Phantom Drops PSOL—Liquid Staking Token That Skips Lockup Pain

Solana’s Phantom wallet just flipped the script on staking with PSOL—a liquid staking token that lets users earn yields without locking assets. No more choosing between DeFi opportunities and staking rewards.

How it works: Stake SOL through Phantom, get PSOL tokens representing your stake + rewards. Trade, lend, or leverage PSOL while still earning staking APY—because why let your capital sit idle when Wall Street never would?

The catch? You’re still trusting a centralized entity with decentralization theater. But for yield-hungry degens, that’s a tradeoff as old as crypto itself.

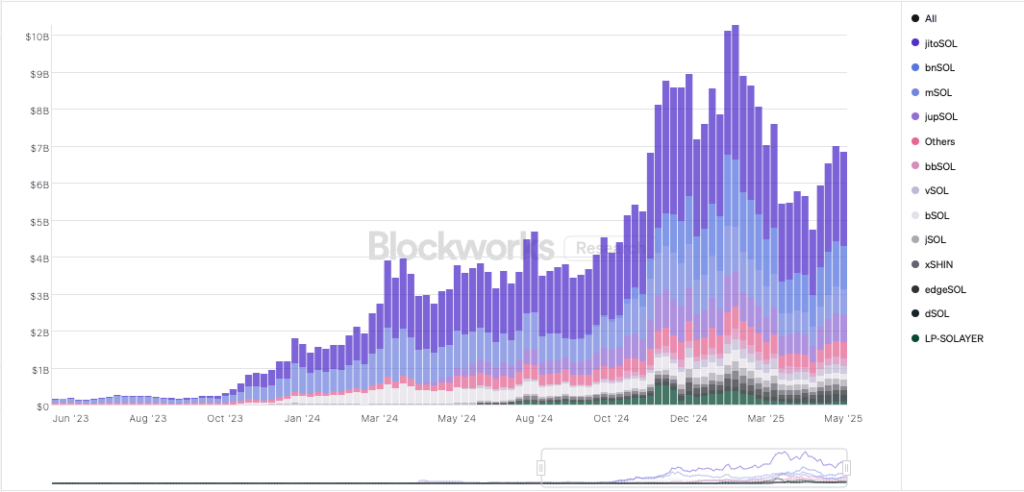

Solana’s liquid staking ecosystem sees a rapid rise

According to Phantom, the MOVE into liquid staking is part of its effort to support the broader Solana ecosystem, which has seen rapid growth in liquid staking over the past few months.

The total market cap for staked SOL tokens was $7 billion in May. Jito, Binance, Marinade, and Jupiter liquid staked SOL tokens account for the majority of this market. Still, the value of these tokens declined from its all-time high of $10 billion in the last week of January 2025.

Solana is positioning liquid staking as a way for users to maintain liquidity while earning yield and helping secure the network. With liquid staking, users lock up real SOL and receive an equivalent amount in liquid staked SOL, such as PSOL.

These liquid tokens can then be used across DeFi protocols to earn additional rewards. On the flipside, issuing liquid staked SOL increases the effective circulating supply of SOL, which may exert downward pressure on its price.