Bitcoin’s Wild Rides Tamed by Wall Street’s Greasy Fingers

Institutional money is turning crypto’s rollercoaster into a corporate merry-go-round—just don’t expect bankers to apologize for killing the fun.

Once the playground of retail degens, Bitcoin now moves at the pace of pension funds and compliance paperwork. The ’number go up’ machine still works... just with more middlemen taking their cut.

Welcome to maturity—where 1000% annual gains get replaced by 10% quarterly returns and PowerPoints about ’digital gold.’ Hedge funds have successfully gentrified the crypto wild west. Now if only they could do something about those pesky 3am liquidations.

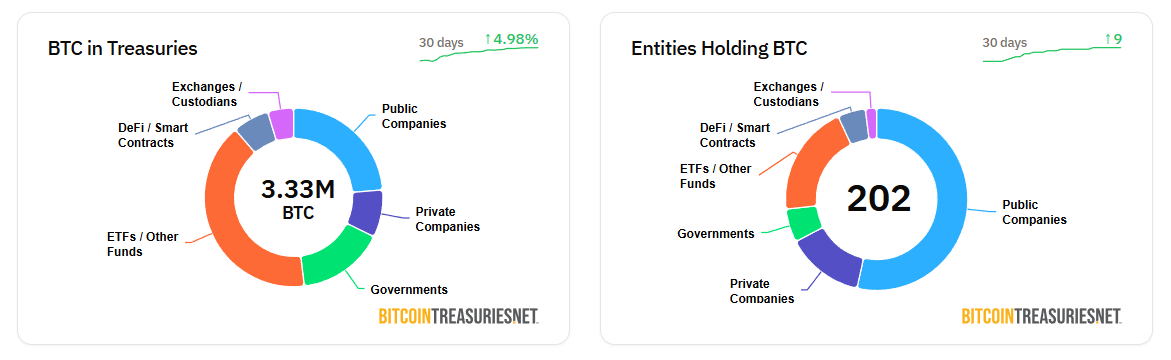

Entities holding Bitcoin | Source: Bitcoin Treasuries

Entities holding Bitcoin | Source: Bitcoin Treasuries

With this level of accumulation, Woo says Bitcoin is now acting more like a macro asset, and he expects it will “continue to absorb capital until it reaches its equilibrium.”

Woo believes Bitcoin will continue to grow over the long term but suggests that its compound annual growth rate is likely to moderate and settle around 8%, taking into account that long-term monetary expansion averages about 5% and global GDP growth is around 3%.

Despite the slowing growth, Woo remains optimistic about Bitcoin’s long-term prospects, encouraging investors to “enjoy the ride” for the next 15 to 20 years, noting that few publicly investable assets can match Bitcoin’s performance over the long term, even as its compound annual growth rate gradually declines.