Pi Network Tanks 30% as Developers Cling to Centralized Controls

Another ’decentralized’ project shows its true colors—Pi Network’s token price nosedives after core team freezes wallets ’for maintenance.’ Sound familiar?

Behind the crash: The same old story

Nodes remain permissioned, validators handpicked, and surprise—developers still hold veto power over transactions. But keep mining those tokens on your phone; we’re sure the open mainnet launch is just around the corner (said every bagholder since 2021).Finance jab: At this rate, Pi’s ’stellar’ ROI might finally beat your bank’s 0.5% savings account... in 2035.

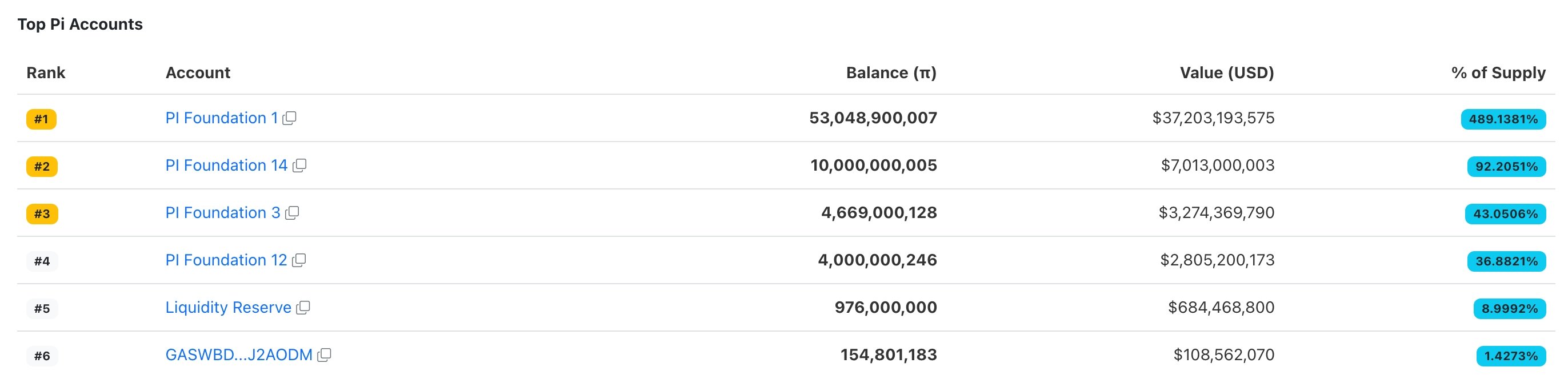

Pi Foundation coins | Source: PiScan

Pi Foundation coins | Source: PiScan

This situation presents substantial risks to the Pi Network community. For one, the membership of the so-called Pi Foundation has not been made public, and the community members’ input is not represented in it.

The other risk is when a hacker or an insider accesses the Pi Foundation wallets and decides to dump the tokens. Additionally, the Pi Foundation is not subject to any audit to verify its holdings, which are estimated to be worth $70 billion.

This centralization and opaqueness mostly explain why major exchanges like Binance and Coinbase have resisted listing Pi coin, three months after the mainnet launch.

Pi Network has other risks that are hurting its price. For example, millions of tokens are brought to the market each month. 1.48 billion tokens will be unlocked in the next 12 months, and billions more in the next few years.

Pi Network price analysis

The eight-hour chart shows that the Pi Coin price peaked at $1.6673 ahead of the highly anticipated ecosystem news event. It then plunged to the current $0.6980, its lowest point in over a week.

Pi has moved below the key support at $0.7760, the highest swing on April 12. Moving below that support invalidated the formation of the bullish break-and-retest pattern.

The coin has also moved below the 25-period moving average, while the Relative Strength Index has pointed downwards and moved below 50.

Therefore, the Pi Network price will likely drop and retest support at $0.6, which coincides with the ascending trendline connecting the lowest swings since April 7. A drop below that level will point to more downside, potentially $0.40.