Base Chain Transactions Rocket as DEX Volume Nears $400B—Wall Street’s FOMO Intensifies

Base Chain just hit hyperdrive—transaction counts are surging as decentralized exchange (DEX) volume flirts with the $400 billion mark. The Ethereum L2’s low fees and Coinbase backing keep drawing both degens and institutional players, even as traditional finance scrambles to pretend they ’saw it coming.’

DEXs eat another bite of CEX lunch

With Uniswap and Aerodrome leading the charge, Base’s DEX volume is up 120% month-over-month. Retail traders are bypassing KYC hurdles while hedge funds quietly backdoor exposure through OTC desks—hypocrisy tastes better with a side of yield.

The cynical take? This milestone means two things: 1) Crypto’s plumbing works better than ever, and 2) your bank’s ’blockchain strategy’ PowerPoint just got another meaningless slide. Base isn’t just growing—it’s exposing how slow money moves everywhere else.

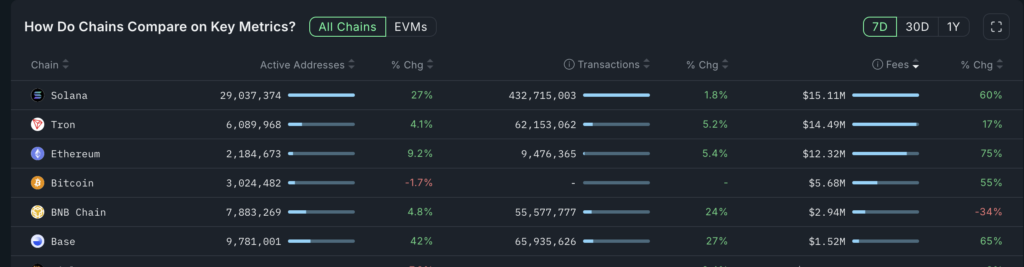

Base Chain metrics | Source: Nansen

Base Chain metrics | Source: Nansen

More data by DeFi Llama shows that protocols in the Base Chain are nearing a $400 billion milestone.

They have handled over $363 billion since its inception, with $25 billion in the last 30 days. If the trend continues, Base will likely cross the $400 billion level in June or July.

The most active DEX network on the Base Chain is Aerodrome, which has processed over $183 billion in transactions since inception. Uniswap (UNI) is the second one after it handled over $130 billion. The other top players in the network are PancakeSwap, Woofi, Javsphere, and Sushi.

Base Chain has also become the sixth biggest chain in decentralized finance or DeFi. its total value locked has jumped to $4.7 billion, making it a bigger chain than most popular players like Sui, Avalanche, Cardano, and Cronos.

Base Chain has attracted users because of its significantly lower transaction fees and faster speeds. It has also become a major player in the meme coin industry, with tokens on its ecosystem having a market cap of over $1.7 billion.

The most notable ones are BRETT (BRETT), Toshi, Degen, and Ponke.

Base Chain resists pressure to airdrop

Coinbase has resisted measures to have a Base airdrop, which WOULD give investors access to the $BASE token. Polymarket odds of such an airdrop are at just 2%, signaling that traders don’t expect it to happen in the second quarter.

A Base airdrop would be notable and likely valued at billions of dollars. Arbitrum, which is smaller than Base, has a fully diluted valuation of $3.9 billion, while Optimism has $3.07 billion. Polygon (POL) has an FDV of $2.46 billion, meaning that Base would likely spot a higher valuation.