatory clarity? For once, yes. Now if only the ’efficient market hypothesis’ applied to crypto.

Bottom line: This isn’t some vaporware blockchain bleeding out. Hedera’s built for the marathon—and smart money’s already lacing up.

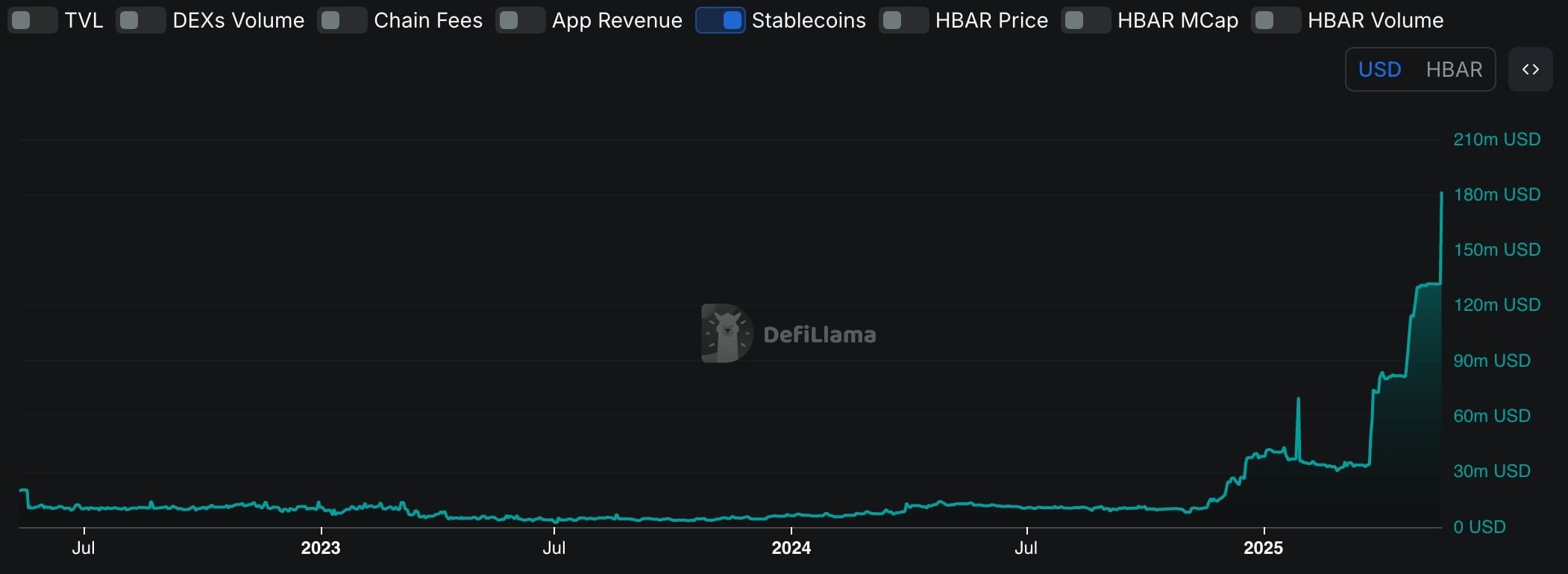

Hedera stablecoin market cap | Source: DeFi Llama

Hedera stablecoin market cap | Source: DeFi Llama

A soaring stablecoin supply on a blockchain is generally seen as a positive indicator, suggesting rising on-chain activity. It can also drive higher network revenues as transaction volumes increase. For example, Tron (TRX) has become the most profitable chain due to its dominant share of Tether transactions.

Decentralized exchange volume on Hedera also climbed, with a more than 80% increase in the past week to $70.4 million. This brought the network’s cumulative DEX volume to $4.58 billion.

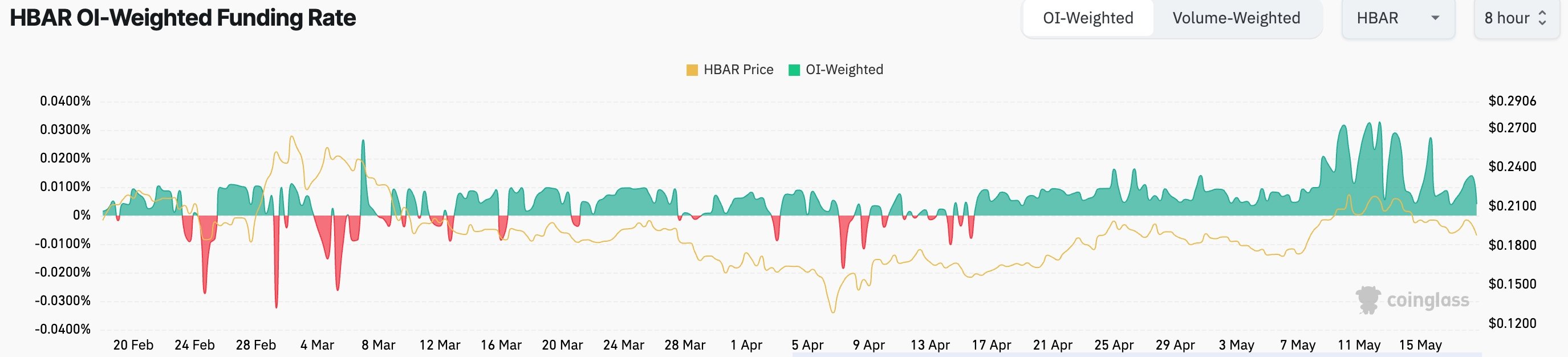

Another bullish signal is that the funding rate in the futures market has remained positive since April 16. A positive funding rate indicates that traders expect future prices to rise, a generally bullish sentiment.

HBAR price technical analysis

The daily chart shows that HBAR has pulled back in recent sessions. On the positive side, the token remains above the 200-day Exponential Moving Average and the 61.8% Fibonacci retracement level.

Hedera has also formed an inverse head and shoulders pattern, a popular bullish reversal sign in technical analysis.

Therefore, the Hedera Price may bounce back in the next few days as the US credit rating downgrade jitters endIf this happens, the initial target to watch will be at $0.2240, the 50% Fibonacci Retracement level. A move below the support at $0.15 will invalidate the bullish outlook.