Whales Dominate: 80% of Bitcoin Locked in Mega-Wallets (10+ BTC Club)

Bitcoin’s wealth gap just got a blockchain confirmation—new data reveals four out of every five coins are hoarded by wallets holding 10 BTC or more. Forget ’decentralization for the people’—this is a whale’s playground.

The 1% of Crypto

While retail investors scrape together fractions of a coin, these deep-pocketed holders treat Bitcoin like a private yacht club. The kicker? Many are likely institutional players or early adopters who bought in before Wall Street started pretending to care about ’digital gold.’

Liquidity? What Liquidity?

With such concentrated ownership, price swings could get even wilder—whales move markets when they sneeze. Meanwhile, your average trader is left playing volatility roulette with pocket change. Ah, the democratization of finance.

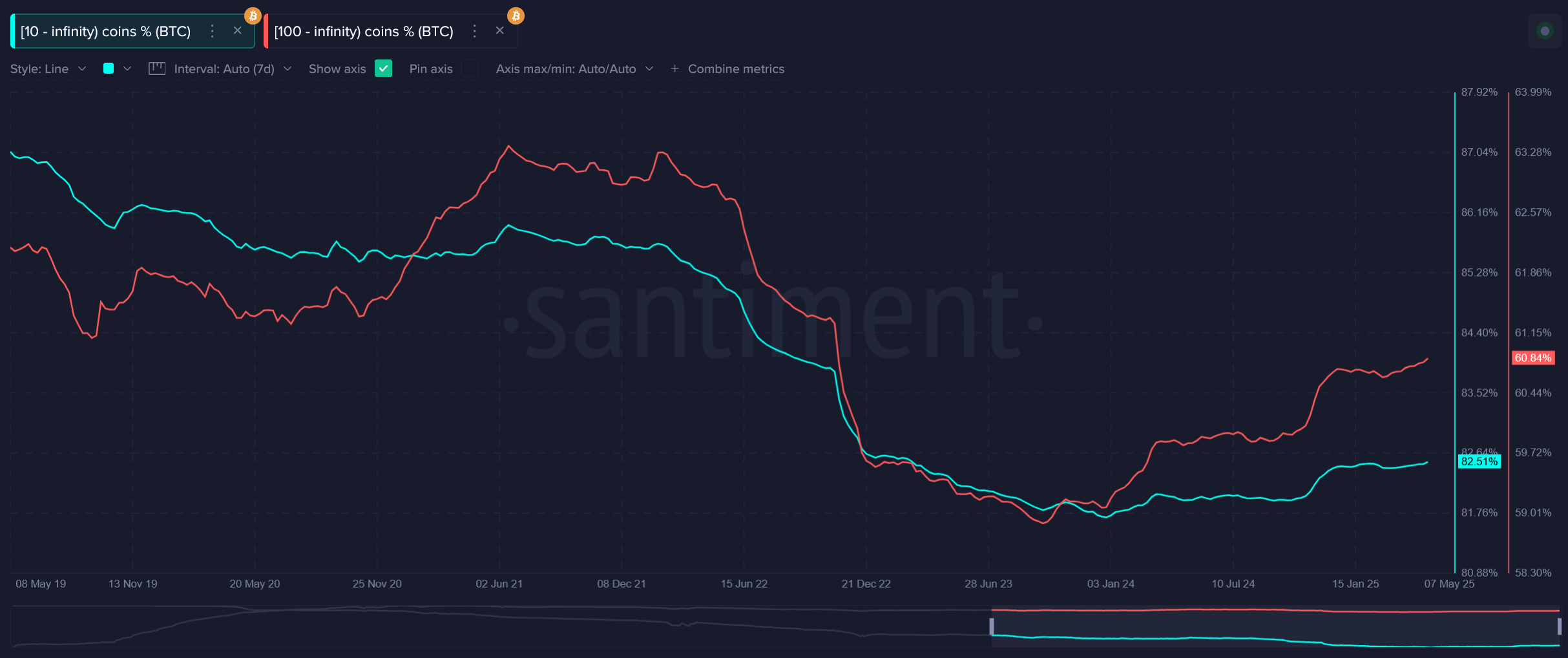

Cohort of wallets holding 10 BTC vs 100 BTC | Source: Santiment

Cohort of wallets holding 10 BTC vs 100 BTC | Source: Santiment

Some 3.47 million BTC remain in wallets holding fewer than 10 BTC, worth an estimated $358 billion. Whether this smaller group will continue to hold or sell could depend on future market sentiment, the analysts claim.

“Historically, major price retraces tend to instigate retail panic-selling, followed by larger wallets absorbing more of the loose coins that retail is no longer comfortable holding for the long run.”

Santiment

Crypto mining has also become less accessible for individuals due to high costs and lower rewards. On top of that, many crypto miners have fully “embraced eager institutional investors, and often take profit shortly after their successful mining sessions are complete,” the analysts added.

Santiment estimates that between 3 million and 4 million Bitcoin “could be gone for good” due to lost private keys or inaccessible wallets, while around 1.14 million coins still remain to be mined until the year 2140.