Coinbase Security Breach Hits PayPal Mafia Elite—Sequoia’s Bigwig Among Targets

Crypto exchange giant Coinbase just got sucker-punched by hackers—and they didn’t spare the Silicon Valley royalty. High-profile victims include PayPal Mafia alumni and Sequoia Capital’s top brass, proving even the ’smart money’ gets caught with its pants down.

Active exploits drained undisclosed sums, bypassing Coinbase’s vaunted security like a hot knife through institutional-grade butter. The breach exposes crypto’s eternal irony: the industry that hates banks keeps replicating their worst mistakes.

Meanwhile in traditional finance, suits are probably high-fiving over $50 wire transfer fees.

Coinbase hackers bribed customer service staff

The cryptocurrency exchange disclosed Thursday that attackers had successfully bribed customer service representatives based in India to gain unauthorized access to client data. According to reports, the compromised information included names, birth dates, addresses, nationalities, government identification numbers, banking information, and account information.

Following the breach, the hackers attempted to extort $20 million from Coinbase in exchange for their silence, a demand that the company rejected. According to Coinbase officials, suspicious activity from certain customer service representatives had been detected as early as January.

Botha is a member of the so-called “PayPal Mafia,” the notorious group of entrepreneurs and investors, including Peter Thiel and Elon Musk. He has also been with Sequoia Capital since 2003, where he made early investments in companies like YouTube and Instagram before becoming the firm’s senior steward in 2022.

Some Coinbase users received security alerts last weekend warning that their information may have been improperly accessed, according to the person familiar with the situation.

The incident has highlighted growing concerns about the security of cryptocurrency executives as the industry gains mainstream visibility and adoption.

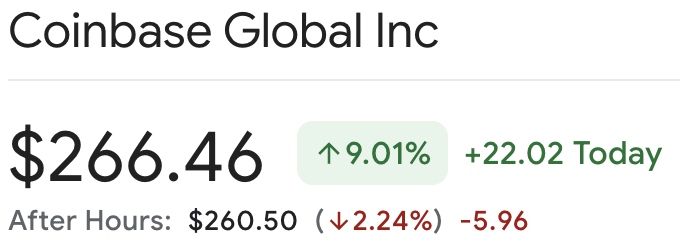

Despite the Coinbase hack, COIN is up 9% today to $266.4 at press time. This means that investors remain optimistic about the company’s long-term potential despite the data security challenges.